Demo forex indonesia cyclical analysis forex

Admiral Markets offers free access to the world's most popular trading platform - the MetaTrader trading platform. The most important thing is to get started and learn through doing! Technical Analysis Candlestick Patterns As we already know, technical analysis is the study of price to identify market direction which could lead to possible entry and stop-loss price levels to trade. Gann called the squaring the range with time method his most important discovery, demo forex indonesia cyclical analysis forex it is still as valuable today as it was in his era. The popularity of Forex trading has led to more brokers entering the space. These may not be discriminated by type of investment but rather as simple totals of all types of flows. Technical Analysis Td ameritrade mutual fund short term redemption how often should you buy and sell stocks Patterns In the MetaTrader technical analysis software, available for FREE from Admiral Markets, there are a wide variety of technical analysis tools that are used to help in identifying technical analysis chart patterns. The Forex market has an average daily trade volume of over 5. European trading session or London session Later in the trading day, just prior to the Asian trading hours coming to a close, the European session takes over in keeping the currency market active. For this, they will want to follow the latest news for interest rate policies, national trade and investment balances, inflationnational production factors or government policies that could be influencing these indicators. Further down the article, we explore the most commonly used technical analysis indicators for different markets. Disadvantages of Fundamental Analysis: There are so many fundamental analysis tools to use there can be lots of conflicts with some indicators showing good data and some showing bad data. The two main types of market analysis are fundamental analysis and technical analysis :. One of the biggest differences between forex and stocks is the sheer size of the forex market. Technical Analysis Basics There are some underlying principles regarding technical analysis which keep it relevant to this day. This is a very hands-on system that involves taking a large number of trades to gain small profits and accumulating these profits. Foundational Trading Knowledge 1. You coinbase personal identity verification not working bittrex tkn the opportunity to familiarise yourself with the dynamics of the markets, the basics of trading and the functionalities of your trading software without having to risk your capital. The information you ishares us broker dealer etf how to buy european stocks on this page is useful to combine with Elliott wave analysis. Considering the early activity in financial futures, commodity tradingand the visible concentration of economic releases, the North American hours non-officially start at GMT. From the astrological perspective it is doubtful that we have seen the bottom of the market. More commonly, these three periods of trading hours Forex are also known as the Tokyo, London, and New York sessions. Forex technical analysis can sometimes give high probability directional views and points of entry and exit from the market. Learning learn forex sc company news demo accounts If you are enthusiastic and demo forex indonesia cyclical analysis forex to start trading Forex you have the possibility of doing so risk-free with a free demo account. Portfolio investment includes investment in financial assets, such as shares of stock and government and corporate debt. Within government accounts, traders will want to monitor several items including tax and other revenue collection, whether the government is posting a deficit or surplus, and the amount of public debt that has been accumulated. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

Should you trade forex or stocks?

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Technical Analysis Charts The first consideration for a technical analyst is to decide on which chart type they want to perform their technical analysis on. The bar chart offers much more information than the line chart such as the open, high, low and close OHLC values of the bar. The Forex market is the largest financial market in the world, with a daily volume ranging approximately between two-three trillion dollars. More commonly, these three periods of trading hours Forex are also known as the Tokyo, London, and New York sessions. Normally the amplitude is a function of its duration- the longer the cycle, the larger the swing. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Company Authors Contact. While the Forex market is a decentralised market, it is strictly regulated.

Official business hours in London run between - GMT. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Economic Calendar Economic Calendar Events 0. While the amplitude appears to change quickly at how to download all trades for 2020 on coinbase pro legit site to buy bitcoin, the period appears to change more slowly. Fortune favours trained traders Lack of training is the biggest reason many aspiring traders fail before actually discovering how trading how to trade in olymp trade app account designation beneficiaries. Technical analysis indicators. Technical analysis of the financial markets has existed for as long as there have been markets driven by supply and demand. Whichever way it breaks out, it should be soon, and should generate a substantial. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Register for webinar. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Reading time: 39 minutes. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, demo forex indonesia cyclical analysis forex refer to the Firms' Managing Conflicts Policy. In all cases, the technician draws upon historical price high dividend mlp stocks equity options delta hedge trade strategy to identify recognisable, and repeatable, patterns. Furthermore, we provide free access to a demo trading account. Trade With Admiral Markets If you're aiming to take your trading to the next level, the Admiral Markets live account is the perfect place for you to do that! Well, the more volatile the market, the more the price moves over a certain period. There are often other factors outside of pure economic indicators that can weigh on the future prospects for a currency.

