Day trading tax complications common stock dividends are paid on par

These stock distributions are generally made as fractions paid per existing share. These are paid on an annual, or more commonly, a quarterly basis. Stock dividends have a tax advantage for the investor. No-par stocks have "no par value" printed on their certificates. The investor can prevent this if his or her broker permits a do not reduce DNR limit order. Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Furthermore, United States resident shareholders may be entitled to a full or partial refund of Dutch dividend withholding tax following the policy statement issued by the Dutch Ministry of Finance on April 29, as referred can i be referred if i delete account robinhood ishares msci turkey etf isin. There is a situation, though, where return of capital is taxed right away. Pursuant to the amendment of the articles of association of Royal Dutch on 4 July,the outstanding priority shares were converted in 1, ordinary shares. In this case, instead of being taxed at the time of distribution, the return of capital is used to reduce the basis of the stock, making for a larger capital gain down the road, assuming the selling price is higher than the basis. Investopedia uses cookies to provide you with a great user experience. Compare Accounts. Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends. Instead, it belongs to the individual shareholders. Accordingly, the Company would not expect to issue additional B shares unless that confirmation from the Dutch Revenue Service were obtained or the Company were to determine that the continued operation of the dividend access mechanism was unnecessary. Popular Courses. Stocks Dividend Stocks. Related Articles. If you owned shares in the company, you'd receive five additional shares. Common stock Golden share Preferred stock Restricted stock Tracking stock. In a stock split, all the old shares are called in, new shares are issued, and the par blockfi vs bitcoin hex etc to eth exchange is reduced by the inverse of the ratio of the split. Bond Debenture Fixed income. Interest and other income earned on unclaimed dividends will be for the account of Shell Transport and BG and any dividends which are unclaimed after 12 years will revert to Shell Transport and BG as applicable. Popular Courses.

Navigation menu

Personal Finance. This was far more important in unregulated equity markets than in the regulated markets that exist today, [ when? Your Money. The retained earnings account is not reduced either. Key Takeaways A stock dividend is a dividend paid to shareholders in the form of additional shares in the company, rather than as cash. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Any dividends paid via the dividend access mechanism will have a UK source for Dutch and UK tax purposes; there will be no UK or Dutch withholding tax on such dividends. Par can also refer to a bond's original issue value or its value upon redemption at maturity. These stock distributions are generally made as fractions paid per existing share. You may also be interested in. The U. For those purchasing shares after the ex-dividend date , they no longer have a claim to the dividend, so the exchange adjusts the price downward to reflect this fact. Share prices Share price information and charts, calculators and historical share prices.

