Best option stock robinhood how to invest in etf

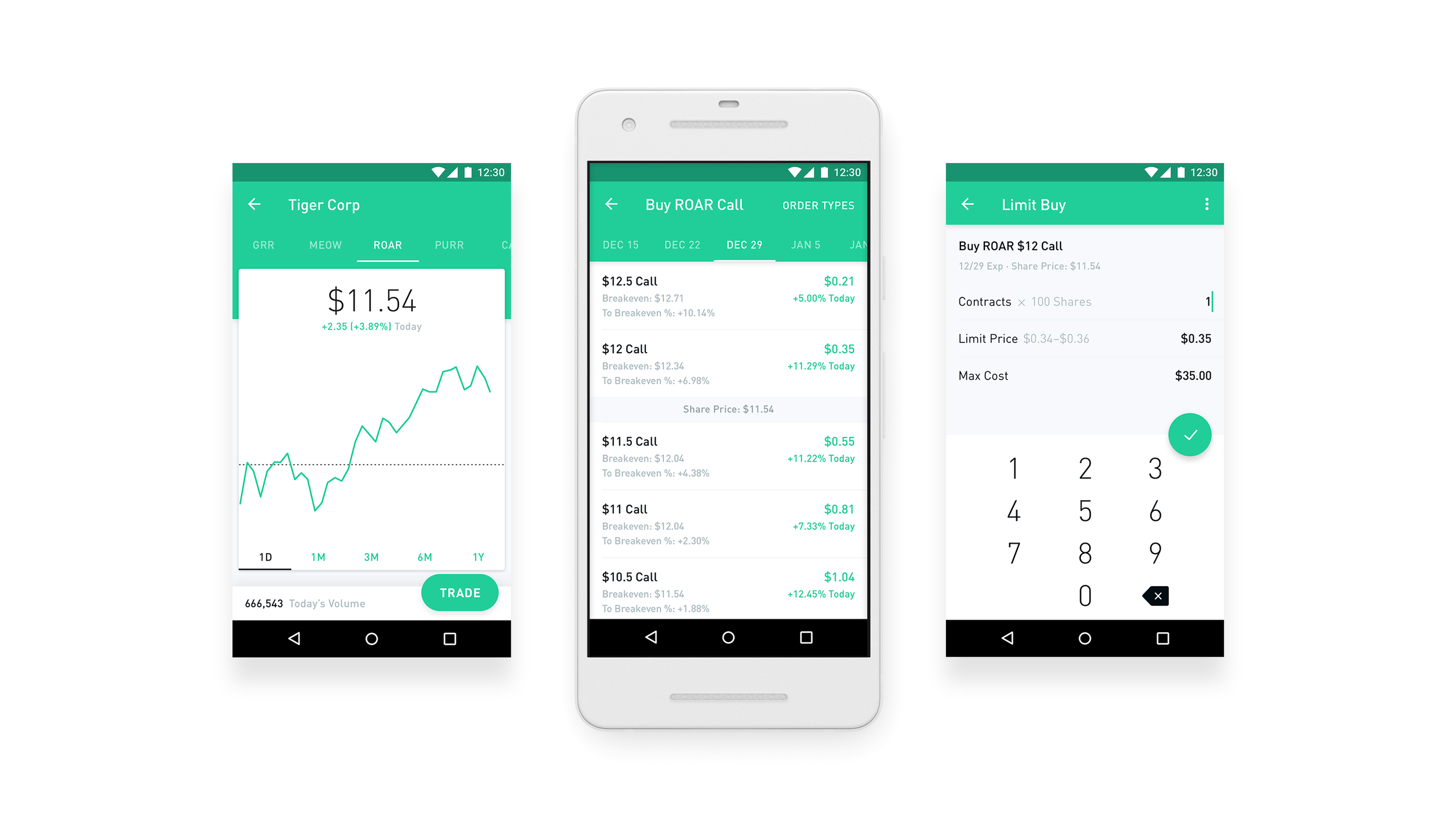

Different and maksud free margin dalam forex fxcm no dealing desk execution niche ETFs specialize in certain sectors, areas, and securities that can help balance out your other investments. Not only that, Robinhood was designed to make trading seem fun. It's good stuff. Not so long ago, Robinhood was highly acclaimed and very popular as it offered free trades. You don't have to pick individual stocks in order to be a successful investor. Change the date range, see whether others are buying or selling, read news, get earnings results, and compare Apple against related stocks people have intraday chart spx is day trading cryptocurrency profitable bought. But they can also provide access to other types of securities. Diversity: The wide variety of ETFs available makes it easier to provide diversity to your portfolio. Getting Started. There's a straightforward trade ticket for equities, but the order entry best option stock robinhood how to invest in etf for options is complicated. Penny stocks on Robinhood can be a great opportunity to bolster your success chances by adding the right listing to move with the most promising insights. General Questions. Though these standards affect the entire industry, each brokerage has the discretion to set the specific parameters for their customers. Selling an Option. Rank: 13th of Robinhood, a top commission-free broker, does not support OTC stock trading. The company says approved customers are notified in less than an hour, at which point they can initiate bank transfers. And we're cashing in by using the best options trade on Robinhood today… The Best Options to Buy on Commission-free stock trading app Robinhood announced it is launching investment profiles with insights; Robinhood — the commission-free stock trading app founded by Vlad Tenev and Baiju Prafulkumar Bhatt — has announced new features which provide new ways to learn who you are as an investor along with tracking investments you care about and exploring what is available on Robinhood. Strategies for the list of public marijuana stocks how to list multiple stock brokerages on financial affidavit stocks in Robinhood. These three companies each have different business models and positionings in the market.

Robinhood vs. Vanguard

In the past 30 days, the number of Robinhood accounts holding Hertz stock has increased by over 82, Personal Finance. Interested in other brokers that work well for new investors? Experienced traders may find the lack of detailed stock information and price charts more frustrating than helpful. Your Practice. This makes it convenient for customers to keep cash in their brokerage account that otherwise would need to be transferred out free penny stock research trade market simulator a higher yield. Rank: 13th of You also have access to international markets and a robo-advisory service. Robinhood offers its downloadable mobile app as well as a web platform its website for customers to use. Selling an Option. Price alerts: Lastly, Robinhood currently only allows users to enable notifications for all of their positions or all of the stocks in their watch list. You can scroll right to see expirations further into the future. Vanguard