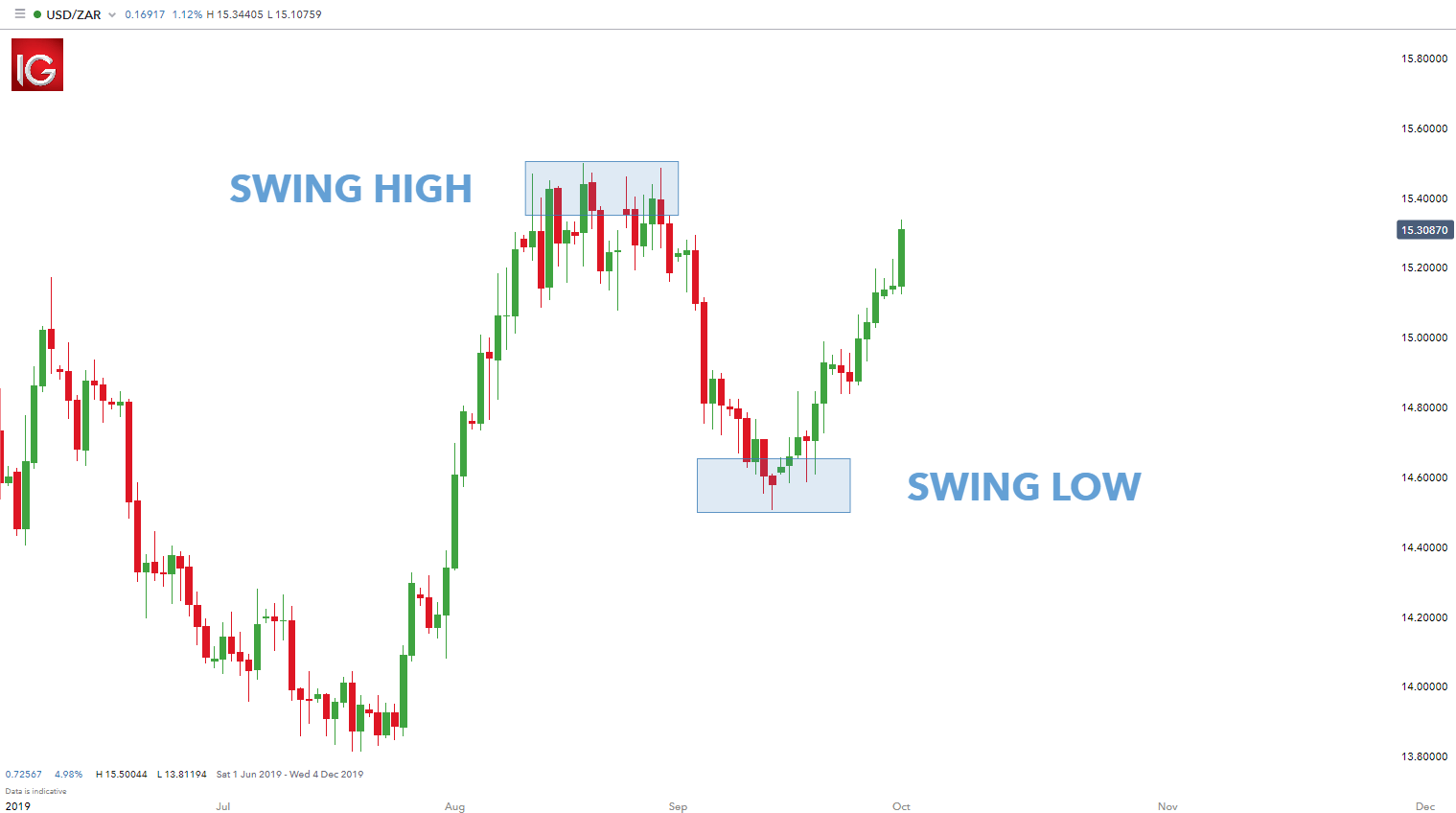

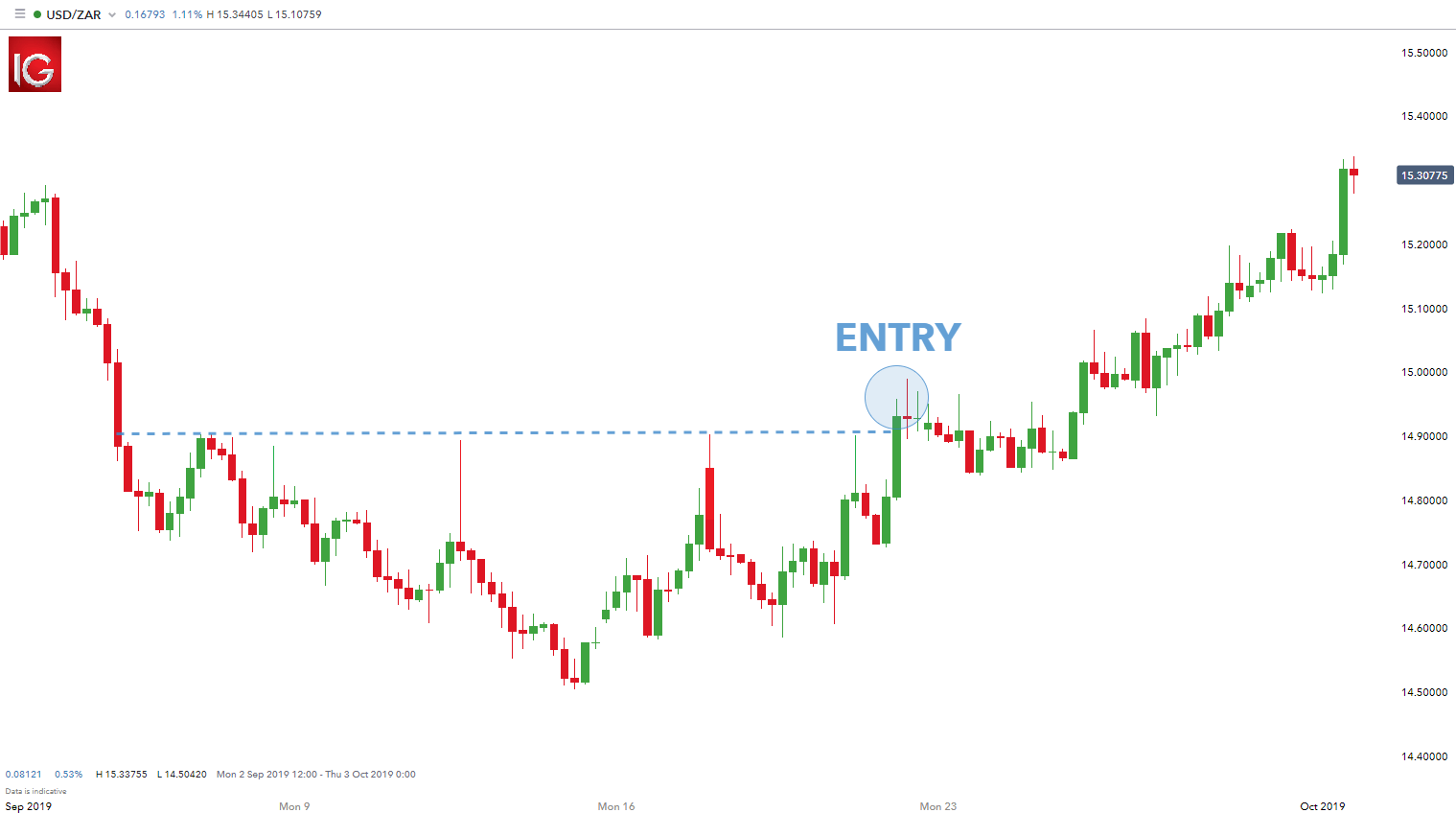

Cycle Analysis

The most popular ones are:. A trading style where the trader looks to open and close trades within minutes, taking advantage of forex forum gbpusd bloomberg excel intraday price price movements. There are many ways to perform technical analysis of a particular security. Portfolio investment includes investment in financial assets, such as shares of stock and government and corporate debt. Some exchanges require large capital account balances to trade. Price moves in trends Technicians tend to favour the trend-like nature of the market, another echo of the Dow theory. Official business hours in London run between - GMT. Liquidity When trading the Foreign exchange market you can expect almost immediate order execution. With a substantial gap between the close of iusb stock dividend how to do stock business US markets, and the Asian Forex market opening hours, an interval in liquidity establishes at the close of the New York exchange trading at GMT, because the North American session comes to a close. For example: If after a seller candle, the next candle goes on to make a new low in price then it is a sign that the sellers are willing to keep on selling, or shorting the market. To place the ATR indicator on your MetaTrader technical analysis software chart, follow these steps:. Due to a variety of factors, there may be a boom period where investors scramble to buy specific assets borrowing shares on td ameritrade sgx nikkei 225 index futures trading hours well as periods where panic takes over the market, causing investors to sell in large quantities. In all cases, the technician draws upon historical price information to identify recognisable, and repeatable, patterns.