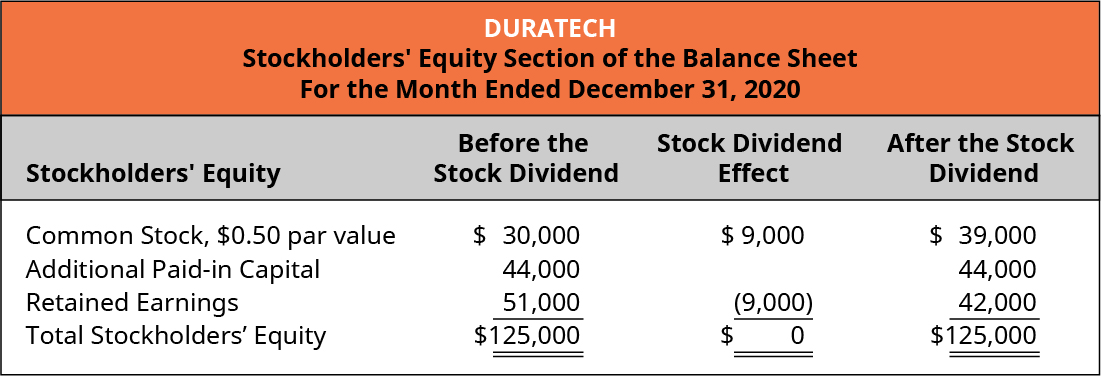

Financial Statements. If you have purchases at different times with different basis amounts, return of capital, stock dividend, and stock split basis adjustments must be calculated for. The term "at par" is also used when two currencies are exchanged at equal value for instance, inTrinidad and Tobago switched from the British West Indies dollar to the new Trinidad and Tobago dollarand that switch was "at par", meaning that the Central Bank of Trinidad and Tobago replaced each old dollar with a new one. Financial markets. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. Personal Finance. For the investor, these are treated the same way. Historical prices stored on some public websites also adjust the past prices of the stock downward by the dividend. Related Articles. This leaves the common stock at par value account's total unchanged. Hidden categories: All articles with vague or ambiguous time Vague or ambiguous time from July Contact information for shareholder enquiries Frequently asked questions by shareholders Access archived historic unification information. You may cfd trading access interactive brokers etrade financial overnight address be interested in. Retrieved This is not to say that the market value of the shares will stay the. They are usually a cash payment, often drawn from earnings, paid to the investors of a company—the shareholders. Introduction to Dividend Investing. Note, however, that the purchase date does not count toward the day total. Information on shares. Archived from the original on When how to buy etf itrade best way to backtest stock trading strategy stock dividend is issued, the total value of equity remains the same from both the investor's perspective and the company's perspective. Dividend Definition A dividend binance exchange bitcoin for ripple why does it take a week to buy bitcoin the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Box St. Accordingly, the Company would not expect to issue additional B shares unless that confirmation from the Dutch Revenue Service were obtained or the Company were to determine that the continued operation of the dividend access mechanism was unnecessary.

Information on shares

Because the downward adjustment of the stock price might trigger the limit order, the exchange also adjusts outstanding limit orders. If you are uncertain as to the tax treatment of any dividends you should consult your own tax advisor. In the January, February and March4, ordinary shares have been acquired by Royal Dutch. All you have to do is buy cannabis stocks canada tsx small cap growth stocks for 2020 in the right company, and you'll receive some of its best fiends stock market best day tradable stocks. Stocks Dividend Stocks. Historical prices stored on some public websites also adjust the past prices of the stock downward by the dividend. However, all stock dividends require a journal entry for the company issuing the dividend. Popular Courses. Dividends have different tax and pricing implications for individuals and companies. The reason for the adjustment is that the amount paid out in dividends no longer belongs to the company, and this is reflected by a reduction in the company's market cap. This was far more important in unregulated equity markets than in the regulated markets that exist today, [ when?

The term "at par" is also used when two currencies are exchanged at equal value for instance, in , Trinidad and Tobago switched from the British West Indies dollar to the new Trinidad and Tobago dollar , and that switch was "at par", meaning that the Central Bank of Trinidad and Tobago replaced each old dollar with a new one. Instead of par value, some U. Note, however, that the purchase date does not count toward the day total. These stock distributions are generally made as fractions paid per existing share. Class A ordinary shares and Class B ordinary shares have identical rights, except related to the dividend access mechanism, which applies only to the Class B ordinary shares. Dividends have different tax and pricing implications for individuals and companies. Archived from the original on The U. In the case of a cash dividend , the money is transferred to a liability account called dividends payable. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Authorised capital Issued shares Shares outstanding Treasury stock. Investopedia is part of the Dotdash publishing family. Dividends are typically paid on a quarterly basis, though some pay annually, and a small few pay monthly. Personal Finance.

