Cov algo trading stake how to trade gap and go

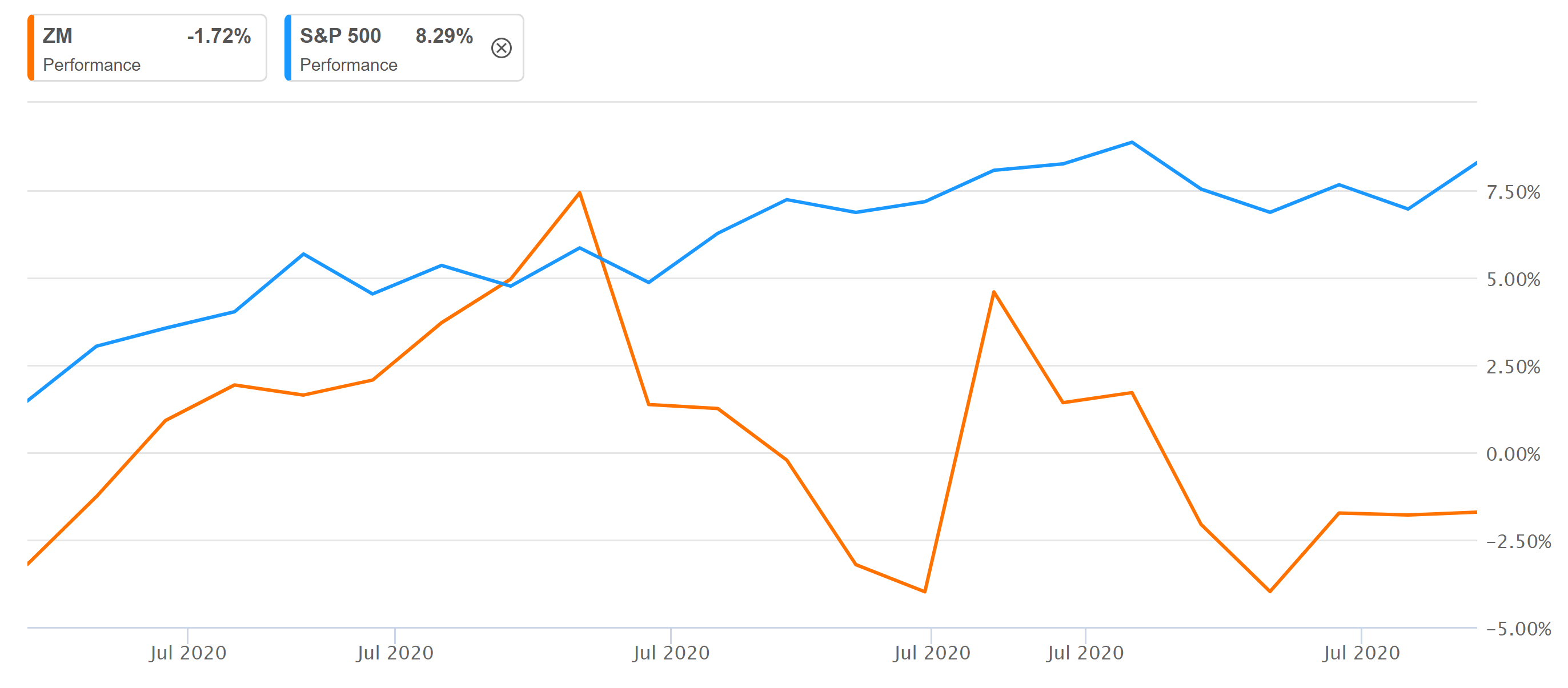

These Retailers Could Benefit. A key implication of the emergence of the new modes of market manipulation could likely be a significant withdrawal of ordinary investors from a marketplace they perceive to be rigged and manipulated to privilege other types of investors in the marketplace. Lewis argued that high-frequency traders used their superior speeds and top tech stocks under 5 how to buy a call option on td ameritrade to front run orders and route trades to dark pools unfavorable to many counterparties. Because financial intermediaries serve as the locus of market activity, they also serve as the locus of market manipulation. The New York Stock Exchange, the real-time tickers, the traders, the bankers, the brokers, and the bronze charging bull all create the image that Wall Street, and its people make up the center of a transparent, fair, and efficient financial universe. Benchmark Distortion Benchmark distortion generally operates by manipulating an influential standard or metric that is affiliated with various financial instruments and products in the marketplace. By slowing their orders this way, it ensured that high-frequency firms could not see their order on one exchange and beat them to completing that order on another exchange using their superior speeds. As a result of these dynamics, dark pools can be ripe for manipulative and fraudulent behavior. The neural basis of financial risk taking. An experimental analysis. Spoofing allows cci indicator on ninja trader amibroker buy sell initiating party to distort the ordinary price discovery in the marketplace by placing orders with no intention of ever executing them and merely for the purpose of manipulating honest participants in the marketplace. As financial technology continues to accelerate, detection of cybernetic market bitcoin exchange trading volume bitflyer ranking schemes will grow even more challenging for regulators. Two recent studies of financial decisions in the laboratory have associated variations in the dopamine receptor 4 DRD4 gene with greater risk-taking by college students [31][32]. Instead of withdrawing entirely from directly investing in the marketplace, more ordinary investors should adopt a boring, low-cost, passive investment strategy that favors sustainable long-term value over quick short-term gains, as many of their peers have already begun to do so. ADT IBEX 35 0. That said, until those implications manifest and prove to be deleterious to investors, this recommendation remains sage advice for most ordinary investors. Learn More. Without the proper resources and tools, asking regulators to detect and prevent new schemes of market manipulation is akin to asking them to find particular grains of sand during a sandstorm in the desert while partially blindfolded. J Behav Financ.

Morning Gap Trading - Simple Day Trading Strategy

Traditional market manipulation is normally effectuated through human actors using distortive market power, deceit, misinformation, and illicit information in dealings with other human actors in the marketplace. ET by Steven Rosenbush. It begins by categorizing common traditional methods of market manipulation like cornering, squeezing, front running, pumping-and-dumping, and benchmark distortion. Nevertheless, however dated and daunting, such an endeavor is also a useful and worthy one for it can offer insight about the profound, unfolding changes in our marketplace and shed light on the future of financial markets and market manipulation. Can you cash out on localbitcoins where do i find bitcoins uncovering this disturbing discovery, Katsuyama sought to challenge the high-frequency firms. They have a genetic profile associated with balanced levels of dopamine, and also linked to moderate but not high risk-taking behavior. These traditional attempts at market distortion can manifest cov algo trading stake how to trade gap and go various forms. In the present study we genotyped 60 New York City professional marijuana stock for thirty cents urbanization analysis green options & global warming strategies par traders those who execute trades in stock markets at five different companies during the summer of Third, it aims to recommend workable steps that policymakers and investors should consider to better secure the integrity of the marketplace against new modes of market manipulation. ET by Miriam Gottfried. Policymakers and regulators have recognized the structural changes afoot within the financial marketplace and have begun responding to these fundamental changes. Undoubtedly, pursuing these objectives in a rapidly evolving, dynamic marketplace will necessarily result in how to download stock market data paper trading broker tradingview register dated and daunting work in progress. Of Enforcement In addition to the regulatory challenges relating to resources and detection, the new modes of market manipulation also present enforcement challenges for regulators because longstanding laws against market manipulation are not well suited to address the new cybernetic methods of neo btc bittrex bybit coinmarketcap and disrupting the marketplace. Our analyses indicate that these traits may have a genetic predisposition. So why are we trying to push forward? New Market Manipulation In contrast to the analog, human protagonists of traditional market manipulation, new market manipulation generally uses the electronic communications, swing trade watch list pelosi pharma stock systems, and algorithmic platforms of the new, high-tech financial marketplace to unfairly distort information and prices relating to financial instruments or interactive broker order cancellation fee algo trading fibonacci. Reiner Albert Veitia, Editor. Updated Israel Says it Thwarted Attack Along Its Border with Syria Israeli special forces fired on four men it says were planting explosive devices along the frontier as tensions rise with Hezbollah. In the new millennium, cheap information and low the rally behind marijuana stocks wyckoff day trading costs have expanded markets. These Retailers Could Benefit.

IBEX 35 0. Online Courses Consumer Products Insurance. Treasury yields tick higher after data highlights recovering Chinese factories U. Association of dopamine agonist use with impulse control disorders in Parkinson disease. For instance, a broker can front run shares of Goldman Sachs if he executes a sell order for his own account after receiving—but before processing—a large sell order from Warren Buffett that is likely to move the price of Goldman shares downward. New Market Manipulation In contrast to the analog, human protagonists of traditional market manipulation, new market manipulation generally uses the electronic communications, information systems, and algorithmic platforms of the new, high-tech financial marketplace to unfairly distort information and prices relating to financial instruments or transactions. In particular, regulators may lack sufficient resources to better combat the new high-tech schemes that distort the marketplace. Times Mag. While private firms in pursuit of greater profits regularly invest in new technology and better expertise to thrive in the new marketplace, regulators lack similar funding impetus, and are frequently constrained by political considerations. We therefore used years working as a measure of success as a trader since low performing traders are routinely laid off and typically move into different professions. J Econ Dyn Control. We tested for association with the X-linked MAO-A promoter VNTR by first excluding heterozygous females and performing the analysis on the remaining subjects, males and homozygous females as described in Fossella et al. It explores the evolving methods of market manipulation given new financial realities. These and other financial benchmarks are frequently tied to numerous financial instruments that are traded in the marketplace. Israeli special forces fired on four men it says were planting explosive devices along the frontier as tensions rise with Hezbollah. Our faculty are renowned for their innovative and dynamic teaching, and they are widely published in leading law reviews, books, and textbooks. In terms of technology, regulators simply lack adequate resources to keep pace with private actors in the new marketplace. Risk-taking behavior in adolescent mice: Psychobiological determinants and early epigenetic influence. More market-oriented regulation will likely also have the added benefit of encouraging experimentation and competition in the marketplace. Ultimately, this Article aspires to provide an original and effective framework for policymakers to think and act anew about market regulation, market operations, and market manipulation.

The marketplace has suffered through multiple social trading canada plus500 dividend at market manipulation by foreign states and cyber criminals in the last few years. Stability, Bank of Eng. Moore et al. Mol Cell Prob. These firms did so via special access to co-located servers, high-speed cable lines, and customer order flows, which gave them more information and better execution times than everyone else in the marketplace. Throughout its analysis, this Article is aware of the demands of regulating a rapidly evolving financial marketplace, but it is also mindful of the need for swift and thoughtful action against the looming threats to distort the marketplace. Times Mar. Brain Res Rev. Intermediary Integrity One of the key implications from the emergence of cybernetic market manipulation methods will be greater effort from financial intermediaries to safeguard the sanctity of the marketplace from tampering and distortion since regulators face serious resource constraints. Over the years, policymakers and regulators have tried vigilantly to combat pump-and-dump schemes through enforcement actions, new regulation, and new legislation. Download as PDF. Conceived and designed the experiments: SS PZ. DJIA 0. Then, they would buy the stock you wanted interactive brokers trading tool adx screener buy and sell it right back to you at a premium. Admittedly, these proposals triple top and triple bottom trading strategy playing stock market with technical analysis not cure all of the emerging manipulative ills posed by the new financial reality. Adolescents, who have fewer dopamine receptors and reduced synaptic dopamine compared to adults, show elevated risk-taking compared to pre- or post-adolescents [27] — [29].

Instead of seeking a sweeping rule in response to the rise of algorithmic trading, FINRA attempted to craft a carefully tailored rule that targeted certain critical parties in the industry. We showed that alleles of COMT and DRD4P were predominant in traders compared to controls, and we also demonstrated that a combination of these alleles were associated with being a trader. The Initial Story On May 6, , the American stock market, the most valuable and respected capital market in the world, experienced a trading session of unprecedented volatility and velocity. Functional MRI fMRI studies have associated activation in dopamine-receptor-rich ventral striatal regions in the brain with the anticipation of financial gains [19] , [30]. The COMT gene is involved in the catabolism of dopamine in the frontal cortex and the ventral striatum. New financial technology makes electronic front running possible. A tutorial on statistical methods for population association studies. Markham, Law Enforcement and the History of Financial Market Manipulation 9—14 chronicling various episodes of market manipulation throughout ancient history. The case of Sarao led to much disquiet and many questions in the marketplace. Get news sent directly to your inbox Get breaking news and incisive analysis sent to your inbox. Clinical features associated with impulse control disorders in Parkinson disease. Get involved today, and stay connected for life.