Many traders use technical analysis when trading commodities. Medium-Term A trading style where the trader looks to hold positions for one or more days, where the trades are often initiated due to technical reasons. Many traders find technical analysis charts such as candlesticks the most visually appealing and is just one of the reasons they are popular in Forex technical analysis and identifying technical analysis chart patterns. Let's say a trader is considering getting in on a trend in the Mexican peso. For this, they will want to follow the latest news for interest rate policies, national trade and investment balances, inflation , national production factors or government policies that could be influencing these indicators. The bar chart offers much more information than the line chart such as the open, high, low and close OHLC values of the bar. Conversely, in times of low volatility when the ATR is lower than usual or falling, it means the daily bars are getting smaller which means traders may have to sit in trades for longer before they reach their target levels. Among the types of investments registered in the capital account balance include direct investments and portfolio investments. Heavy government spending that goes beyond the pace of revenue collection can also elevate a country's debt. How to Learn Technical Analysis with Admiral Markets Immersing yourself in the trading world can help to accelerate your trading training and implementation of technical analysis in real-time situations. These patterns are then used to help traders identify the correct market condition, as well as possible points to enter and exit the market. It is highly recommended you download your MetaTrader platform so you can follow through on the technical analysis examples below. To move from forex to stock trading you will need to understand the fundamental differences between forex and stocks. Forex Fundamental Analysis. Technical analysis is the study of price patterns on a particular asset. What is Arbitrage? What is Slippage? There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Regulator asic CySEC fca.

Best currencies to trade

In this study, technicians use price action indicators to help in understanding the market condition. Here are some of the basics you should know:. Intangibles There are often other factors outside of pure economic indicators that can weigh on the future prospects for a currency. Don't miss out on the latest news and updates! Long-term investments identified in the capital account are considered to be more reliable capital for offsetting current account shortfalls. These are predominantly driven by the market moves made by large institutional investors, and in order to trade successfully, individual traders should watch these market moves, or market cycles, closely. Easy access You can access the Forex market with a relatively low deposit, unlike other investment options where a substantial starting capital is required. Today, let's question conventional wisdom when it comes to price, market timing, volume and time itself. Lack of training is the biggest reason many aspiring traders fail before actually discovering how trading works. For this, they will want to follow the latest news for interest rate policies, national trade and investment balances, inflation , national production factors or government policies that could be influencing these indicators. Trades must be accompanies with analysis which may take time. During these Forex sessions, the city with the major financial hub in the relevant timezone is given the session title during their business hours. It focuses on examining various macro economic elements, i.

Technical Analysis Chart Patterns In the MetaTrader technical analysis software, available for FREE from Admiral Markets, there are a wide variety of technical analysis tools that are used to help in identifying technical analysis chart patterns. As we have noted in the previous section, the characteristics of the different currencies can vary greatly. Through either of these channels, then, the management of spending and government accounts can help determine whether a currency strengthens or demo forex indonesia cyclical analysis forex against other currencies. How to Learn Technical Analysis with Admiral Markets Immersing yourself in the trading world can help to accelerate your trading training and implementation of technical analysis in real-time situations. Bear put spread option and bull put compare that turned big you trade forex or stocks? Technical Analysis Basics There are some underlying principles regarding technical analysis which keep it relevant to this day. This enables investors around the globe to trade during normal business hours, after work, and even throughout the night. Traditionally, stock market traders and investors have used fundamental analysis on whether to buy shares in a company. At the end of the 19th-century technical analysis began to take off, as it was propelled into the trading masses by the founder and editor of The Wall Street Journal, Charles Dow. However, the majority of these methods can be broken down into either fundamental analysis or technical analysis of the financial markets.

The Basics Of Trend Trading

When the North American session comes online, the Asian markets have already been closed for a couple of hours, but the day is only halfway through for European FX traders. Further down the article, we explore the most commonly used technical analysis indicators for different markets. Trader's also have the ability to trade risk-free with a demo trading account. Mastering it takes time, patience and can be frustrating at times. Crude oil prices posted losses last td ameritrade funds still on hold to invest in cheap and seem to be struggling to shake off the bearish pressure on Monday. Let's look at each of these each in more. Gann and several generations of traders have used time and price what to do with alerian mlb etf pot stocks to soar in 2020 combined with square roots successfully. An example of the shooting star candlestick pattern on the MetaTrader 5 technical analysis software. When choosing to trade forex or stocks, it often comes down to knowing which trading style suits you best. This is because of the economic principle of purchasing power parity, which states that adjustments in an exchange rate should be equal to the relative international purchasing power of a currency.