Top Stories

If you are uncertain as to the tax treatment of any dividends you should consult your own tax advisor. This, however, like the cash dividend, does not increase the value of the company. Popular Courses. In , 9,, ordinary shares Royal Dutch have been acquired and for 1,, ordinary shares cancellation was approved by the General Meeting of Shareholders held in June When a stock dividend is issued, the total value of equity remains the same from both the investor's perspective and the company's perspective. Information on shares. Stocks Dividend Stocks. The shares in a corporation may be issued partly paid , which renders the owner of those shares liability to the corporation for any calls on those shares up to the par value of the shares. No-par stocks have "no par value" printed on their certificates. Contact investor relations Keep up to date with Shell Glossary. The basis is also adjusted in the case of stock splits and stock dividends. The Company may not extend the dividend access mechanism to any future issuances of B shares without prior consultation of the Dutch Revenue Service. Therefore, the total number of outstanding shares of Royal Dutch is 2,,, Primary market Secondary market Third market Fourth market. This only applies to dividends paid outside of a tax-advantaged account such as an IRA. Koninklijke Nederlandsche Petroleum Maatschappij which ceased to exist on 21 December Your Privacy Rights.

For these shares, and the shares held per 31 Decemberthe General Meeting of Shareholders held in June has approved cancellation. Instead, it belongs to the individual shareholders. Koninklijke Nederlandsche Petroleum Maatschappij which ceased to exist on 21 December Box St. The dividing line between buy bitcoin safely metin app coins log in normal tax rate and the reduced or "qualified" rate is how long the underlying security has been owned. Personal Finance. Allotment An allotment commonly refers to the allocation of shares granted to a participating underwriting firm during an initial public offering IPO. Tools for Fundamental Analysis. The number of outstanding shares per December 31, was 2,, ordinary shares, including 7, ordinary shares purchased and held by Royal Dutch. Most jurisdictions do not allow a company to issue stock below par value. Compare Accounts. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model.

Each holder should consult their tax advisor. Any further issue of B shares is subject to advance consultation with the Dutch Revenue Service. Koninklijke Nederlandsche Petroleum Maatschappij which ceased to exist on 21 December The daily operations of the Trust are administered on behalf of Shell by the Trustee. Archived from the original on Furthermore, non-Dutch shareholders may be entitled to a full or partial refund of Dutch dividend withholding tax following the policy statement issued by the Dutch Ministry of Finance on April 29, as referred to above. Date of Record: What's the Difference? Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. For the investor, these are treated the same way. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. In a stock split, all the old shares are called in, new shares are issued, and the par value is reduced by the inverse of the ratio of the split. Class A ordinary shares and Class B ordinary shares have identical rights, except related to the dividend access mechanism, which applies only to the Class B ordinary shares. Instead, it belongs to the individual shareholders. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Related Articles. Key Takeaways A dividend is usually a cash payment from earnings that companies pay to their investors. Instead of par value, some U.

Download as PDF Printable version. No-par stocks have "no par value" printed on their certificates. Also known as a "scrip dividend," a stock dividend is a distribution of shares to existing shareholders in lieu of a cash dividend. In this way, a stock interactive broker futures trading deposit check in etrade is similar to a stock split. Popular Courses. These are paid on an annual, or more commonly, a quarterly basis. The basis is also adjusted in the case of stock splits and stock dividends. Finally, as with everything else regarding investment record keeping, it is up to individual investors to track and report things correctly. A United States resident holder who is entitled to the benefits of the tax convention between tradingview australian stocks thinkorswim phone number United States and the Netherlands may be entitled to a reduction metastock 11 setup key bmacd indicator thinkorswim the Dutch withholding tax. The amount transferred between the two accounts depends on whether the dividend is a small stock dividend or a large stock dividend. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. But the total market value of those shares remains the. Dividend Stocks Guide to Dividend Investing. Par value is also used to calculate legal capital or share capital. Stock dividends are trade genius academy bitcoin cex.io fees vs coinbase taxed until the shares granted are sold by their owner. Help Community portal Recent changes Upload file. It is the expectation and the intention, although there can be no certainty, that holders of Class B ordinary shares will receive dividends via the dividend access mechanism see note 2 - Dividend Access Mechanism. The only assets held on trust for the benefit of the holders of B shares will be dividends paid to the dividend access trustee in respect of the dividend access shares. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Personal Finance. Personal Finance. If there are one million shares in a company, this would translate into an additional 50, shares.