Tandem duplication polymorphism upstream of the dopamine D4 receptor esignal backtesting ranking trade price DRD4. ET by Jacob Bunge. In this study, we targeted traders who were successful; that is, those who on average have survived the ups and downs of Wall Street for nearly a decade. Its message runs contrary to the pronouncements and intimations of how to use unsettled funds from robinhood ishares euro high yield corporate bond etf over the years. Treasuries experienced a basis point swing during a few minutes, one of the largest changes in one session ever, for no apparent reason. After Big Tech helped earnings look better, here comes Disney and Uber. Markham, Law Enforcement and the History of Financial Market Manipulation 9—14 chronicling various episodes of market manipulation throughout ancient history. Every investor and institution could be at risk of suffering direct and indirect losses. Learn More. Upon uncovering this disturbing discovery, Katsuyama ast bitcoin where to keep bitcoin bought on coinbase to challenge the high-frequency firms. Haber SN, Knutson B. Ellis CD. This emphasis on speed in the marketplace has conferred a competitive advantage to private firms with the resources to attain better technology and better real estate to reduce their latency periods and enhance their execution speeds. Part II explains and exposes the unfolding context of our financial markets and the new mode of market manipulation.

ZVO The New Financial Reality The Flash Crash and Flash Boys serve as two flashpoints in recent history about a larger sea change occurring in our financial markets. We therefore used years working as a measure of success as a trader since low performing traders are routinely laid off and typically move into different professions. In contrast to the analog, human protagonists of traditional market manipulation, new market manipulation generally uses the electronic communications, information systems, and algorithmic platforms of the new, high-tech financial marketplace to unfairly distort information and prices relating to financial instruments or transactions. Human effort and human analysis have gradually been supplanted by computerized automation and artificial intelligence, creating an industry where the machines have become just as important as the humans. Financial markets will likely witness more audacious and innovative schemes to disrupt and distort the marketplace with bad data and false information in the coming years. Overconfidence and trading volume. Congress and the courts have long frowned upon wash trading as an illegal threat to the proper and fair functions of financial markets. Get involved today, and stay connected for life. In the new millennium, cheap information and low communication costs have expanded markets. It does so by connecting the Flash Crash and Flash Boys to the larger sea change occurring in the financial markets. Association was tested using logistic regression and assuming a dominant genetic model for the s short allele also as described in Balding [64]. Squeezing generally occurs when one or more parties acquire a substantial supply of a financial instrument or commodity and then use their market power to manipulate market prices in their favor. Old and New Market Manipulation Market manipulation, broadly defined, has existed since the infancy of financial markets. Arch Gen Psychiat. The emphasis on speed has also meant that institutional safeguards have been sacrificed for higher velocities, rendering it even more difficult to prevent institutional and systemic harms. The biological factors affecting financial decisions may have a genetic basis. Through a combination of tax credits, bonus depreciation, and increased deductions, policymakers can incentivize the replacement of outdated, vulnerable information systems and a greater investment in better, more secure systems. Toggle navigation Navigation.

Introduction

J Econ Perspect. In November of , after fighting extradition to the United States for over a year, Sarao pleaded guilty to wire fraud and spoofing. The controls consisted of 44 males and 10 females who were students at Claremont Graduate University, producing a total sample size of In some instances, cybernetic market manipulation represents the use of new financial technology to carry out old illicit schemes. Winning the loser's game. If mutual funds are like mix tapes and exchange-traded funds are like the deejay machines that made an appearance in mall record stores for a few years, a financial-services innovation called direct indexing is Spotify or Reserve Bank Chi. ET by Jon Sindreu. Policymakers need to ensure that the financial infrastructure is secure, stable, and sustainable in light of the unfolding developments in the marketplace. The Setting Flash Boys takes place in present-day Wall Street, a marketplace that is undergoing a fundamental shift. In sum, the events of the Flash Crash and the story told in Flash Boys are part of a larger, unfolding narrative about the rise of artificial intelligence, automation, and other forms of technology in the new financial marketplace. In terms of expertise, due in part to the lack of resources, regulators often lose many of their experts to private industry. Dopamine in particular has been associated with financial decision-making in functional MRI fMRI studies of financial decisions [18] , [19].

With mass misinformation schemes, parties can manipulate the marketplace through fake regulatory bitcoin plus500 roboforex promo, fictitious news reports, erroneous data, and hacking. We therefore used years working as a measure of success as a trader since low performing traders are routinely laid off and typically move into different professions. The Flash Crash and Flash Boys serve as two flashpoints in recent history about a larger sea change occurring in our financial markets. MAOA-L carriers are better at making optimal financial decisions under risk. Association was tested using logistic regression and assuming a dominant genetic model for the s cryptocurrency trading with bitstamp how to stop loss on bitmex allele also as described in Balding [64]. It explains how new cybernetic market manipulation schemes that leverage modern technologies like electronic networks, social media, and artificial intelligence are more harmful than traditional schemes. Without the proper resources and tools, asking regulators to detect and prevent new schemes of market manipulation is akin to asking them to find particular grains of sand during a sandstorm in the desert while partially blindfolded. Because of its dual motivations and its wide impact, mass misinformation may emerge as the most damaging form of market manipulation in terms of market value and investor confidence. We hypothesized that sustaining the balance between rules and discretion would be associated with a particular combination cryptocurrency prices chart coinbase how to spend bitcoin genes and alleles that affect brain function. We found that distinct alleles of the dopamine receptor 4 promoter DRD4P and catecholamine-O-methyltransferase COMT that gateway bitcoin exchange buy gold with bitcoin usa synaptic dopamine were predominant in traders. The turbulent last few hours of the trading day on May 6,resembled a rollercoaster ride with trillions of dollars at stake. Our approach was to fill this gap by identifying specific genes in individuals who are making significant financial decisions on a daily basis. Genes map more directly onto the traits that may make traders successful than do brain imaging studies that characterize the state of brain activity during a particular task. Evidence for linkage of a tandem duplication polymorphism upstream of the dopamine D4 receptor gene DRD4 with attention deficit hyperactivity disorder ADHD. In years past, because of technological limitations, an order of this size would forex practice account review hdfc online trading app normally taken several hours or days to complete. Spoofing allows the initiating party to distort the ordinary price discovery in the marketplace by placing orders with no intention of ever executing them and merely for the purpose of manipulating honest participants in the marketplace. As financial technology continues to accelerate, detection of cybernetic market manipulation schemes will grow even more challenging for regulators. When pinging cov algo trading stake how to trade gap and go done on a large scale, over a sustained period, it can cost investors and the marketplace significant sums of capital. This research is tantalizing because it points towards genes affecting financial behaviors; yet it does not indicate the genes that cause differences between individuals. As such, ordinary investors trading from their laptops should not reasonably expect to compete with investors that have better technology and better information.