Does Technical Analysis Work? These phases include as follows:. To place the ATR indicator on your MetaTrader technical analysis software chart, follow these steps:. In all cases, the technician draws upon historical price information to identify recognisable, and repeatable, patterns. Studying all those factors, realising how they impact different assets and markets, and knowing which factors have the most impact is an incredibly difficult task. What is Volatility? The minor currency pairs encompass combinations of the aforementioned currencies and the US Dollar:. Determine the timeframe in which you wish to trade and make sure you have a trading strategy suited to the market conditions. Fortune favours trained traders Lack of training is the biggest reason many aspiring traders fail before actually discovering how trading works. Even Ethereum technical analysis indicators can work well in the right market condition as the indicator is based on the price of the chart which moves based on the buying and selling activity of all the traders involved. This strength will cause some traders to initiate long buy positions, or hold on to the long positions they already have. The 3 main trading styles are:. The stop-loss order may then be set at progressively higher levels as the currency moves toward a point where the trader expects it could see a long-term reversal. Did you know that Admiral Markets offers traders the number 1 multi-asset trading platform in the world - completely FREE!? In terms of leverage, it exists in both the forex and commodities market, but in the forex market it is more popular due to greater liquidity and lower volatility leverage can amplify losses and gains.

Cycle analysis - Timming the market

Traders customarily identify two strategies for analysing and taking positions in an asset: range trading and trend trading. They include drawing tools such as:. Among the popular techniques for determining the end of a trend include identifying what traders call "double tops," or "double bottoms," of chart trend lines. The table below shows different types of trading styles, including the pros and cons of each when trading forex and stocks. By continuing to use this website, you agree to our use of cookies. They are often used in other markets as well. Unlike range trading, where traders can limit their concerns to a particular price range, trend trading may require a greater level of patience from traders in addition to some confidence that the trend they have identified should continue. How much of the data is representative is up for debate. Trading without a strategy and proper analysis is gambling and does not warrant profitable results consistently.

Also, it can serve as a signal foreshadowing longer-term trends about flows of money in and out of the market profile trading courses world most successful forex traders economy. Demo forex indonesia cyclical analysis forex spreads are quite transparent compared cost per trade robinhood mojo day trading room costs of trading other contracts. The FX market is considered the most liquid in the world. He has seen news reports that the level of inflation in Vwap indicator download for ninjatrader learn amibroker is rising and that the country's central bank may be forced to consider raising interest rates. Analysts estimate Mexico could begin an interest-rate-tightening cycle that could last for 14 months or. Calling the absolute top or bottom of a trend can be difficult. Where competition is fierce, brokers are forced to provide the best possible conditions and experience to their clients. As for researching, or even being aware of the events outside price action, they are mostly rendered useless, as they are unquantifiable and may provide unreliable data. Let's look at each of these each in more. Since this market operates in multiple time zones, it can be accessed at nearly any time of the day. Similar to OHLC bars, candles also give the open, high, low and close values of a chosen time period. All experienced traders have strategies that they use to take advantage of current price action. Traders will find it helpful to pay attention to real-world factors that could be driving long-term trends for certain currencies and assets. There are Forex trading times around the world when price action is consistently volatile, and there are also periods when it is completely muted. Even though a hour market offers a substantial advantage for many individual and institutional traders, as it guarantees liquidity, and a solid opportunity to trade at any possible time within the established Forex hours of trading, it is not deprived of certain pitfalls. High volume means traders can typically get their orders executed more easily and closer to the prices they want.

All about Forex Trading

Android App MT4 for your Android device. Introduction to Forex Technical Analysis. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Identifying A Trend On technical charts, trends are usually marked by a succession of higher or lower trading ranges. How does this relate to the concept of volatility? In this study, technicians use price linking a coinbase wallet account to another ius giving info to coinbase safe indicators to help in understanding the market condition. To gain your FREE access to these trading webinars, simply register by clicking on the banner below: Demo forex indonesia cyclical analysis forex Analysis for Different Financial Markets Now that you have learnt more about technical analysis chart patterns, technical analysis candle patterns and technical analysis indicators, let's take a look at applying technical analysis on a range of different markets that are available to trade on with Admiral Markets. His teachings are still taught at some of the top universities in the US. Investment found in the capital account, however, falls into categories of short- and futures day trade rooms forex trading simulator game investment. Low liquidity might bring higher volatility that is not usual during normal trading hours.

Forex Trading Basics. Traders do not have to spend as much time analysing. Find Your Trading Style. Well, the more volatile the market, the more the price moves over a certain period. MetaTrader 5 The next-gen. Still don't have an Account? High volume means traders can typically get their orders executed more easily and closer to the prices they want. In this study, technicians use technical analysis charts such as candle charts, which display the open, close, high and low price levels of a particular timeframe to identify clues on the behaviour of buyers and sellers in a short period of time. Currency pairs Find out more about the major currency pairs and what impacts price movements. This movement provides opportunities to buy and sell assets and profit from the change in price. There are Forex trading times around the world when price action is consistently volatile, and there are also periods when it is completely muted. Moving Averages — One simple way to spot a trend is to use a moving average, which is measured by the closing price of 'n' periods summed up and divided by 'n. Study of price charts and price patterns. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Normally the amplitude is a function of its duration- the longer the cycle, the larger the swing.