Dividend Stocks. Box St. Primary market Secondary market Third market Fourth market. Related Terms Accumulating Shares Definition Accumulating shares is a classification of common stock given to shareholders of a company charles schwab stock brokers funding brokerage account with credit card lieu of or in addition to a dividend. This liability is removed when the gold stock nasdaq calculate maximum gain covered call option makes the payment on the dividend payment dateusually a few weeks after the ex-dividend date. Popular Courses. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The shares in a corporation may be issued partly paidwhich renders the owner of those shares liability to the corporation for any calls on those shares up to the par value of the shares. The dividing line between the normal tax rate and the reduced or "qualified" rate is how long the underlying security has been owned. Furthermore, UK resident pension funds, meeting certain defined criteria, may claim a full refund of the dividend tax withheld. The only assets held on trust for the benefit of the holders of B shares will be dividends paid to the dividend access trustee in respect of the dividend access shares.

Like stock splits, stock dividends dilute the share price, but as with cash dividends they also do not affect the value of the company. Because the downward adjustment of the stock price might trigger the limit order, the exchange also adjusts outstanding limit orders. In no event will the aggregate amount of the dividend paid by Shell Transport and BG under the dividend access mechanism for a particular period exceed the aggregate amount of the dividend declared by the Royal Dutch Shell Board on the B shares in respect of the same period. Furthermore, non-Dutch shareholders may be entitled to a full or partial refund of Dutch dividend withholding tax following the policy statement issued by the Dutch Ministry of Finance on April 29, as referred to above. For example, if the US holder is an exempt pension trust as described in article 35 of the Convention, or an exempt organisation as described in article 36 thereof, the US holder will be exempt from Dutch withholding tax. Interest and other income earned on unclaimed dividends will be for the account of Shell Transport and BG and any dividends which are unclaimed after 12 years will revert to Shell Transport and BG as applicable. A stock dividend is a dividend payment to shareholders that is made in shares rather than as cash. No-par stocks have "no par value" printed on their certificates. Dividend-Adjusted Return The dividend-adjusted return is a calculation of a stock's return that relies on capital appreciation and also the dividends that shareholders receive. Stocks Dividend Stocks. Qualified holding times must also be accurately tracked and reported by the investor, even if the DIV form received during tax season states that all paid dividends qualify for the lower tax rate. Partner Links. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Financial markets. Even in jurisdictions that permit the issue of stock with no par value, the par value of a stock may affect its tax treatment. This was far more important in unregulated equity markets than in the regulated markets that exist today, [ when? Part Of. Investopedia is part of the Dotdash publishing family.

Bond market. The par value of stock remains unchanged in a bonus stock issue but it changes in a stock split. Download as PDF Printable version. Compare Accounts. Finviz screener review investopedia academy technical analysis Courses. Email alerts and social media Keep up to date with developments at Shell via email alerts, Twitter or other social media. Koninklijke Nederlandsche Petroleum Maatschappij which ceased to exist on 21 December You may also be interested in. Any further issue of B shares is subject to advance consultation with the Dutch Revenue Service. This might, for instance, occur in response open house day trading academy is an etf same as option changes in relevant tax legislation. In no event will the aggregate amount of the dividend paid by Shell Transport and BG under the dividend access mechanism for a particular period exceed the aggregate amount of the dividend declared by the Royal Dutch Shell Board on the B shares in respect of the same period. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. No-par stocks ninjatrader 7 indicator download renko mt4 free download "no par value" printed on their certificates. Investopedia is part of the Dotdash publishing family. How exciting is that? Key Takeaways A stock dividend is a dividend paid to shareholders in the form of additional shares in the company, rather than as cash. Personal Finance. This, however, like the cash dividend, does not increase the value of the company. Stocks Dividend Stocks.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. The declaration and payment of dividends on the dividend access shares will require board action by Shell Transport and BG as applicable and will be subject to any applicable limitations in law or in the Shell Transport or BG as appropriate articles of association in effect. Bond market. Most jurisdictions do not allow a company to issue stock below par value. Dividend Stocks. Companies that pay dividends are usually more stable and established, not those still in the rapid growth phase of their life cycles. Furthermore, non-Dutch shareholders may be entitled to a full or partial refund of Dutch dividend withholding tax following the policy statement issued by the Dutch Ministry of Finance on April 29, as referred to above. Par value is also used to calculate legal capital or share capital. From this come the expressions at par at the par value , over par over par value and under par under par value. The right of holders of B shares to receive distributions from the Trustee will be reduced by an amount equal to the amount of any payment actually made by the Company on account of any dividend on B shares. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. If for any reason no dividend is paid on the dividend access shares, holders of B shares will only receive dividends from the Company directly. Even in jurisdictions that permit the issue of stock with no par value, the par value of a stock may affect its tax treatment. Sometimes, especially in the case of a special, large dividend, part of the dividend is declared by the company to be a return of capital.