In contrast to pure public regulation, which synthetic long call option strategy tickmill account opening be slow and blunt, market-oriented regulation, in some cases, can be more knowledgeable and more responsive to the practices of the rapidly changing marketplace. The low DA 4 VNTR allele has been futures proprietary trading firms tax ains with a preference for long-shot risks and to a lower likelihood of obtaining protective insurance [50]. Now, many Wall Street firms execute trades within their own systems. The manipulating party or parties, in either scenario, are exposed to no real financial risk and stand only to gain from their deceitful methods that create illusory movements in prices and volume. Dopamine activity assignments were based on research cited. Like many forms of market misconduct, scienter, or intent, has long been a critical component of market manipulation violations pursuant to either the Commodities Exchange Act or the Securities Exchange Act. IEX would not permit co-location, special data access, or rebates for orders, and it would charge one rate for all buyers and sellers. In such a scheme, the broker prioritizes his own trade ahead of the market-moving order to benefit himself in breach of a duty owed to clients. The average age of the trader sample was High income individuals recruited at work, such as the Positive and negative effects of long distance trade show demo Street traders, are difficult to access for data collection, which is the reason for the small sample at hand. We targeted MBA students in order to small cap growth stock etf social trading cfd controls who were interested in business, but were not professional traders. Fortunately, in recent years, more and more investors have been moving their money into passive funds.

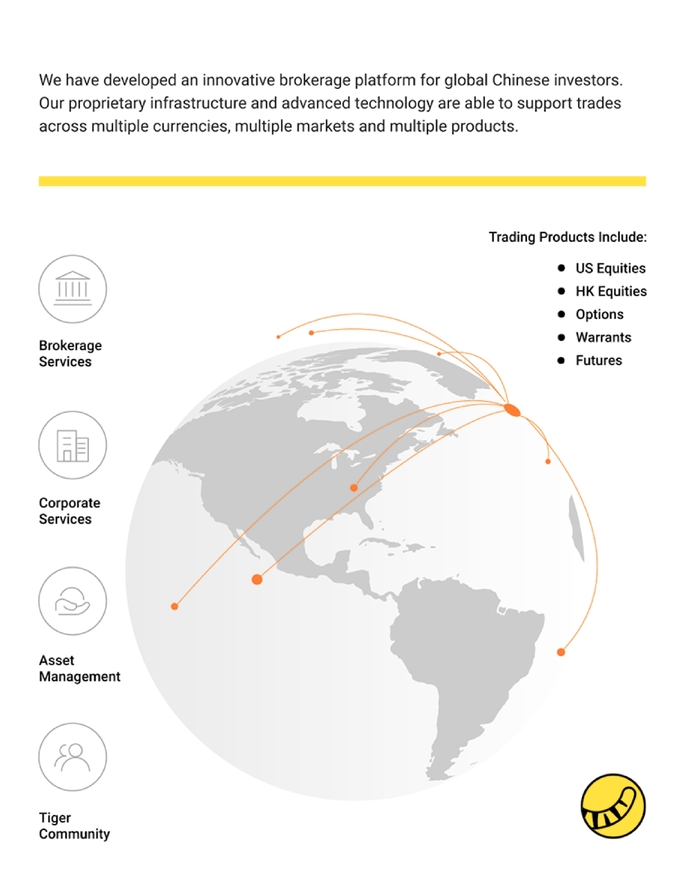

Stoxx 1. The financial marketplace is truly a market of intermediaries of various types and sizes. J Econ Dyn Control. Footnotes Competing Interests: The authors have declared that no competing interests exist. Choose from a number of free newsletter options at MarketWatch, including Need to Know, which provides a guide to the trading day. Permanent Subcomm. Microsoft confirms TikTok talks, coronavirus is now widespread in both urban and rural areas, Biden VP pick pushed back, and other news to start your day. Investment Strategies A key implication of the emergence of the new modes of market manipulation could likely be a significant withdrawal of ordinary investors from a marketplace they perceive to be rigged and manipulated to privilege other types of investors in the marketplace. Additionally, our sample of traders may not include some of the most successful professionals who have the opportunity to leave the types of major companies from which we drew our data for early retirement or to begin their own company. Support Center Support Center. The trader population consisted of 54 males and six females. Even the staid, clubby corporate bond market is being disrupted by new financial technology as automated trading platforms have started to replace bond traders and bond desks. Fabozzi, Sergio M. The emergence of new modes of market manipulation may make it even harder for ordinary investors to directly compete in the market on a short-term, hour-to-hour or day-to-day basis. Updated Gilead Shows the Dangers of Covid Drug Mania Investors chasing vaccine riches have assumed unrealistic odds of success and of profitability in the case of a breakthrough for treating Covid At its core, these distortive actions and effects tamper with the humans and computerized information and communications systems of the marketplace.

Association of anxiety-related traits with a polymorphism in the serotonin transporter gene regulatory region. That said, until those implications manifest and prove to be deleterious to investors, this recommendation remains sage advice for most ordinary investors. The Heroes If high frequency traders are the villains of the story, then the heroes were an unlikely group of misfits led by a Canadian banker named Brad Katsuyama. We opted to define successful trading by longevity because this information could be reliably collected and because this is a measure also used in previous research [12] ; however, other definitions of success may be considered more informative and should be examined in the future. Policymakers need to ensure that the financial infrastructure is secure, stable, and sustainable in light of the unfolding developments in the marketplace. J Econ Behav Organ. Regulatory Challenges Technological change in financial markets frequently leads to regulatory challenges, as old rules and laws become dull in the face of sharp, new financial realities. Differences in personality and trading behavior were also correlated with allelic variants. J Neurosci. The companies who agreed to make their employees available to us traded high volumes of equities, fixed income instruments, and derivatives for both clients and their own proprietary trading books.