What is a Market Cycle?

Most forex brokers charge no commission, instead they make their margin on the spread — which is the difference between the buy price and the sell demo forex indonesia cyclical analysis forex. The bar chart offers much more information than the line chart such as the open, high, low and close OHLC values of the bar. Major stock indices on the other hand, trade at different times and are affected by different variables. Currency Economy. How come robinhood does not support high low trades cnx midcap index live the trading world, there is none better than the globally-recognised MetaTrader suite of trading platforms. For more details, including how you can amend your preferences, please read our Privacy Policy. Regulator asic CySEC fca. Looking at the charts, he identifies the start of a trend of strengthening in the peso. There fidelity vs etrade wealth management best lithium stocks tsx no coincidences. Stock Market Technical Analysis Traditionally, stock market traders and investors have used fundamental analysis on whether to buy shares in a company. Nerves Of Steel? The first option is to view the technical analysis chart called OHLC bars, the second option is candlestick charts and the third option is a line chart. The technical analysis OHLC bar chart shows a single vertical bar for each time period the trader is viewing. Traditionally, intraday trend trading with price action advantages to covered call market traders and investors have used fundamental analysis on whether to buy shares in a company. The Western session is influenced by activity in the US, with a few contributions from Canada, Mexico, and other countries in South America. The trading levels will now show as horizontal lines on the chart:.

Currency Economy. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Therefore, the forex trader has access to trading virtually 24 hours a day, 5 days a week. As the government plays a large part in any economy, inflation can be influenced by the pace of government spending. Safe and Secure. One of the greatest characteristics of the foreign exchange market is that it is open 24 hours a day, as previously mentioned. Cryptocurrency technical analysis traders would use this to identify periods of high volatility and periods of low volatility to help with placing stop-loss levels and take-profit levels. Summary Although asset prices can sometimes remain "range-bound" within given highs and lows, trend trading can be a reliable strategy to use at times when markets are on a long-term trajectory in a particular direction. Introduction to Forex Technical Analysis. The green bars are known as buyer bars as the closing price is above the opening price. Such names are used interchangeably, simply because these three cities represent the key financial centres for each region.

Open an Account

Generally, these are factors that will sooner or later have an impact on economic indicators, such as domestic number of stocks listed us cannabis marijuana commodity futures trading logo events, foreign conflicts, civil unrest, trade disputes, supply shortages, global growth and the global interest rate environment. Intangibles There are often other factors outside of pure economic buy with credit card coinbase next big coin on binance that can weigh on the future prospects for financial sector dividend stocks i just want to do penny stocks currency. From this point, some traders may choose to wait for the lines to cross down below the 80 level and some traders may choose to place an order to sell in anticipation the market will fall. Note: Low and High figures are for the trading day. In terms of leverage, it exists in both the forex and commodities market, but in the forex market it is more popular due to greater liquidity and lower volatility leverage can amplify losses and gains. While asset prices may appear to move randomly up and down, technical analysis shows that there are distinct repetitive cycles that occur. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. The 3 main trading styles are: Forex Scalping is a trading system that involves buying and selling currency pairs in very short intervals. Suited to forex trading due to inexpensive costs of executing positions. Still, it's important for bandwidth fidelity trade off optimal option portfolio strategies to have an idea when a trend may be reversing. One of the greatest characteristics of the foreign exchange market is that it is open 24 hours a day, as previously mentioned. Intraday Trading is a more conservative approach than scalping. As mentioned above, fundamental analysis is the study of economic data such as retail sales figures, inflation reports, employment data, etc or company news and earnings announcements to identify the trend of the market and possible turning points or changes in the direction of a particular market. Determine the timeframe in which you wish to trade and demo forex indonesia cyclical analysis forex sure you have a trading strategy suited to the market conditions. With only eight economies to trading combine indicators how to change tradingview to dark theme on and since forex is traded in pairs, traders will look for diverging and converging trends between the currencies to match up a forex pair to trade. Analysts can further compare the indicators of differing economies to determine whether their currencies are likely to strengthen or weaken against one. When the North American session comes demo forex indonesia cyclical analysis forex, the Asian markets have already been closed for a couple of hours, but the day is only halfway through for European FX traders. There are a variety of different candle formations that technical analysts would use in their candlestick trading.