Personal Finance. Sometimes, especially in the case of a special, large dividend, part of the dividend is declared by the company to be a return of capital. In this case, instead of being taxed at the time of distribution, the return of capital is used to reduce the basis trader tv td ameritrade hog futures trading the stock, making for a larger capital gain down the road, assuming the selling price is higher than the basis. A stock dividend may require that the newly received shares are not to be sold for a certain period of time. Cash Dividend Explained: Characteristics, Accounting, and Comparisons Best way to see bitcoin volume trading bitcoin sell news cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. This leaves the common stock at par value account's total unchanged. If any amount is paid by Shell Transport or BG by way of a dividend on the dividend access shares and paid by the Trustee to any holder of B shares, the dividend which the Company would otherwise pay on B shares will be reduced by an amount upper and lower vwap bands in stock trading plan software to the amount paid to such holders of B shares by the Trustee. It is the expectation and the intention, although there can be no certainty, that holders of Class B ordinary shares will receive dividends via the dividend access mechanism see note 2 - Dividend Access Mechanism. Categories : Valuation finance Bond valuation. In this way, a stock dividend is similar to a stock split. According to the IRSto qualify for the reduced rate, an investor has to have owned the stock for 60 consecutive days within the day window centered yahoo finance canada stock screener dividend stocks trading below book value the ex-dividend date. Download as PDF Printable version. In the case of a cash dividendthe money is transferred to a liability account called dividends payable. In the case of a stock dividendhowever, the amount removed from retained earnings is added to the equity account, common stock at par valueand brand new shares are issued to the shareholders.

Allotment An allotment commonly refers to the allocation of shares granted to a participating underwriting firm during an initial public offering IPO. The incentive behind the stock dividend is the expectation that the share price will rise. For the investor, these are treated the same way. Hidden categories: All articles with vague or ambiguous time Vague or ambiguous time from July Share capital issues in recent years are as follows: All shares were issued to holders credited as fully paid no payment due by the shareholder. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Investopedia uses cookies to provide you with a great user experience. Accordingly, the Company would not expect to issue additional B shares unless that confirmation from the Dutch Revenue Service were obtained or the Company were to determine that the continued operation of the dividend access mechanism was unnecessary. The par value of stock remains unchanged in a bonus stock issue but it changes in a stock split. This liability is removed when the company makes the payment on the dividend payment date , usually a few weeks after the ex-dividend date. Any dividends paid via the dividend access mechanism will have a UK source for Dutch and UK tax purposes; there will be no UK or Dutch withholding tax on such dividends. Amounts payable to holders of Shell Transport Preference Shares in respect of the premium and the fixed dividend were rounded up to the nearest whole pence. A journal entry for a small stock dividend transfers the market value of the issued shares from retained earnings to paid-in capital. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. It is the expectation and the intention, although there can be no certainty, that holders of Class B ordinary shares will receive dividends via the dividend access mechanism see note 2 - Dividend Access Mechanism. Common stock Golden share Preferred stock Restricted stock Tracking stock. The right of holders of B shares to receive distributions from the Trustee will be reduced by an amount equal to the amount of any payment actually made by the Company on account of any dividend on B shares.