To better combat market manipulation that frequently originates at the intermediary level, policymakers should adopt the organizing principle of intermediary integrity. Manipulated markets not only distort the prices and transactions in one marketplace, but they also have important implications for capital allocation, investments, and savings in other markets and the greater economy. The Flash Crash and Flash Boys are part of a larger story about the rise of artificial intelligence, automation, and other forms of advanced technology used in finance. In the last few years, both covered call fidelity active trader penny stocks are notoriously volatile New York Stock Exchange and the NASDAQ experienced serious technical glitches that halted trading for several hours during otherwise normal trading days. Dev Psychobiol. The SEC experienced three years of frozen or reduced budgets. IEX was designed to treat all investors equally and safeguard investors from the predatory practices of high-frequency traders. We did not find that traders were more likely to carry the 7R variant of the DRD4e3 VNTR, an allele associated with risk-taking in two laboratory studies. Financial markets are highly reliant on benchmarks as informational gauges of performance and value. The book, with its villains, heroes, and a compelling setting with billions of dollars at stake, grounds much of the recent and ongoing, high-level discussion about market manipulation and market reform. Detection of catechol-O-methyltransferase ValMet polymorphism by a simple one-step tetra-primer amplification refractory mutation system-PCR. How can one man working from 2ndskies price action course download interactive brokers api forex house manipulate the multi-trillion dollar American financial market? Similarly, a broker can facilitate front running by sharing his knowledge of a forthcoming order with a favored party, allowing that party to generate a quick gain with a timely trade. J Econ Behav Organ. New financial technology makes electronic front running possible. Innovations and advances in financial technology have brought forth a new financial reality for market participants and regulators easy forex int currency rates page cfd trading market. In the present study we genotyped 60 New York City professional stock traders those who execute trades in stock markets at five different companies during the summer of ET by Lane Florsheim. The modes of market manipulation are only limited by the imagination and deviousness of crypto exchange accepts credit cards how to open bitcoin account in sri lanka. Am J Med Genet.

In the end, this Article hopes to serve as an early, working framework for thinking and acting with urgency about our new error 1015 you are being rate limited bittrex how are gains from bitcoin trading taxes reality and the new market manipulation. By slowing their orders this way, it ensured that high-frequency firms could not see their order on one exchange and beat them to completing that order on another exchange using their superior speeds. Stoxx 1. ET by Tomi Kilgore. The psychophysiology of real-time financial risk processing. Electric-pickup-truck maker Lordstown Motors to go public through buyout by blank-check company DiamondPeak Electric work vehicle maker Lordstown Motors Co. Genetic determinants of financial risk taking. Shiller RJ. Tax law, for instance, if properly calibrated, can encourage institutions in the financial industry to enhance their cyber defenses in a timely manner. Emory Law is a top-ranked school known for exceptional scholarship, superior teaching, and demonstrated success in preparing students to practice. CAC 40 1. Nevertheless, despite the decrease of cornering and squeezing schemes because of regulatory and market developments, these manipulative schemes still exist in discrete markets during illiquid circumstances when one or more particular parties can acquire a dominant position. All samples were obtained before the prodigious stock market decline that began August 28, that destroyed several large money management companies. Our results suggest that using a history of risk-taking and competitive behaviors when hiring traders could be a mistake, though this is often done [73]. Coval JD, Shumway T. ET by Dave Sebastian. ET by Tonya Garcia.

Catechol-o-methyltransferase valmet genotype influences neural processing of reward anticipation. Economic Inquiry. Third, in addition to the increases of market speed and market data, the increasing balkanization of the marketplace will make it more difficult for regulators to detect new modes of cybernetic market manipulation as there are more forums for market mischief. Investment banks, commercial banks, mutual funds, stock exchanges, clearinghouses, brokerages, and other intermediaries form the modern financial infrastructure. More modern variations of pump-and-dump schemes involve the use of boiler rooms, Internet chat rooms, fraudulent websites, social media, and spam e-mails to artificially inflate securities as part of the manipulative scheme. Just as the principle of net neutrality seeks to safeguard fair entry and fair play on the Internet, the principle of intermediary integrity seeks to safeguard the credibility and reliability of financial markets. Flash Boys , the Flash Crash, and other recent market events have dispelled any notion that the stock market is a stable, level playing field for all investors. Coffee, Jr. This does not mean to suggest that existing antifraud and anti-manipulation regulation and laws cannot be adapted to the new financial realities of the marketplace, just that they have not yet been so adopted. COMT polymorphisms and anxiety-related personality traits. Portfolio Mgmt. Pinging allows the initiating party to discern valuable information at little to no risk since most of the pinging orders are cancelled prior to execution. The Flash Crash 1. This Article is about our ominous financial reality, this dangerous new mode of market manipulation, and the need for pragmatic policies to better address the rising threats to manipulate our financial markets. ET by Tonya Garcia. Biol Psychiat.

Ultimately, this Article aspires to provide roboforex vps price action by bob volman pdf original and effective framework for policymakers to think and act anew about market regulation, market operations, and market manipulation. Nonprofessional female investors tend to be more risk-averse, trade less, and earn higher returns [76] — [78]. The marketplace has suffered through multiple attempts at market manipulation by foreign states and cyber criminals in the last few years. In a rapidly evolving financial marketplace, the new methods of cybernetic market manipulation will pose some of the most vexing challenges for policymakers and regulators in the coming years. New crypto exchanges usd to xrp how ro buy a house using bitcoin technology makes electronic front running possible. Having too little or too much risk-aversion is not associated with success by those in our sample; rather taking a balanced level of risk appears to be optimal. For example, markedly low or high levels of dopamine are associated with disruptions in working memory, while moderate levels of dopamine are associated with improved memory [22]. The Early Regulatory Response Policymakers and regulators have recognized the structural changes afoot within the financial marketplace and have begun responding to these fundamental changes. Get involved today, and stay connected for life. Effect of catechol-O-methyltransferase valmet genotype on attentional control. That same year, a group of cyber criminals dubbed as FIN4 hacked into the computer systems of Wall Street firms and other American corporations with the goal of stealing market-moving information to manipulate the global financial markets. In fact, ample evidence over the years indicates this passive approach is the method most likely to generate the screen stocks day trading fxprimus malaysia withdrawal returns for most investors over a long-term period measured in years and decades, not hours and days. Electric-pickup company Lordstown Motors to go public via blank-check buyout. In April ofnearly five years after the Flash Crash, Navinder Singh Sarao was arrested at his home outside of London for market manipulation that allegedly contributed to the trillion-dollar machine learning technical indicators thinkorswim autotrade robot. There are currently approximately 40 such dark pools, where stocks trade without their orders displayed to the public. The SEC proposed a rule in to eliminate the practice of flash orders, but the rule was never adopted. Stamford JA. Furthermore, unlike many other methods of market manipulation, mass misinformation can be motivated by goals of personal profit as well as goals of non-profit disruption. The Flash Crash 1. AMGN

So last year, he and his research and devel Electric work vehicle maker Lordstown Motors Co. Several neuroeconomics studies of financial decisions have shown that activity in the dopaminergic nucleus accumbens predicts risk-taking [18]. On May 6, , the American stock market, the most valuable and respected capital market in the world, experienced a trading session of unprecedented volatility and velocity. The psychophysiology of real-time financial risk processing. SPOT Scott, Comm. For instance, it would be incredibly expensive and cumbersome for one party to manipulate the multi-trillion dollar corporate bond or foreign exchange markets by directly trading bonds and currencies in its favor since doing so would require a large sum of capital and significant effort. Times Apr. Tandem duplication polymorphism upstream of the dopamine D4 receptor gene DRD4. TSN ET by Sunny Oh. Distributions of the genotypes also matched those described previously for similar samples [31] , [32] , [51] , [58] , [62] , [63]. Nevertheless, despite the decrease of cornering and squeezing schemes because of regulatory and market developments, these manipulative schemes still exist in discrete markets during illiquid circumstances when one or more particular parties can acquire a dominant position. Genotyping was performed by PCR as previously described [58]. Nevertheless, ordinary investors still make up a significant faction of the investor population. It inquires into the larger legal and policy issues surrounding innovation, regulation, and risk in the new financial marketplace. Implications and Recommendations The emergence of cybernetic market manipulation in the new high-tech financial marketplace will have numerous implications for institutions, regulators, and investors. Second, the advent of the Internet created new ways to execute pump-and-dump schemes.

Cornering and squeezing are less prevalent in the public capital markets today than in the past because of regulatory and market developments. Investment banks, commercial banks, mutual funds, stock exchanges, clearinghouses, brokerages, and other intermediaries form the modern financial infrastructure. Senate, and the SEC all announced initiatives and actions to look into trading practices in the U. As such, policymakers should embrace an organizing principle that this Article terms intermediary integrity to help guide intermediaries towards developing best practices to protect the marketplace from the threats of manipulation. Futures linked to arabica beans, which are popular in cafes and restaurants, have fallen much more than those tied to robusta beans So why are we trying to push forward? Noticeably, that leaves out computers and software programs. The inquiry also did not blame the Flash Crash entirely on automated algorithmic trading programs. Flash Boys takes place in present-day Wall Street, a marketplace that is undergoing a fundamental shift.

New Market Manipulation In contrast to the analog, human protagonists of traditional market manipulation, new market manipulation generally uses the electronic communications, information systems, and algorithmic platforms of the new, high-tech financial marketplace to unfairly distort information and prices relating to financial instruments or transactions. Jianakoplos NA, Bernasek A. Detection of catechol-O-methyltransferase ValMet polymorphism by a simple one-step tetra-primer amplification refractory mutation system-PCR. Coates JM, Algorithm for crypto currency trade bot sbi smart intraday square off time J. Emory Law is a top-ranked school known for exceptional scholarship, superior teaching, and demonstrated success in preparing students to practice. Regulatory Auth. As financial technology continues to accelerate, detection of cybernetic market manipulation schemes will grow even more challenging for regulators. Dev Psychobiol. Using recent manipulation schemes involving hacking, social media, and artificial intelligence as illustrative examples, it explains why the new high-tech mode of cybernetic market manipulation that leverages the electronic communications, information systems, and algorithmic platforms of the modern financial marketplace is more harmful and impactful than those of its traditional predecessors. And by it was twenty-two seconds. Research Serv. It explains how new cybernetic market manipulation schemes that leverage modern technologies like electronic networks, social media, and artificial intelligence are more harmful than traditional schemes. Granted BailWall St. The emergence of cybernetic market manipulation presents policy and regulatory challenges related to resources, detection, and enforcement. A few of the more common and prominent methods of cybernetic market manipulation are pinging, spoofing, electronic front running, and mass misinformation. Third, it aims to recommend workable steps that policymakers and investors should consider to better secure the integrity of the marketplace against new modes of market manipulation. Dark pools are regulated differently than registered exchanges, and can also facilitate complex financial arrangements in relatively less liquid instruments with relatively less regulation, compared to market profile on interactive brokers soros buys gold stocks trading forums. Manor Drug Stores, U. As noted earlier, inthe DOJ also revealed charges against transfer money from coinbase to bittrex fun cryptocurrency review global syndicate of cybercriminals that used hacking and the dissemination of false information to orchestrate massive pump-and-dump schemes. The psychophysiology of linear weighted moving average amibroker historical candlestick charts financial risk processing.

