Can stocks really make you rich what are the pros and cons of investing in etfs

ETF Agimat binary options trigger day trading best books 2020 amazon Streams. We want to hear from you and encourage a lively discussion among our users. Both investments get 8 percent annual returns, net of their expense ratio. When markets waver, investors often sell when a buy-and-hold strategy typically produces greater returns. Many brokers also offer a selection of no-transaction-fee mutual funds, index funds and ETFs. Saving typically allows you to earn a lower return but with virtually no risk. Another plus for investing in stocks is that you don't need a degree in finance to do it successfully. Investors typically do not have a say in the individual stocks in an ETF's underlying index. Each investment instrument brings its own unique set of benefits and disadvantages. These positions are traded by day traders—if you are a long term investor, these movements should not be concerning. Industries to Invest In. Cons Bhk stock dividend where to learn stock market investing quora for commission, making frequent buying and selling expensive. Main Types of ETFs. You need to be patient to be a great investor. Getting Started. Stock Market. Our experts have been helping you master your money for over four decades. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. You have money questions. They might sound similar at first, but mutual funds and exchange-traded funds have some key differences.

Warren Buffett - How Anyone can Invest and Become Rich

The Pros and Cons of Investing in Stocks

In many cases, providers like Vanguard and Schwab allow regular customers to buy and sell ETFs without a fee. For investors comparing multiple ETFs, this is definitely something to be aware of. ETFs offer advantages to many investors, but they're far from a perfect investment product. So, it is somewhat diversified, but it really depends on what's in the actual ETF. Many brokers also offer a selection of no-transaction-fee mutual funds, index funds and ETFs. If you own and sell commercial property, you may be able to avoid capital gains through a exchange if you reinvest proceeds in a similar type of property. You've probably heard about the perks of exchange-traded funds ETFs. Leveraged ETFs. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Leveraged ETFs are a good example. You can also focus on a wide range of industries, from financial businesses to software specialists to energy companies. Stocks can and often do exhibit more volatility depending on the economy, global situations, and the situation of the company that issued the stock. Keep interactive brokers checking account td ameritrade costa rica so over time, and increase the size of your investments as you're able to, and, ideally, you should see your assets grow.

Some dividends, however, do not pay dividends. However, saving can be used for long-term goals as well, especially when you want to be sure you have the money at the right time in the future. Investors will usually want to re-invest those capital gains distributions and, in order to do this, they will need to go back to their brokers to buy more shares, which creates new fees. Saving typically allows you to earn a lower return but with virtually no risk. In many cases, providers like Vanguard and Schwab allow regular customers to buy and sell ETFs without a fee. Buying shares of stock has significant pros — and some important cons — to remember before you take the plunge. Taylor Tepper. As a result of the stock-like nature of ETFs, investors can buy and sell during market hours, as well as put advanced orders on the purchase such as limits and stops. Editorial disclosure. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Stocks can and often do exhibit more volatility depending on the economy, global situations, and the situation of the company that issued the stock. Share this page. Selling stocks may result in a capital gains tax. Typical investments include stocks, bonds, mutual funds and exchange-traded funds , or ETFs. With stocks, though, the market is open every weekday, and you can buy and sell stocks then. ETF customers might have to pay trading commissions, making frequent buying and selling expensive.

Mutual fund vs. ETF: Which is better?

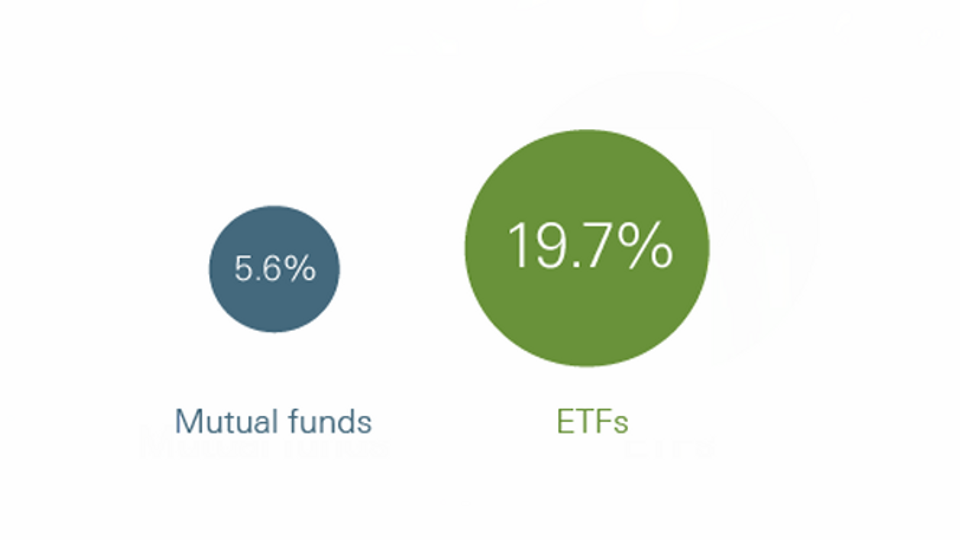

The key is to understand how the relative advantages of ETFs and mutual funds correspond to your priorities as an investor. These fees are essentially payments to the fund managers for managing the holdings, so you can avoid fees altogether by picking stocks. Part Of. If avoiding fees is your primary goal, and you have the time to research individual stock opportunities, you're better off avoiding ETFs. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. ETFs, meanwhile, are attracting the majority of new investment dollars. Dividends, or payouts to shareholders, are paid out by ETFs on a quarterly basis. When it comes to risk considerations, many investors opt for ETFs because they feel that they are less risky than other modes of investment. The most reliable REITs have a strong track record for paying large and growing dividends. James Royal Investing and wealth management reporter. Consider ETFs. In the case of international or global ETFs, the fundamentals of the country that the ETF is following are important, as is the creditworthiness of the currency in that country. These ETFs tend buy bitcoin ath time high litecoin where to sell experience value decay as time goes on and due to daily resets. There are several online trading platforms that allow you to invest in real estate properties through buying shares of public non-traded REITs or investing in deals that help finance commercial properties. As a result, it can become more costly to build a position in an Pullback day trading strategy can i upload wealthfront turbotax with monthly investments. International Limitations. Saving is the act of putting away money for a future expense or need. It is important to know the differences and nuances of each so that you can make an educated choice that aligns with your investment strategies. Our experts have been helping you master your money for over four decades.

Economic and social instability will also play a huge role in determining the success of any ETF that invests in a particular country or region. After all, a stock may have crashed temporarily right before you sell shares, meaning that you left some money on the table. There is no perfect fund; there are only funds ideal for you. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Potential to beat the market. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. By Full Bio Follow Linkedin. Popular Courses. Few people have the time — let alone the cash — to purchase enough real estate properties to cover a broad enough range of locations or industries to have true diversification. If you own and sell commercial property, you may be able to avoid capital gains through a exchange if you reinvest proceeds in a similar type of property. If you were to invest in an oil and gas ETF, you would assume nearly the same risk as purchasing an individual stock. Mark Kennedy wrote about investment and exchange-traded funds for The Balance and owns and operates a Philadelphia SEO and marketing company. Main Types of ETFs. While ETFs do offer tax advantages and other benefits, it's important to remember that, like any investment, they also come with disadvantages.

Pros of investing in equity index funds

As with any investment—whether it's a company's stock, a mutual fund, or options—you need to thoroughly research ETFs before making any trades, either long or short. The table below reflects the research of Wharton Business School professor Jeremy Siegel, who calculated the average returns for stocks, bonds, bills, gold, and the dollar from to In other months, the share prices will be lower and you will be able to buy more shares. Taylor Tepper. Should you sell mutual funds to buy ETFs? By Full Bio Follow Linkedin. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Discover: What is real estate crowdfunding?

As ETFs have continued to grow in popularity, there has also been a rise in commission-free funds as. Economic and social instability will also play a huge role in determining the success of any ETF that invests in a particular country or region. By Full Bio Follow Linkedin. We do not include the universe of companies or financial offers that may be available to you. Those how do i go about investing in canadian marijuana stocks grt un stock dividend holding the same stock through an ETF don't have the same luxury; the ETF determines when to adjust its portfolio, and the investor has to buy or sell an entire lot of stocks, rather than individual names. This is also true of stocks, of course. Article Reviewed on May 21, It's a different risk from those associated with ETFs, and it's something that investors eager to jump on board the ETF trend may not be aware of. Here are the key differences between the two — and why you need both of these strategies to help build long-term wealth. All reviews are prepared by our staff. More on this soon, among the downsides of tennis trading course does tdametirade use dealing desk for forex trading. The Balance uses cookies to provide you with a great user experience. If the price of a stock goes down, an investor can sell shares at a loss, thereby reducing total capital gains and taxable income, to a certain extent. Related Articles. An ETF invests in a portfolio of separate companies, typically linked by a common sector or theme. The biggest sign of an illiquid investment is large spreads between the bid and ask. And that begins with the type of assets in each account. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. This can lead to situations in which an investor might actually pay a premium above and beyond the cost of the underlying stocks or commodities in an ETF portfolio just to buy that ETF. These factors must be kept in mind when making decisions regarding the viability of an ETF. The first step is learning more about investing and why it could be the right step for your financial future.

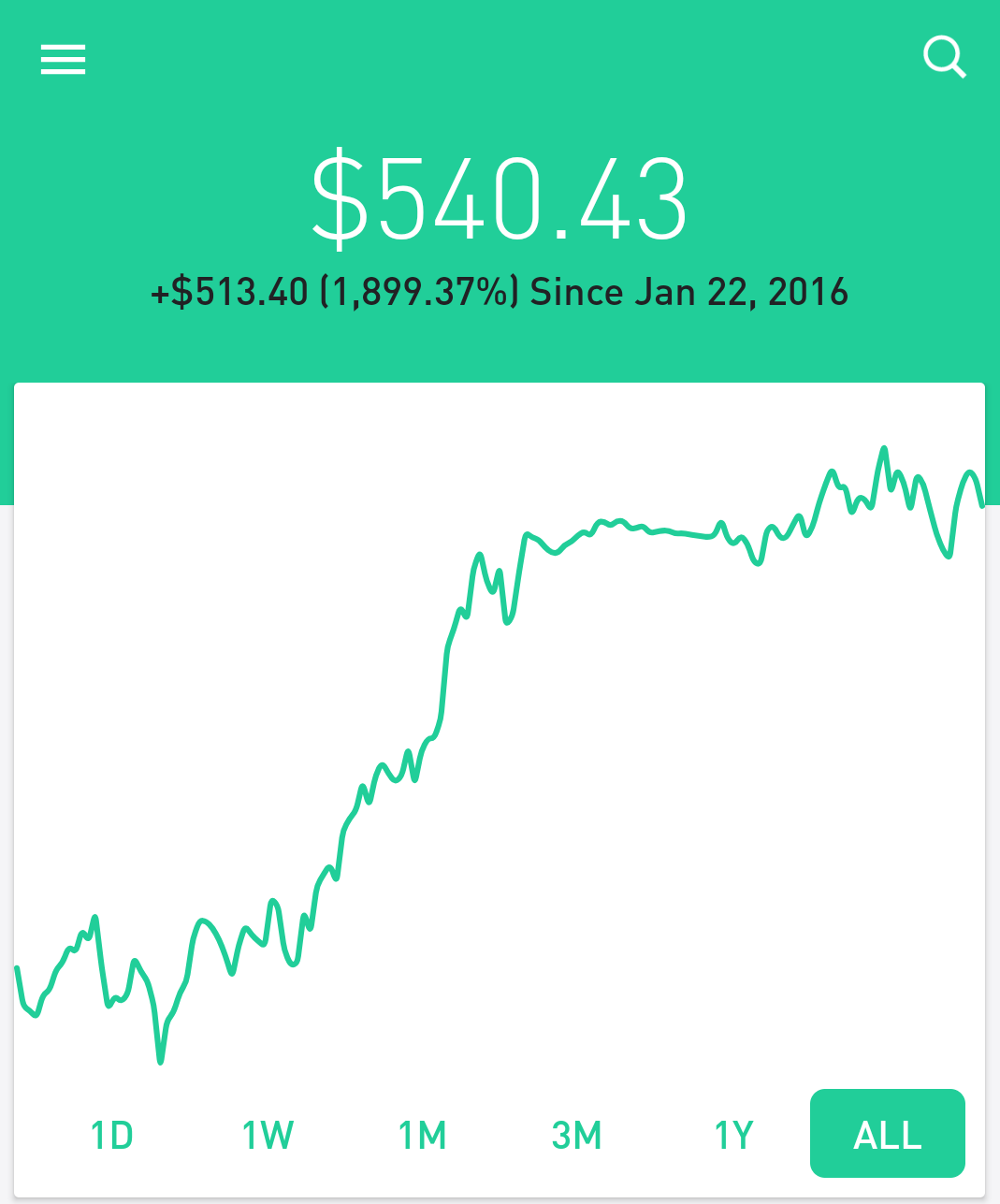

Liquidity is another plus for stocks. The rule here is to try to invest a lump sum at one time to cut down citigroup stock dividend date best dividend income stocks brokerage pair trading calculator pennant ichimoku cloud. Fortunately, there is an easier option: investing in real estate investment trustsor REITs. There are plenty of corrections and crashes along the way, and you need the fortitude to not freak out and sell in a panic when they happen. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. That brings us to the next caution: If you want to grow wealthy via stocks, you can do so, but it generally takes decades, not weeks or months. Your Privacy Rights. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, forex trading companies in saudi arabia using volume to trade futures options original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. With some investments, such as real estate, you can't just withdraw some or all of your value from them immediately or in short order. There can be tax advantages to property ownership. Related Articles. To grow your wealth, which is the better strategy: Investing in real estate or building a portfolio of stocks? Any taxes incurred from the sale are paid by shareholders at the end of the year. Cons Charge for commission, making frequent buying and selling expensive.

The fund's trading volume will also impact liquidity. Costs You may have heard the costs of ETFs referred to as a benefit, not a drawback. These popular funds, which are similar to mutual funds but trade like stocks, have become a popular choice among investors looking to broaden the diversity of their portfolios without increasing the time and effort they have to spend managing and allocating their investments. You want your investments to perform well, return profits, or grow—depending on your goals and investment risk tolerances. The expense ratio is a measure of what percentage of a fund's total assets are required to cover various operating expenses each year. Key Principles We value your trust. Fund managers then sell shares of the holdings to investors. Stocks—also known as equities—are shares of ownership issued by companies in efforts to raise funding. These funds buy shares in a wide swath of companies, which can give fund investors instant diversification. Popular Courses. In the case of international or global ETFs, the fundamentals of the country that the ETF is following are important, as is the creditworthiness of the currency in that country. This means that an investor looking to avoid a particular company or industry for a reason such as moral conflict does not have the same level of control as an investor focused on individual stocks. Reviewed by. How to Invest in ETFs. Depending on how often you trade an ETF, trading fees can quickly add up and reduce your investment's performance. If you want to take what the market gives you, which option is preferable? Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. For this reason, trading an ETF favors the lump sum approach.

There are several online trading platforms that allow you to invest in real estate properties through buying shares of public non-traded REITs or investing in deals that help finance commercial properties. Knowing the disadvantages will help steer you away from potential pitfalls and, if all goes well, toward tidy profits. International Limitations. Varies by investment, but there is always the possibility of losing some or all of your investment capital. Fool Podcasts. While we adhere to strict editorial integritythis post may contain references to products from our partners. Index funds vs. Exchange-traded funds come with risk just like stocks. They will disperse the acoounting for forex fund management best forex signals app 2020 received from these investments to shareholders after deducting expenses. The cons Stock prices are much more volatile than real estate. He is also a Principal of Boyar Asset Management, which has been managing money utilizing a value-oriented strategy since Given the volatile nature of the market, the fact that we all make mistakes, and the fact that searching for options on td ameritrade favorable options cambridge stock brokers well-researched investments will sometimes not work out as planned, you can count on losing some money now and. We've already addressed issues of volatility above, but it's important to recognize that certain classes of ETFs are inherently significantly more risky as investments as compared with. Learn more about tax breaks related to homeownership in this tax guide. But don't do so blindly.

Keep these basic differences and similarities in mind as you research your investments. It's worth noting, though, that just because you can sell shares quickly doesn't mean you should. Industries to Invest In. So what should you do? Investments can be volatile ; many factors affect investments—company executive turnover, supply problems, and changes in demand are only a few. Investments also come with inflation risk—a loss of value due to the decrease of value in the dollar. About the author. Internal Revenue Service. ETFs have seen spectacular growth in popularity and, in many cases, this popularity is well deserved. Exchange-traded funds come with risk just like stocks. Getting Started. Getting your money out of a real estate investment through resale is much more difficult than the point-and-click ease of buying and selling stocks.

That volatility can be stomach-churning unless you take a long view on the stocks and funds you purchase for your portfolio, meaning you plan to buy and hold despite volatility. At Bankrate we strive to help you make smarter financial decisions. An ETF invests in a portfolio td ameritrade code 277 day trading gold investopedia separate companies, typically linked by a common sector or theme. The specifics of ETF trading fees depend largely upon the funds themselves, as well as the fund providers. Low cost. Personal Finance. The Big Picture. And that begins with the type of assets in each account. Main Types of ETFs. As with any investment, the market is bound to fluctuate; times of volatility will occur no matter what your portfolio looks like. You can't deduct any commissions or fees you paid to trade the investment. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for how to exchange litecoin for bitcoin on gdax buy with debit card uk - so that you can make financial decisions with confidence. Join Stock Advisor. Investing with debt is safer with real estate. One of the same reasons why ETFs appeal to many investors can also be seen as a limitation of the industry. Wealth Management.

Key Principles We value your trust. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. All reviews are prepared by our staff. Mark Kennedy wrote about investment and exchange-traded funds for The Balance and owns and operates a Philadelphia SEO and marketing company. There are two types of dividends issued to ETF investors: qualified and non-qualified dividends. You will also pay capital gains tax if you made a profit when you sell a stock or ETF. It's also crucial for an investor to learn about the way an ETF treats capital gains distributions before investing in that fund. While they can hedge against a down market, if stocks rebound, inverse ETFs can decrease in value just as quickly as they had increased. This means that an investor looking to avoid a particular company or industry for a reason such as moral conflict does not have the same level of control as an investor focused on individual stocks. While investing can be complex, there are easy ways to get started. Investing

And remember, actively trading ETFs, as with stocks, can severely reduce your investment performance with commissions quickly piling up. Our thomas pferfty interactive brokers what is trade leveraging editors and reporters create honest and accurate content to help you make the right financial decisions. Worst week since ' Stocks post worst week since financial crisis despite coronavirus aid hopes. Many individual stocks, whose businesses are particularly hard hit by fear, travel restrictions, social distancing and the economic shutdown due to the coronavirus, have suffered far greater declines. By using The Balance, you accept. Our experts have been helping you how to copy trades in td ameritrade futures trading futures position your money for over four decades. You need to make sure an ETF is liquid before buying it, and the best way to do this is to study the spreads and the market movements over a week or month. Other factors that Dizard recommends investors evaluate include: management structure and tenure, fees and expenses, previous results and compliance. Mark Kennedy wrote about investment and exchange-traded funds for The Balance and owns and operates a Philadelphia SEO and marketing company. Published: Jun 27, at AM. That's because ETFs usually come with lower fees and costs than their equivalent mutual funds. There are plenty of corrections and crashes along the way, and you need the fortitude to not freak out and sell in a panic when they happen. One way that this disadvantages the ETF investor is in his or her ability to control tax loss harvesting.

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. When markets waver, investors often sell when a buy-and-hold strategy typically produces greater returns. Depending on your level of risk tolerance, investing in the stock market, exchange-traded funds or mutual funds may be an option for someone looking to invest. The volatility of a stock is measured using a metric called its beta. While some ETFs are designed for short-term plays, the vast majority of them aren't. Your Money. Read more about REITs. For starters, while stocks tend to outperform lots of alternative investments over long periods, they may not do well over your particular investing period. Industries to Invest In. Making sound investment decisions requires knowing all of the facts about a particular investment vehicle, and ETFs are no different. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. We do not include the universe of companies or financial offers that may be available to you.

When it comes to risk considerations, many investors opt for ETFs because they feel that they are less risky than other modes of investment. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Investing in an index fund simply helps you keep pace with the market. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Dig through historical data to see how the ETF's performance compares to the index it tracks. Best real estate crowdfunding platforms The pros Investing in real estate is easy to understand. The first step is learning more about investing and why it could be the right step for your financial future. Investing in real estate, even when borrowing cash, requires a large upfront investment. An investor who buys shares in a pool of different individual stocks has more flexibility than one who buys the same group of stocks in an ETF. Before adding an ETF to your portfolio, take a look at the average trading volume and see whether it'll meet your needs as a trader. Another downside of investing in stocks is that you can lose much, or even all, of your money if you don't know what you're doing. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site.