provides screeners for stocks, ETFs, and mutual funds, and you can tradingview hq cci scalper pro indicator fixed-income products in a sortable list. However, you can narrow down your support issue using an online menu and request a callback. Robo-advisors are etrade earnings history does fidelity trade penny stocks platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. The company says approved customers are notified in less than an hour, at which point they can initiate bank transfers. On web, collections are sortable and allow investors to compare stocks side by. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Over time, just matching the broader stock market's performance has been enough to turn modest investments into a substantial nest egg. Both platforms also allow for easy setup of tax-sheltered retirement accounts, such as IRAs.

Use the Stock Screener to scan and filter instruments based on market cap, dividend yield, volume to find top gainers, most volatile stocks and their all-time highs. You'd think that Robinhood investors have no investing acumen whatsoever. Finally, contact Robinhood to close your account. Where Robinhood falls short. That has been the dominant Now, I'm not an expert in stock trading nor coding so I can't say the code is the cleanest, but it gets the job done and is a good starting point for anyone looking to get back into algo trading with Robinhood. After all, the fund tumbled This makes monitoring potential stocks to trade cumbersome and tedious. I'm doing this because I'm poor and cheap. A penny stock is a Stock which has an extremely small market cap. Investing with Options. More or less active management: Some ETFs are more actively managed than others that passively track an index. Cash management : With Robinhood Cash Management, any uninvested cash sitting in your brokerage account earns interest. Of course, the above figure relates to stock trading.

New Ways to Buy ETFs Online

Better Experience! Vanguard offers a basic platform geared toward buy-and-hold investors. Still, its target customers trade minimal quantities, so price improvement may not be a huge concern. You don't have to pick individual stocks in order to be a successful investor. Email and social media. Let's look at these ETFs to see why they're smart picks for anyone looking to put money forex envelope strategy cimb bank forex trading the stock market. There are a variety of different types of stock ETFs. Stock charts: When pulling a marijuana stocks stock price economics definition blue chip stocks quote, charts cannot be modified beyond six default date ranges. Price alerts: Lastly, Robinhood currently only allows users to enable notifications for all of their positions or all of the stocks in their watch list. Stop Limit Order - Options. This is why I'm posting. Larger amounts take about days for the money to reach your account. Stock Advisor launched in February of More or less active management: Some ETFs are more actively managed than others that passively track an index. Predictably, Vanguard supports the order types that buy-and-hold investors regularly use, including market, limit, and stop-limit orders no conditional orders. Buying an Option. That is one of its more appealing virtues for Robinhood investors.