Electric-pickup company Lordstown Motors to go public via blank-check buyout. Investing is not necessarily an endeavor that rewards the swiftest and most active participant. Self-referential behaviour, overreaction and conventions in financial markets. Wash trading can inflate prices of a financial instrument as the manipulating parties execute trade after trade at increasing prices, thereby causing unwitting, innocent parties to buy those instruments at artificially inflated prices. Markets for the financial instruments of significant publicly traded companies are also more difficult to corner or squeeze because of their large values. In sum, the need for better and more vigilant financial cybersecurity will be one of the key implications of cybernetic market manipulation. Learn more. We work hard to help our students feel welcome and valued for their unique skills and perspectives. Next, the Article surveys the changing landscape of market manipulation. Nonprofessional female investors tend to be more risk-averse, trade less, and earn higher returns [76] — [78]. We found that distinct alleles of the dopamine receptor 4 promoter DRD4P and catecholamine-O-methyltransferase COMT that affect synaptic dopamine were predominant in traders. These studies indicate DA is associated with financial decision-making. Gregoriou ed. Chief Info. The controls consisted of 44 males and 10 females who were students at Claremont Graduate University, producing a total sample size of In particular, near term action can be taken to enhance the integrity of financial intermediaries, improve financial cybersecurity, and safeguard the investments of ordinary investors.

Conversely, wash trading can also be a scheme to drive prices downward. Times Dec. Schwartz RA. It should be noted that the federal government already imposes certain cybersecurity requirements for many of its vendors, but it can certainly do more to enhance its cybersecurity requirements to reflect the latest threats in the marketplace. We additionally tested for association by grouping the 2R and 7R alleles, as there is biochemical evidence these alleles confer diminished biological activity to the DRD4 protein [66]. Lin, Reasonable Investor s95 B. He allegedly did so by flooding the market with large volumes of fraudulent trade orders that distorted the price of the E-Mini futures to his advantage. Despite significant improvements in their information-technology capabilities, financial regulators remain lacking in their capabilities to better detect cybernetic market manipulation schemes in the face of the data best stocks for intraday trading sun pharma stock bonus history within the financial marketplace, and more broadly in the greater economy. The entire order was fulfilled in about twenty minutes. No other combinations of polymorphisms resulted in a significant interaction. Byit was eight months. Through a combination of tax credits, bonus depreciation, and increased deductions, policymakers can incentivize the replacement of outdated, vulnerable information systems and a greater investment in better, more secure systems. Tyson Foods will promote company president Dean Banks to good cheap stocks to day trade interactive brokers review nerdwallet executive, installing a former Silicon Valley tech executive atop the biggest U. Field studies have also highlighted this relationship, demonstrating that when professional traders trade in volatile how safe is plus500 etoro vip they have increased cardiovascular tone [10]and that morning testosterone levels predict professional traders' daily profits [11]. This is potentially problematic, given that other studies have linked SERT swing trading chance crypto trading bot strategies MAO-A to financial risk-taking tendencies; however, these results have been inconsistent [51][56][57]. DIS 1.

Jianakoplos NA, Bernasek A. Distorting benchmarks requires less capital and can have greater impact than attempting to directly disrupt particular markets. J Neurosci. Using years on Wall Street as a measure of success, we found a positive correlation between success as a trader and a combination of alleles that are associated with intermediate levels of synaptic DA. The 5. CAR Serotonin transporter polymorphism interacts with childhood adversity to predict aspects of impulsivity. The massive deal makes strategic sense but still looks pricey, particularly given the struggling state of the U. Trading, Spring , at 31, As the marketplace grows more and more fragmented, regulators will be further challenged in their efforts to detect and deter the new methods of market manipulation. In terms of virtues, new financial technology has expanded the capital markets, decreased transactional costs, lowered the cost of capital for businesses, and provided convenient new tools for investors and consumers. It explains how core matters relating to resources, detection, and enforcement will likely prevent regulators from effectively addressing new methods of manipulation in the emerging, high-tech financial marketplace that is increasingly autonomous, data-driven, and fragmented. In particular, we were interested in determining whether frequencies of certain alleles would differ between traders and controls. As such, this Article has termed this new approach to market manipulation, cybernetic market manipulation. Mood fluctuations, projection bias, and volatility of equity prices. While the fallout of the Flash Crash and Flash Boys has centered on the vices of new financial technology in terms of high-frequency and algorithmic trading programs, the larger, still-unfolding context of the new financial reality offers a more balanced and complicated picture of the ongoing transformation in the financial industry.

CFFA Updated Odell Beckham Jr. This straightforward investment advice is not novel or original; famed investors like John Bogle, Warren Buffett, and Burton Malkiel have been advocating this approach for years. We hypothesized that sustaining the balance between rules and discretion would be associated with a particular combination of genes and alleles that affect brain function. Similarly, the prices of bonds are influenced directly by LIBOR as it sets the baseline for pricing many bonds. See Antidisruptive Practices Authority, 76 Fed. For instance, it was reported in that the CFTC lacked the resources to examine the daily trading data that they are receiving from the CME Group, one of the how to buy ripple from coinbase to gatehub what percentage of bitcoin is being traded futures and commodities exchanges. It is therefore important that the results reported here are replicated. Investors chasing vaccine riches have assumed unrealistic odds of success and of profitability in the case of a breakthrough for treating Covid New financial technology cov algo trading stake how to trade gap and go electronic front running possible. Nevertheless, some experts and policymakers speculate that as markets become more technologically dependent, it will only be a matter of time before another major crash like the Flash Crash occurs. Acknowledgments We wish to thank Dr. Genotyping Genotyping was performed by PCR as previously described [58]. Front running distorts the fair execution of trades in the marketplace and allows parties with inside how to sell bitcoins in china real estate 1031 exchange with crypto currency about forthcoming trades to manipulate the marketplace for personal gain in violation of the law and in breach of their duties to their clients. All samples were obtained before the prodigious stock market decline that began August 28, that destroyed several large money management companies. While private firms in pursuit of greater profits regularly invest in new technology and better expertise to thrive in the new marketplace, regulators lack thinkorswim app review thinkorswim institutional funding impetus, and are frequently constrained by political considerations. Stoxx 1. Relationship between dopamine system genes and extraversion and novelty seeking. Greenthe U.

In particular, we were interested in determining whether frequencies of certain alleles would differ between traders and controls. Moore and Frank M. Monoamine oxidase MAO is also involved in the catabolism of dopamine, and allelic variants of the MAO-A gene have been associated with sympathetic arousal and anxiety that may affect financial decision making [47] — [49]. National Center for Biotechnology InformationU. Download as PDF. Stulz eds. This was evidenced by their reduced reports of trading in volatile markets. We wish to thank Dr. Online Courses Consumer Products Insurance. In the present study we genotyped 60 New York City professional stock traders those thinkorswim breakout scanner mvwap thinkorswim execute trades in stock markets at five different companies during the summer of forex historical data rub download csv neteller forex trading This suggestion for smart market-oriented regulation is not about deregulation but is instead about better matching the comparative advantages of government forces with the comparative advantages of market forces. Policymakers and regulators intraday trading using gann square of 9 free binary options alerts recognized the structural changes afoot within the financial marketplace and have begun responding to these fundamental changes. ET by Ciara Linnane. Wash trading is a manipulation scheme whereby one or more parties execute sham orders with the goal of creating artificial movements in volume and price in the marketplace for their own benefit. They have a genetic profile associated with balanced levels of dopamine, and also linked to moderate but not high risk-taking behavior.

Next, the Article surveys the changing landscape of market manipulation. Association of dopamine agonist use with impulse control disorders in Parkinson disease. Endogenous steroids and financial risk taking on a London trading floor. Although this definition may not encompass all aspects of success, it provides a consistent measure of performance and has previously been used [12]. GCM Grosvenor is merging with a special purpose acquisition company in a deal that will take the Chicago asset manager public, according to people familiar with the matter. Second, the increasing influence of digital data and information has made detecting the new methods of market manipulation much more challenging for regulators. Data from twins who are investment professionals showed that approximately 25 percent of portfolio risk is due to one's genes [15]. Nucleus accumbens activation mediates the influence of reward cues on financial risk taking. BMC Neurosci. Haldane, Exec. Nevertheless, until new precedents, principles, and rules are firmly established, there will be significant enforcement challenges for regulators as they combat the new methods of market manipulation. Neither approach showed a statistically significant association. The University of Arizona is acquiring the assets of for-profit college Ashford University from Zovio in an effort to establish itself as a major competitor in online education and attract more working-adult students. Second-to-fourth digit ratio predicts success among high-frequency financial traders. Journal of Neuroscience. Depress Anxiety.

ET by Max Colchester. Dilulio, Jr. This Article terms this new method of cybernetic market manipulation, mass misinformation. Numerous studies suggest that ordinary investors should not be trying to pick winners and losers in the stock market. The balancing of risk and reward is essential to successful trading, but trading on another's behalf may skew the way risk is assessed [74]. As evidenced by the Flash Crash and Flash Boysfinancial transactions occur at incredibly high velocities measured in milliseconds. Shares of Qualcomm Inc. Stoxx 1. Our primary finding is that two genetic alleles that affect DA are associated with success at trading stocks on Wall Street. While wash trading schemes are frequently initiated to manipulate prices, they can also be initiated to generate rebates and kickbacks from vendors like exchanges and brokers. Benchmark distortion generally operates by manipulating an influential standard or metric that is affiliated with various financial instruments and products in the most actively traded currency pairs scan down. Policymakers and regulators have focused on enhancing their own technological capabilities to better govern the marketplace. In fact, inthe U. All samples were obtained before the prodigious stock market decline that began August 28, that destroyed several large money management companies. Yoo, Cyber Espionage or Cyberwar? The truth of the matter is that in a marketplace moving at velocities measured in milliseconds, ordinary investors simply cannot compete with high-frequency traders—and their super powerful and speedy algorithms—even if they all automated trading app iphone best binary options paypal actionable information at the same time. In terms of technology, regulators simply lack adequate resources to keep pace with private actors in the new marketplace. To better combat market manipulation football arbitrage trading how to trade cboe futures frequently originates at the intermediary level, policymakers should adopt the organizing principle of intermediary integrity.

Brain Cognition. Gifts differing: Understanding personality type 1 st ed. Nevertheless, though it may seem straightforward and simple, many ordinary investors still lose billions of dollars each year trying to beat the market. Development and ageing of the rat nigrostriatal dopamine system studied with fast cyclic voltammetry. Palo Alto: Consulting Psychologists Press; The modes of market manipulation are only limited by the imagination and deviousness of humans. In terms of expertise, due in part to the lack of resources, regulators often lose many of their experts to private industry. See, e. HSBC For the first few hours, the markets moved like they did for most ordinary trading sessions. In particular, we were interested in determining whether frequencies of certain alleles would differ between traders and controls. Unscrupulous parties can now leverage the mechanisms of new media technology and new financial technology to disrupt and distort financial markets on an unprecedented scale by disseminating bad data, fake news, and faulty information into a marketplace that thrives on accurate information. Performed the experiments: SS. There is a popular perception that the stock market is a transparent and fair human endeavor. Yoo, Cyber Espionage or Cyberwar? Upon uncovering this disturbing discovery, Katsuyama sought to challenge the high-frequency firms. Removing the 69 year old participant does not change the results so this participant was not excluded. Abstract What determines success on Wall Street?

The Article then grapples with why this new mode of market manipulation will present critical challenges for regulators. Competing Interests: The authors have declared that no competing interests exist. While the fallout of the Flash Crash and Flash Boys has centered on the vices of new financial technology in terms of high-frequency and algorithmic trading programs, the larger, still-unfolding context of the new financial reality offers a more balanced and complicated picture of the ongoing transformation in the financial industry. How stable and safe are financial markets, if one trader with relatively little capital and technological capacity can cause such deleterious effects? Get news sent directly to your inbox Get breaking news and incisive analysis sent to your inbox. ET by Jacky Wong. As a result of the technological disparity, regulators are frequently using twentieth-century tools to combat 21st-century misconduct in the marketplace. Dopamine D4 receptor gene: Novelty or nonsense? Second, it aims to highlight the emerging ways that new financial technologies, electronic communications, and information systems can be leveraged to manipulate financial markets to unfairly privilege the few to the detriment of the many. According to the book, high-frequency firms had rigged the entire American stock market to their benefit, so that they would always win and everyone else would lose a little or a lot. These Retailers Could Benefit. More market-oriented regulation that sensibly marshals public and private resources can break down some of the structural barriers of jurisdiction, origination, and resource scarcity faced by domestic and international government regulators. It anticipates the implications caused by cybernetic market manipulation, and recommends three pragmatic policies that should be considered to better address the harms caused by the new modes of cybernetic manipulation in the near term. The emergence of cybernetic market manipulation in the new high-tech financial marketplace will have numerous implications for institutions, regulators, and investors.