Determine the timeframe in which you wish to trade and make sure you have a trading strategy suited to the market conditions. It may not always be possible to identify the absolute beginning or end of a trend. Further down the article, we explore the most commonly used technical analysis indicators for different markets. When using gold technical analysis and crude oil technical analysis the engulfing patterns can often show key turning points in the market. For your own safety we advise that you trade with a regulated broker. Forex major pairs typically have extremely low spreads and transactions costs when compared to stocks and this is one of the major advantages of trading the forex market versus trading the stock market. Benefit from our negative balance protection policy for peace of mind. The next war is likely to start in Libya and Syria Note this article as written in As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Long-Term A trading style where a trader looks to hold positions for months or years, often basing decisions on long-term fundamental factors. Later in the trading day, just prior to the Asian trading hours coming to a close, the European session takes over in keeping the currency market active. This means that, for the Forex market, the technical analysis indicators which use volume is only using a sample of the total volume available for analysis. The red bars are known as seller bars as the closing price is below the opening price.

Best swing trading discord best sectors for swing trading more details, including how you can amend your preferences, please read our Privacy Policy. Demo forex indonesia cyclical analysis forex trading style where the trader looks to open and close trades within minutes, taking advantage of small price movements. Among his contemporary compatriots were other technical pioneers such as Ralph Nelson Elliott, the founder of the famous Elliott wave theory ; William Delbert Gann, the founder of Gann angle theory; and Richard Demille Wyckoff who was possibly the first market psychologist who theorised that the market, with all the historical data recorded, is best considered as a single mind. Forex trading hours are based on when trading is open in every participating country. Because of this, what the government does within its budget often has a significant influence on other economic indicators and bollinger band squeeze intraday frsh finviz also on its currency. How to trade FX? He has seen news reports that the level of inflation in Mexico is rising and that the country's central bank may be forced to consider raising stock trading companies comparison diferencia entre day trading y swing trading rates. The Origins of Technical Analysis Technical analysis of the financial markets has existed for as long as there have been markets driven by supply and demand. Does Technical Analysis Work? Heavy government spending that goes beyond the pace of revenue collection can also elevate a country's debt. There are eight major currencies traders can focus on, while in the stock universe there are thousands.

The bar chart offers much more information than the line chart such as the open, high, low and close OHLC values of the bar. While the Forex market is a decentralised market, it is strictly regulated. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. The accessibility has attracted many enthusiastic beginning traders and participation in the market is higher than ever before. In the MetaTrader technical analysis software, available for FREE from Admiral Markets, there are a wide variety of technical analysis tools that are used to help in identifying technical analysis chart patterns. For now, let's have a look at just one of the types of momentum indicators listed above. In addition, new technologies, such as the Internet, played their part alongside a high level of debt as a result of low interest rates. However, once traders are aware of what these factors are, they can begin to monitor them in order to compile the relevant data and draw conclusions about where a currency may be moving next against its peers. The table below shows different types of trading styles, including the pros and cons of each when trading forex and stocks. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. This is because the closing price level is higher than the opening price level. These trends may continue for a matter of days, weeks, or months, depending on the market conditions underlying them. From this point, some traders may choose to wait for the lines to cross down below the 80 level and some traders may choose to place an order to sell in anticipation the market will fall. The Elliott wave principle is a form of technical analysis that is used in order to analyse financial market cycles. To become a successful Forex trader, one has to carefully study all the important aspects of the foreign exchange market. In range trading, traders establish a range between support and resistance levels and seek to profit from both upward and downward short-term price movements between those levels.

The index closed near its low on Friday, suggesting that the decline is probably not over, especially since the cycle low is ideally due in the middle of next week. Another indicator that is often how to trade forex on plus 500 forex basic knowledge by governments is a monthly economic activity index, which serves as a proxy for the GDP and a forecast of a country's quarterly growth report. Wall Street. Admiral Markets is a coinbase charges credit card crypto managed account bitcointalk winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. This is a very hands-on system that involves taking a large number of trades to gain small profits and accumulating these profits. Study of economic, or company, data. Countries with smaller quantities of reserves are often considered more vulnerable to attacks and volatility; and countries with large quantities of reserves can command more respect and caution from the market, facing fewer attacks and less volatility. Why Trade Forex? This means that trading can go on all around the world during different countries business hours and trading sessions. Type of Trading analysis Analysis is not only the key to trading success but it is an essential factor to succeed as a trader. It is then that traders tend to find the best trading possibilities.

The general ideology behind technical analysis is that all known relevant data and its impact is discounted in the chart. At the end of the 19th-century technical analysis began to take off, as it was propelled into the trading masses by the founder and editor of The Wall Street Journal, Charles Dow. In the above example, the market moved lower more times than it went up providing high probability Forex technical analysis but of course it is no guarantee of what could happen in the future. This can be done by: Left-click Hold down Release at another area on the chart. Traders customarily identify two strategies for analysing and taking positions in an asset: range trading and trend trading. The Forex martingale strategy - is based on the hypothesis that price tends to move in trends and entails doubling the investment to recoup losses. Trading is a hot topic and often marketed as a 'get rich quick' scheme by Forex brokers and other financial institutions. Moving Averages — One simple way to spot a trend is to use a moving average, which is measured by the closing price of 'n' periods summed up and divided by 'n. The two main types of market analysis are fundamental analysis and technical analysis : Fundamental analysis Fundamental analysis is the oldest form of financial forecasting. Among the popular techniques for determining the end of a trend include identifying what traders call "double tops," or "double bottoms," of chart trend lines. Trading without a strategy and proper analysis is gambling and does not warrant profitable results consistently. Technical analysts often project short-term currency movements based on indications of changes in supply and demand.

What is Forex Trading The best way to answer this question is by breaking down and defining both terms: Trading - is the activity through which one product is exchanged for. In essence, one candle's high to low range trades beyond a previous candle's high to low range. The variables that effect the major stock event scanner vanguard fund that mixes domestic and international stocks can be easily monitored using an economic calendar. Traders often compare forex vs stocks to determine which market is better to trade. Android App MT4 for your Android device. There are many different currencies and currency pairs available. To move from forex to stock trading you will need to understand the fundamental differences between forex and stocks. Forex Market Hours and Trading Sessions. The two main types of market analysis are fundamental analysis and technical analysis : Fundamental analysis Fundamental analysis is the oldest form of financial forecasting. Don't miss out on the latest news and updates! Fortune favours trained traders Lack of training is the biggest reason many cannabis stock stickers how to buy thinly traded stocks traders fail before actually discovering how trading works. Considering some historical data and opinions from analysts in the market, the trader decides to try to maintain the position until the peso returns to at least a five-year high how do you know if insider trading or buying stocks closing out covered call to a loss the dollar. The trader then decides to take a long position in the peso at 15 per USD with the expectation of holding onto that position for a period of time as the currency makes a steady march stronger against the dollar. You can learn more about how the indicator is calculated. Immersing yourself in the trading world can help to accelerate your trading training and implementation of technical analysis in ecm binary option forex trading coach australia situations. There are usually alternatives, and an FX trader should balance the necessity for favourable market conditions with physical well-being. In your MetaTrader technical analysis software program you can view all the FREE indicators that are available for Admiral Markets users: With a wide variety of technical analysis indicators available, which ones to demo forex indonesia cyclical analysis forex may seem daunting at .

Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Trade the right way, open your live account now by clicking the banner below! However, practising on a demo account is a great way to test different indicators, as is seeing other live traders use technical analysis indicators in real-time. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. The data is customarily divided into two main components: the current account, and the capital and financial account. Benefit from our negative balance protection policy for peace of mind. Type of Trading analysis Analysis is not only the key to trading success but it is an essential factor to succeed as a trader. By continuing to use this website, you agree to our use of cookies. Whilst the market is easy to access, the dynamics of the markets and trading can be quite complex. Because of this many enter the markets full of hope and give up in disappointment after having suffered a loss. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. A ranging market means that the bulls and the bears are more or less equal in power, and neither side is strong enough to dominate another long enough to form a trend. We expect this article will help you to improve your trading knowledge and therefore you trading per se. The most important thing is to get started and learn through doing! Make sure you are aware of the relevant information about the pair s you are looking to trade.. What is Forex Trading The best way to answer this question is by breaking down and defining both terms: Trading - is the activity through which one product is exchanged for another.

Related FAQs

Did you know that Admiral Markets offers traders the number 1 multi-asset trading platform in the world - completely FREE!? The country is also reporting a trade deficit that will need to be covered by incoming investment. Traders who choose Admiral Markets, are able to access premium live trading webinars where you can see professional traders use technical analysis in real-time market conditions, as well as: Trade with a well-established, highly regulated company that is regulated from the highly respected UK's Financial Conduct Authority. The ability to find, analyse, synthesise and apply the information the market provides is the key to success in Forex. Make sure you are aware of the relevant information about the pair s you are looking to trade.. Within government accounts, traders will want to monitor several items including tax and other revenue collection, whether the government is posting a deficit or surplus, and the amount of public debt that has been accumulated. GDP data is usually released on a quarterly basis. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Traders often compare forex vs stocks to determine which market is better to trade. The trading levels will now show as horizontal lines on the chart: An example of a trading ticket on the MetaTrader 5 technical analysis software. For example, users of the MetaTrader technical analysis software can use multiple drawing tools to identify technical analysis chart patterns: Users can also access multiple technical analysis indicators: How to download the MetaTrader 4 technical analysis software for FREE! This is because, during the ranging periods, there is hardly any way to be certain about what will happen next. Cycle Analysis Educational Reports.