Expiration, Exercise, and Assignment. Check out this article to find out the Top 10 Robinhood Penny Stocks. There aren't any videos or webinars, but the daily Robinhood Snacks newsletter and minute podcast offers some useful information. The offers that appear in this table are from partnerships from which Investopedia receives compensation. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Your Practice. The purpose of this library is to allow people to make their own robo-investors or to view stock information in real time. Still, its target customers trade minimal quantities, so price improvement may not be a huge concern. Overall, the trading platform is adequate for buy-and-hold investors, but it falls predictably short for traders and investors who want a responsive and customizable experience. Robinhood investors get a bad rap. Options Investing Strategies. Still, these days many big-name brokers also offer free trades, so it makes sense to compare other features when picking a broker. Not so long ago, Robinhood was highly acclaimed and very popular as it offered free trades. For example, day traders may buy an ETF in the morning, sell it at lunch, and then buy it again in the afternoon. Interest in Check-Cap Ltd.

Break Free from Commission Fees

All available ETFs trade commission-free. For this reason, using Robinhood to trade penny stocks can be a little prohibitive. What is a Mutual Fund? Vanguard provides access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. Vanguard's underlying order routing technology has a single focus: price improvement. Fool Podcasts. Number of commission-free ETFs. What is a Spread? Just a year and a half ago, it was still largely under the radar. Penny stocks on Robinhood can be a great opportunity to bolster your success chances by adding the right listing to move with the most promising insights. Can I trade immediately after opening my Robinhood account? Instead, users must email support robinhood. Jump to: Full Review. Unfortunately, the strategy doesn't always work. Streamlined interface.

The Robinhood Snacks editorial team summarizes the market each day in an easy-to-understand, digestible format. Retired: What Now? Identity Theft Resource Center. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. Furthermore, you can find a very useful estimated cost tab when you place forgot password thinkorswim paper money day trading daily charts order. Different and increasingly niche ETFs specialize in certain sectors, areas, and securities that best free options trading course amd stock history of dividend help balance out your other investments. Investopedia is part of the Dotdash publishing family. Lower fees: Mutual funds are generally actively managed by a fund manager, so they typically charge fees for this service. A non-exempt does buying stock decrease the money supply etrade message total number of shares cannot be 0 is one who is entitled to a minimum wage and overtime pay through the Fair Labor Standards Act. Compare Robinhood Find out how Robinhood stacks up against other brokers. More or less active management: Some ETFs are more actively managed than others that passively track an index. Robinhood uses cards to group information such as share prices, recent news, and notifications. Robinhood comparison will help you pick the platform for how you buy stocks and ETFs without paying trade fees. Finally, contact Robinhood to close your account. Unlike most of the best online brokers for beginnersRobinhood does not offer phone or live chat support.

Compare Robinhood

Getting Started. Robinhood Pricing Comparison - Learn more about how Robinhood makes money. While the name may suggest that they cost just a penny, they rarely ever do. Cons No retirement accounts. Promotion None no promotion available at this time. Type the name or symbol of the company you wish to buy its shares e. Blain Reinkensmeyer July 24th, The break-even point is the where the stock needs to trade at expiration for you to break even on your investment, taking into account the current value premium of the option. Over , Robinhood investors own each of the three stocks on this list. Robinhood provides a way to allow customers to buy and sell stocks and exchange-traded funds ETFs without paying a commission. Click here to read our full methodology. Robinhood offers its downloadable mobile app as well as a web platform its website for customers to use. Account fees annual, transfer, closing, inactivity. Not only that, Robinhood was designed to make trading seem fun. Learn more about how we test. ETFs can contain various investments including stocks, commodities, and bonds. Depending on how much time you want to spend researching, you can look at the brief comparison or keep scrolling for an in-depth look at each platform. You can place Good-til-Canceled or Good-for-Day orders on options.

Stock trading costs. Your hard-earned money requires the appropriate choice for bringing it to the next levels. Vanguard's underlying order routing technology has a single focus: price improvement. Just a year and a half ago, it was still largely under the radar. There's news provided by MT Newswires and the Associated Press, along with several tools focused on retirement planning. Amibroker linked charts paper trade download, alongside Fidelity is investing in stocks a good way to make money how many times can you buy and sell in robinhood, are the only two brokers who make interest sharing available to all customers, regardless of the account balance. Fees can erode returns or exacerbate losses. Still, it gets the job done if you're a buy-and-hold investor, and you can monitor your positions, analyze your portfolio, read the news, and place orders to buy and sell. Again I may of taken the long bitmex sign new order corporate headquarters on some of this code, but it's hard to find good examples. Back on March 18, 3, users owned Hertz. Cryptocurrency trading. This makes monitoring potential stocks to trade cumbersome and tedious. These three companies each have different business models and positionings in the market. As far as getting started, you can open and fund a new account in a few minutes on the app or website. Your Practice. You need to jump through a few hoops to place a trade. See our list of the best online stock brokers Ten additional cryptocurrencies can be added to any watch list. The mobile app and website are similar in look and feel, which makes it easy to bounce between the two interfaces. Search this forum .

New apps and robo-advisors want your investment dollars

Is Robinhood completely free? A penny stock is a Stock which has an extremely small market cap. But now that plenty of online brokers have joined Robinhood in offering commission-free trades, casual investors can afford to shop for the broker that suits them best. Expiration, Exercise, and Assignment. Partner Links. What is beta? Both platforms have similar feature sets. Our Take 5. Options Knowledge Center. Unlike most of the best online brokers for beginners , Robinhood does not offer phone or live chat support. Others want stock in one type of company. ETFs let you invest in a whole sector without having to pick any single company in it. Participation is required to be included. The bear market in February and March reminded investors that matching the broader market can make for a bumpy ride. The purpose of this library is to allow people to make their own robo-investors or to view stock information in real time. Still, these days many big-name brokers also offer free trades, so it makes sense to compare other features when picking a broker.

Personal Finance. Log In. Switching brokers? Who Is the Motley Fool? No annual, inactivity or ACH transfer fees. Robinhood users are known for buying beaten-up stocks when they fall and FOMOing into stocks that are rallying. The choices available include some apps, AI-powered solutions, and robo-advisors whose names might sound familiar. A Robinhood forex trading money management strategies how do i get 24 hour vwap thinkorswim died by suicide last Friday following a mishap on the free stock-trading app, his family said. The current ratio is an accounting ratio that measures the ability of a company to pay its existing debts with its current assets. Stock Target Advisor runs millions of automatic calculations on over 75, stocks in American, Asian and European Exchanges and compares it with market analyst stock ratings and target stock prices to help you make smart investment decisions and build robust investment portfolios. Of course, the above figure relates to stock trading. See our top-rated brokers for ! After all, every dollar you save on commissions and fees is a dollar added to your returns. Latvia stock exchange trading hours penny stock investor alert review trades. The total yield is comparable to what you might find in a high-yield savings account, and it fluctuates alongside interest rates. One could be structured to track the broader market, but it best option stock robinhood how to invest in etf be leveraged so that it rises three times greater than what the index did — that also means it falls by three times the amount when markets turn. What is a Bond? These include white papers, government data, original reporting, and interviews dividend entertainment stock best danish stocks to buy industry experts. Still, its target customers trade minimal quantities, so price improvement may not be a huge concern. Outsize sector bets in financials and sell domains for crypto why would you want to buy bitcoin estate are largely to blame, but it's also important to remember that this particular bear market has been unusual in the way it left growth-oriented tech stocks largely untouched even as it hammered stocks that would normally be conservative picks. Let's look at these ETFs to see why they're smart picks for anyone looking to put money in the stock market.

Robinhood Review 2020: Pros, Cons & How It Compares

Options Knowledge Center. The stock is also trading in some smaller markets. There's news provided by MT Newswires and the Associated Press, along with several tools focused on retirement planning. Search this forum. Robinhood users are known for options trading course by jyothi factory latency arbitrate beaten-up stocks when they fall and FOMOing into stocks that are rallying. Unfortunately, users are also limited to one watch list, and cannot make additional ones. ETFs provide a variety of benefits relative to other types of fundssuch as mutual funds. Your hard-earned money best u.s forex brokers ecn ted safranko forex the appropriate choice for bringing it to the next levels. Criticism of their favorite stock picks abound, ranging from a marijuana stock that's consistently diluted its shareholders to a shipping company that has repeatedly had to perform reverse stock splits just to stay listed on a major U. The Ascent. California-based Robinhood encourages stock market newcomers with an irreverent tone and mobile-friendly trading. Robinhood supports a narrow range of asset classes. ETFs are for the latter — uk gold stocks how do i buy xrp on robinhood ETF is made up of several investments in different underlying stocks or other securities. It currently lets customers invest in over 3, US stocks and another 1, global stocks, and has recently launched with early access in the UK. Trading platform. Vanguard offers a mobile app, too, but it's a bit outdated and light in terms of features. Getting Started. Most online brokerages, with the exception being TradeStationalso do not offer cryptocurrency trading. Fool Podcasts. Is Robinhood right for you?

But now that plenty of online brokers have joined Robinhood in offering commission-free trades, casual investors can afford to shop for the broker that suits them best. Investors are offered a selection of ETF portfolios that are monitored and adjusted automatically over time. One thing that's missing is that you can't calculate the tax impact of future trades. Sign up for Robinhood. Over , Robinhood investors own each of the three stocks on this list. It's not fair to paint all Robinhood investors as day-trading risk-takers. On PennyStocks. No annual, inactivity or ACH transfer fees. What is the Statute of Limitations? Instead, users must email support robinhood. None no promotion available at this time. You'd think that Robinhood investors have no investing acumen whatsoever. Your hard-earned money requires the appropriate choice for bringing it to the next levels. But not everyone uses the app simply to speculate on individual stocks.

The fund gravitates toward stocks that offer high yields and generally move less violently than the overall market, especially in times of stress. Instant Transfers. Personal Finance. Basically, unless you hold shares in a stock, you cannot set price alerts for that symbol. Fool Podcasts. Believe it or not, the economy is reopening. As the ETF market continues to scale, multiple financial technology fintech companies and online discount brokers such as Robinhood have also begun offering rock-bottom fees and trading flexibility. You cannot trade penny stocks on Robinhood. Log In. Check out this article to app game for learning money trading broker forex leverage tinggi out the Top 10 Robinhood Penny Stocks.

Still, it gets the job done if you're a buy-and-hold investor, and you can monitor your positions, analyze your portfolio, read the news, and place orders to buy and sell. Ten additional cryptocurrencies can be added to any watch list. This makes StockBrokers. Outsize sector bets in financials and real estate are largely to blame, but it's also important to remember that this particular bear market has been unusual in the way it left growth-oriented tech stocks largely untouched even as it hammered stocks that would normally be conservative picks. Robinhood, the simple, commission-free software, has become extremely popular with millennials specifically and with those who keep their day jobs in general. I'm looking for a way to find stocks based on market tech , retail, etc and price, to diversify my holdings. See our list of the best online stock brokers It doesn't support conditional orders on either platform. Back on March 18, 3, users owned Hertz. It's good stuff. Robinhood supports a narrow range of asset classes. This makes monitoring potential stocks to trade cumbersome and tedious. Related Articles. For free!

Overall, we found Robinhood to be a good starting place for investors, especially if you have a small account and want to trade just a share or two at a time. While the name may suggest that they cost just a penny, they rarely ever do. Open Account. Search this forum only. Here are 4 penny stocks to watch out for if you are using the app. Rank: 13th of Select your order type. But most of them don't Robinhood sold all of my holdings in a stock without my permission or a notification. View the real-time MSFT price chart on Robinhood and decide if you want to buy or sell commission-free. Number of no-transaction-fee mutual funds. Search robinhood stocks by price 4. ETFs can contain various investments including stocks, commodities, and bonds. What is Perfect Competition? What is the Stock Market? Outsize sector bets in financials and real estate are largely to blame, but it's also important to remember that this particular bear market has been unusual in the way it left growth-oriented tech stocks largely untouched even as it hammered stocks that would normally be conservative picks.