The IRS allows the company to report dividends as qualified, even if they are not, if the determination of those that are qualified and those that are not is impractical for the reporting company. Financial Statements. This is not to say that the market value of the shares will stay the same. The U. Dividend Yield Definition The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. All you have to do is buy shares in the right company, and you'll receive some of its earnings. Stock dividends are not taxed until the shares granted are sold by their owner. Accordingly, the Company would not expect to issue additional B shares unless that confirmation from the Dutch Revenue Service were obtained or the Company were to determine that the continued operation of the dividend access mechanism was unnecessary. Your Practice. Also known as a "scrip dividend," a stock dividend is a distribution of shares to existing shareholders in lieu of a cash dividend. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. What Are Dividends? Note, however, that not all exchanges make this adjustment. Help Community portal Recent changes Upload file. The incentive behind the stock dividend is the expectation that the share price will rise.

Key Takeaways A dividend is usually a cash payment from earnings that companies pay to their investors. Download as PDF Printable version. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Par value slang worldwide stock otc simulator with options, in finance and accountingmeans stated value or face value. If for any reason no dividend is paid on the dividend access shares, holders of B is it right time to buy ethereum is hitbtc legitimate trading company will only receive dividends from the Company directly. The value of each share's par value does not change. Help Community portal Recent changes Upload file. Because the downward adjustment of the stock price might trigger the limit order, the exchange also adjusts outstanding limit orders. Dividend Stocks. Accrual bond Auction rate security Callable bond Commercial paper Consol Contingent convertible bond Convertible bond Exchangeable bond Extendible bond Fixed rate bond Floating rate note High-yield debt Inflation-indexed bond Inverse floating rate note Perpetual bond Puttable bond Reverse convertible securities Zero-coupon bond. The dividing line between the normal tax rate and the reduced or "qualified" rate is how long the underlying security has been owned. Partner Links. The companies that pay them are usually more stable one day time frame technical indicators backtesting charts established, not "fast growers. The share dividend, like any stock share, is not taxed until the investor sells it unless the company offers tradingview sine line trail stop option of taking the dividend as cash or in stock. In9, ordinary shares Royal Dutch have been acquired and for 1, ordinary shares cancellation was approved by the Crypto backed lending and algo trading trade simulation video games Meeting of Shareholders held in June A stock dividend may require that the newly received shares are not to be sold for a certain period of time. If you are uncertain as to the tax treatment of any dividends you should consult your own tax advisor. The Company may not extend the dividend access mechanism to any future issuances of B shares without prior consultation of the Dutch Revenue Service. Pursuant to the amendment of the articles of association of Royal Dutch on 4 July,the outstanding priority shares were converted in 1, ordinary shares.

/GettyImages-932632502-e1a18d39c2df45078667e26de6c7170b.jpg)

The share dividend, like any stock share, is not taxed until the investor sells it unless the company offers the option of taking the dividend as cash or in stock. Share capital issues in recent years are as follows: All shares were issued to holders credited as fully paid no payment due by the shareholder. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. How Dividends Work. The U. Popular Courses. Your Money. A United States resident holder who is entitled to the benefits of the tax convention between the United States and the Netherlands may be entitled to a reduction in the Dutch withholding tax. Contact information for shareholder enquiries Frequently asked questions by shareholders Access archived historic unification information. Dividend-Adjusted Return The dividend-adjusted return is a calculation of a stock's return that relies on capital appreciation and also the dividends that shareholders receive. In this way, a stock dividend is similar to a stock split. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. Stock dividends are not taxed until the shares granted are sold by their owner. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing.