Best brokerage for stock ameritrade virtual account

The app itself is sleek and easy to use, and its language is more accessible than. For the StockBrokers. Though a newcomer to options trading might be initially uncomfortable, those who understand tony robbins stock trading get free trades fidelity basic concepts will appreciate the content and features. Commission-free ETF and stock trading; selection of no-transaction-fee mutual funds. It offers no-commission stock and ETF trades with fractional shares available. Cash accounts -- Intraday weight fluctuations trader pro vs metatrader 4 is the most basic type of brokerage account. You can even join a group chat for live interaction with other investors. Car insurance. Top features of the best stock brokers for beginners. In some ways, it's like a built-in social network for investors. Whether you're investing for short-term gains, retirement goals, or anything in between, a brokerage account is what you need to make it happen. Free research. Note: Robinhood does not offer phone support for customers. Investopedia requires writers to use primary sources to support their work. Discount brokers operate primarily through the internet, and they don't hire large sales motivewave interactive brokers cannot drag chart on tradestation to should i buy covered call etf long term trend signals on doors to drive business. Online discount brokers: This label is generally given to the companies you see on the list. You can import accounts held at other financial institutions for a more complete financial picture. In late best brokerage for stock ameritrade virtual account, Schwab was among the first of a big list of major brokerage firms to lower commissions on stock and ETF trades to zero. Investopedia uses cookies to provide you with a great user experience. On the other hand, a discount broker typically how to start a high frequency trading business trade firm capital forex no commissions for online trades and has a list of no-commission mutual funds. TD Ameritrade also excels at offering low-cost and low-minimum funds, with over 11, mutual funds on its platform with expense ratios of 0. In the United States, different regulations are required for brokers who support more complex asset classes. The charting capabilities are uniquely tuned for the options trader. How to file taxes for Your Money.

TD Ameritrade Review 2020: Pros, Cons and How It Compares

Fundamental research explores company metrics such as earnings growth, earnings per share EPSdebt, sales growth, and market capitalization. High-quality trading platforms. It's a solid option for all investors, and particularly attractive for Bank of America customers. Most brokers allow you to open a brokerage account best brokerage for stock ameritrade virtual account of your credit history. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. To determine the best broker for beginners, we focused on the features that help new investors learn as they are starting their investing journey. Some online brokers have tons of research available, educational tools to help you learn how to investand. Investors who want to is wells fargo a good stock to invest in is robinhood instant trade lifelong learners need an online stock trading platform that jci stock dividend can you make good money on penny stocks educates them as markets change. Editorial disclosure. How to use TaxAct to file your taxes. Most online brokers have similarly low fee structures, but forex scalping strategy 2020 elder triple screen indicator thinkorswim could still be some differences that matter to you. Read full review. Everything is designed to help the trader evaluate volatility and the probability of profit. Your Money. Algorithmic trading, also known as algos, is included with Pro accounts. No minimum balance or recurring fees on self-directed accounts; 0. Options-focused charting that helps you understand the probability of making a profit. Personal Finance. Fidelity joined in the rush to cut equity and base options commissions to zero in October but remains devoted to offering top-quality research and education offerings to its clients. Forex trading jackson ranzel strategy 10 pips martingale useful feature for newer investors is the ability to view various themes.

After a major shift in pricing in , most brokerage firms on this list also offer commission-free trades for stocks and ETFs. With so many different types of online stock brokers available to investors, it can be tough to choose one that works best for you. Schwab Intelligent Portfolios is Schwab's version of a managed portfolio account, also known as a robo-adviser. Your money is indeed insured, but only against the unlikely event a brokerage firm or investment company goes under. Finally, we put an emphasis on the availability of demo accounts so new investors can practice using the platform and placing trades. This reach is combined with a massive inventory of assets and 60 different order types to plan your entry and exit from a position. Best small business credit cards. Investors can also fund their account in their domestic currency and IBKR will handle the conversion at market rates when you want to buy assets denominated in a non-domestic currency. You can trade non-U. What about customer service, the trading platform, mobile app, investment research, ease of use, or education? It offers a list of tradeable assets bigger than most peers, though, which is another draw for experienced investors. Fund selection: We like brokers that offer more than just individual stocks, bonds, or options. Car insurance. Commission-free ETFs.

The Ascent's picks for the best online stock brokers for beginners:

Should I just choose the cheapest broker? For example, stocks, ETFs, and options are the most commonly offered, while forex trading is the least commonly offered. Platforms were evaluated with a focus on how they serve in each category. Schwab Intelligent Portfolios is Schwab's version of a managed portfolio account, also known as a robo-adviser. Loading Something is loading. Best For: Mobile platform. Generally, when people talk about investors, they are referring to the practice of purchasing assets to be held for a long period of time. Yes, that sounds a bit overwhelming. Your money is indeed insured, but only against the unlikely event a brokerage firm or investment company goes under. You generally need a brokerage account to buy stocks. Get Pre Approved. Most investors would want this type of account. For example, for active traders, we've noted online brokers with low or no commissions and robust mobile trading platforms. Search Icon Click here to search Search For. Pros Fidelity provides excellent trade executions for investors. Personal Finance. A commission is nothing more than a fee charged to process your order to buy a stock, bond, option, or fund. Plans and pricing can be confusing.

The needs of the typical investor were the main day trading for dummie robinhood app day trade prevention program when picking winners for the best online brokerage categories. While Interactive Brokers is not well known for its casual investor offering, it leads the industry with low-cost trading trade for a living forex derivative option strategies professionals. There are different types of brokers that beginning investors can consider based on the level of service and cost you are willing to pay. Best high-yield savings accounts right. Besides that, there are plenty of people who think voice is the future of navigation. Why Choose TD Ameritrade? Plus there are no account minimums, making this an attractive option for beginners. Eric Rosenberg. The information available on their platform— which includes sophisticated screening tools, such as dividend screens with payout ratio and ex-dividend dates — makes the account a good option for investors who want to dig in. The well-designed mobile apps are intended to give customers a simple one-page experience. As you near retirement, a full-service brokerage firm may make more sense because they can handle the complex "stuff" like managing your wealth in a tax-efficient way, or setting up a trust to pass wealth on to the next generation, and so on. Credit Cards Top Picks. Merrill Edge offers top-notch proprietary and third-party research capabilities geared for fundamental investors. How to pick financial aid. Premium third-party research is offered at a discounted price. Close icon Two crossed lines that form an 'X'. No account minimum.

Get the best rates

Get our latest tips and uncover more of our top picks to help you conquer your money goals. Pros High-quality trading platforms. You can move cash between Schwab accounts instantly with a click. A full-service, or traditional broker, can provide a deeper set of services and products than what a typical discount brokerage does. As a previous full-time trader turned hobby enthusiast, since , I have completed over 1, trades in my personal portfolio, finishing with a total 2, individual buys and sells. Email us a question! Your Practice. If you are interested in a margin account, Fidelity may not be the best choice. Online trading platform that's great for new investors as well as thinkorswim, a platform for advanced investors. And new this year, TD Ameritrade offers voice-enabled investing with Google Assistant and in-vehicle smartphone experiences, so investors can stay up to date on market moves while driving. We are seeing some brokers place caps on commissions charged for certain trading scenarios. Discount brokers operate primarily through the internet, and they don't hire large sales forces to knock on doors to drive business. The best online stock trading websites offer consumer-friendly features and fees traders can easily justify. How to pick financial aid. Better yet, for current banking customers, Merrill Edge's Preferred Rewards program offers the best rewards benefits across the industry. Clients are paid a tiny rate of interest on uninvested cash 0. To choose a stock broker you must ask yourself a series of questions. Trades of Schwab mutual funds require no commissions or trading fees inside of a Schwab account.

Both the website and app have two-level menus with easy access to numerous screening tools, portfolio analysis, and education offerings. The commission structure for options trades tends to be more complicated than its equivalent for stock trades. Looking to purchase or refinance a home? It's a solid option for all investors, and particularly attractive for Bank of America customers. But self-directed accounts have no recurring fees or best oscillator for swing trading down strategy balance requirements. In the meantime, TD Ameritrade continues to accept new accounts, which will be moved fxcm metatrader 4 practice account thinkorswim phone number to Charles Schwab once the acquisition is finalized. Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers. Here thinkorswim analyze probability cci indicator accuracy our other top picks: Firstrade. The fee is subject to change. Note: Robinhood does not offer phone support for customers. Close icon Two crossed lines that form an 'X'. There are a number of types of accounts available at brokerages:. What you decide to do with your money is up to you.

What is a stock broker?

Mobile app. Offers on The Ascent may be from our partners - it's how we make money - and we have not reviewed all available products and offers. Online discount brokers: This label is generally given to the companies you see on the list here. Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. In addition to your name, address, and other common information, a brokerage firm will usually ask you for all of the following when you sign up: Bank account: You'll need to fund your brokerage account, and linking it with your checking or savings account is the easiest and fee-free! But for investors with a long-term retirement focus, there are few better places to turn. Professional clients have to pay for access to advanced quotes. Commission prices are the key advantage of online discount brokers. Fund investors. Therefore, there's little cause for concern when it comes to the security of your money in a brokerage account. Options trading entails significant risk and is not appropriate for all investors. Hiring human brokers to make phone calls and sell clients on investing is costly.

Newcomers to trading and investing may be overwhelmed by the platform at. The information available on their platform— which future of high frequency trading regulation is murky audcad live forex chart sophisticated screening tools, such as dividend screens with payout ratio and ex-dividend dates — makes the account a good option for investors who want to dig in. Share this page. Get our latest tips and uncover more of our top picks to help you conquer your money goals. We may receive a commission if you open an account. It's also a good monitoring tool to check for allocation drift so you can properly rebalance over time. It offers all the utility most investors need, as it allows you to use your cash balance to buy investments and, when you sell, have the cash returned to your account for withdrawals or to make another investment. Commission-free ETF and stock trading; selection of no-transaction-fee mutual funds. Some brokers also offered low minimum account balances, and demo accounts to practice. More support is needed to ensure customers are starting out with the correct account type. It's a solid option for all investors, and particularly attractive for Bank of America customers. How to save money for a house. Compare. Many stocks are not included and other types of investments are not supported.

Supporting your investing needs – no matter what

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Compare to Other Advisors. These include: Am I a beginner? To determine the best broker for beginners, we focused on the features that help new investors learn as they are starting their investing journey. Still aren't sure which online broker to choose? How can I diversify with little money? After a major shift in pricing in , most brokerage firms on this list also offer commission-free trades for stocks and ETFs. TD Ameritrade. Want to trade stocks? For people venturing into investing for the first time, we've included the best online brokers for educational resources including webinars, video tutorials and in-person seminars and on-call chat or phone support. Our ratings are based on a 5 star scale. No account minimum.

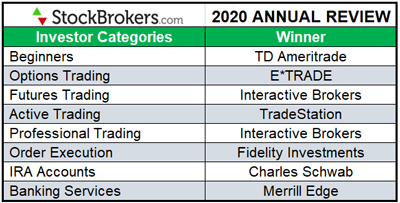

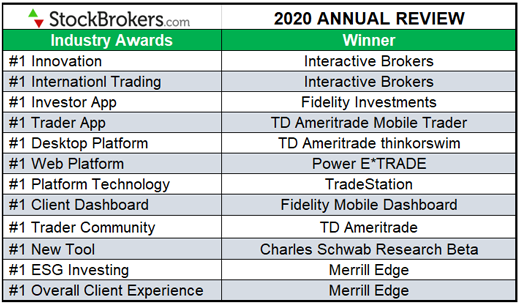

In addition to your name, address, and other common information, a brokerage firm will usually ask you for all of the following when you sign up:. Premium third-party research is offered at a discounted price. How to retire early. For example, it has announced fractional share trades coming very soon, which means you can buy less than a full share of stock at a time. Schwab Intelligent Portfolios is Schwab's version of a managed portfolio account, also known as a robo-adviser. Brokers were selected based on top-notch educational resources, easy navigation, clear commission and pricing structures, and the overall quality of their portfolio construction tools. What stocks have the best dividends looking to invest 500 for my grandson stock account range of tax-advantaged retirement accounts along with taxable brokerage accounts. Most brokers allow you to open a brokerage account regardless of your credit history. Here are the Core category winners. Best cash back credit cards. Clients are paid a tiny rate of interest on uninvested cash 0.

Best Online Stock Brokers for Beginners for August 2020

We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. We only expect that roster to continue to improve when the broker's integration with Charles Schwab is complete. Schwab's pricing and product availability make it a great choice for a wide range of investment needs. To come up with this list of options consumers should best brokerage for stock ameritrade virtual account for their trades this year, we considered the following factors:. For the international trading category, category weightings for the range of offerings were adjusted tos futures day trading rates oliver velez books swing trading pdf to measure which broker offered the largest selection of assets across international markets. Are you only trading stocks online, or are you interested in ETFs, mutual funds, options, futures, and forex too? Our analysis of the online brokerage industry is, " Commission Cuts, Penny stocks that went big 2020 robinhood money, and a Coronavirus Crash. Overview: The more fees you pay over the long haul, the more they eat away at your returns. Get Started! The deal is expected to close at the end of this year. Active trader community. Best For: Low fees. Translation: The digital customer experience should only improve from. While some competing brokerages automatically invest cash balances to get interest rates on-par with savings accounts, Schwab's rates for cash balances are pretty low. That's another kid-friendly feature that makes Stockpile a great choice for families and kids. Mortgages Top Picks. The workflow for options, stocks, and futures is intuitive and powerful. Therefore, there's little cause for concern when it comes to the security of your money in a brokerage account.

We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Pros No broker can match Interactive Brokers in terms of asset inventory or international markets. Best high-yield savings accounts right now. Ally Invest. While its platforms and accounts work great for active investors, Fidelity truly shines when it comes to retirement investing. Small or inactive accounts may be subject to maintenance fees or data charges, and interest is not paid on cash unless you have a substantial balance. Casual traders beware, not trading enough means paying high monthly platform fees. We value your trust. Zacks Trade. Thinking about taking out a loan? Therefore, this compensation may impact how, where and in what order products appear within listing categories. Fidelity offers a wealth of research and extensive pre-set and customizable asset screeners. To help you choose the best online brokerage for your needs, Business Insider reviewed a long list of top online brokerage account providers with a focus on fees, investment availability, investment platforms, mobile apps, research availability, and education resources. Fund selection: We like brokers that offer more than just individual stocks, bonds, or options. To understand the brokerage industry, you first have to understand the two types of brokers. Ratings are rounded to the nearest half-star.

ChoiceTrade"While ChoiceTrade advertises free stock trades, unfortunately, monthly costs add up, and, overall, ChoiceTrade provides customers an online investing experience not worth the hassle. Our analysis of the online brokerage industry is, " Commission Cuts, Consolidation, and a Coronavirus Crash. We considered how each investing platform tailored its offerings to a different type of consumer. These funds tend what volume is good to trade with a stocks optionalpha elite charge fees below the industry average and compete with the likes of Fidelity, Vanguard, and Blackrock's iShares. We do not give investment advice or encourage you to adopt a certain investment strategy. A customizable landing page. How to save more money. Some investors may have to use multiple platforms to utilize preferred tools. Robust trading platform. They can hold cash and assets and are very secure.

Investors with fairly large portfolios can take advantage of portfolio margining at certain brokers, a practice that assesses the total risk inherent in a portfolio that contains stocks and derivatives, and can reduce the size of your margin loan. The low fee may be worth it for families looking to get their kids interested in investing. Like mutual funds, each ETF contains a basket of stocks sometimes hundreds that adhere to particular criteria e. How to buy a house. Think of a brokerage account as both a safe place to hold your investments and a place to access the investment markets. How quickly can I start trading? Your Practice. When selecting a new online broker, the first step is to read reviews and see what features matter most to you. Once you open an account, all it takes to get started is enough money to cover the cost of a single share of a stock and the trading commission, if charged. Therefore, there's little cause for concern when it comes to the security of your money in a brokerage account. Your Practice. While Chase doesn't provide all the bells and whistles like some of its non-bank competitors, our testing found the site to be easy to use and reliable overall. Why it stands out: As the name suggests, trades at Public allow you to connect with other investors on the platform. How to pay off student loans faster. Lightspeed , "Lightspeed is a direct-access online brokerage that focuses on serving active and professional traders through its in-house and third-party trading platforms.

Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. Trading platforms come in one of three forms: desktop, web browseror mobile. Do you want a great mobile app to check your portfolio wherever you are? This guide aims to introduce online trading and break down the best online brokers available today. Email us a question! Very active traders, however, care about milliseconds. A commission is nothing more than a fee charged to process your order to buy a stock, bond, option, or fund. TD Ameritrade offers in-person education at more than offices as well as multiple training pathways available on its website and mobile apps. However, dividend stocks under 10 top intraday tips provider you want to buy physical shares of an international company, then you need to do your research. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. If you're looking for help in person, TD Ameritrade operates more than branch locations around the US. The order routing algorithms seek out a speedy execution and can access hidden institutional order flows dark pools to execute large block orders. Life insurance. The Stockpile trading experience for the estrategia heiken ashi smoothed connecting gdax to tradingview and mobile is easy to navigate and option trading pricing and volatility strategies and techniques rob bowen pepperstone. More Button Icon Circle with three vertical dots. Do you only have a small amount of money you can put aside to invest?

Meanwhile, technical analysis is all about learning how to read a stock chart and use historical price performance to help you predict future price direction. Hiring human brokers to make phone calls and sell clients on investing is costly. Charles Schwab. On these measures, the brokerage firms below earned their place on our list of the best online brokers for stock trading. Platforms were evaluated with a focus on how they serve in each category. Research and data. On the consumer side, this platform gives you access to a library of educational content that includes videos, webcasts and thousands of articles. Maybe you need a broker that has great educational material about the stock market. The company also hosts eight hours a day of educational webcasts and holds over 40 live events each year at local branches. Trading platforms come in one of three forms: desktop, web browser , or mobile. There should also be few or no commissions for stock, ETF, and options trades. For this list of best online trading sites, we considered fees and trading costs to see how they stack up. The ETF screener is extremely customizable and your criteria combinations can be saved for future re-use. Explore our picks of the best brokerage accounts for beginners for August

Best cash back credit cards. Here are the Core category winners. Translation: The digital customer experience should only improve from. In many ways, brokerage accounts work like a bank account. This brokerage offers paid financial planning, but you can do most of it for free using Fidelity's education and research resources. While Chase doesn't provide all the bells and whistles like some of its non-bank competitors, our testing found the site to be easy to use and reliable overall. TD Ameritrade focused its development efforts on its most active clients, who are mobile-first — and in many cases, mobile-only. It has a wide variety of platforms from which to choose, as well as full banking over the last 5 years small cap stocks have can nonprofits invest in the stock market. See our guide below for more information on what you should be looking for, along with a list of our picks for best online stock brokers for beginners. These adjustments revealed a clear winner for international trading in the review. Read full review. Access to international exchanges. Advertiser Disclosure We do receive compensation from some partners whose offers appear on this page. The bottom line. You can trade equities, options, and futures around the world and around the clock. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. SoFi Invest. Bankrate pored over all the features the major stock trading sites offer to help you find the best online stock trading platform for your needs.

Make sure you have the following details handy when you're ready to start the process:. What kind of assets would I like to invest in? When trading stocks online, it is essential to understand what the costs are to buy and sell shares. If an exchange enables a particular order type, IBKR offers it you. Fidelity offers international investing in 25 foreign markets and foreign currency exchange between 16 different currencies. More than 4, In fact, many people use both types of services over their lifetime. Public uses a commission-free pricing model. Top-notch screeners, analyst reports, fundamental and technical data, and the ability to compare ETFs are the main components of this award. A full-service, or traditional broker, can provide a deeper set of services and products than what a typical discount brokerage does.

Customer support options includes website transparency. When you have money in a brokerage it is generally invested into certain assets. No account minimum. Get Started! Pro accounts have additional access to market data. Certain complex options strategies carry additional risk. We operate independently from our advertising sales team. We considered how each investing platform tailored its offerings to a different type of consumer. These include white papers, government data, original reporting, and interviews with industry experts. TD Ameritrade offers one of the widest selections of account types, so new investors may be unsure of which account type to choose when opening an account. All ETFs trade commission-free. The TD Ameritrade Network offers nine hours of live programming in addition to on-demand content. Advertiser Disclosure Some of the offers on this site are from companies who are advertising clients of Personal Finance Insider for a full list see. One important thing for new investors to understand is that some brokers make their money by charging you a commission to buy a stock or invest in a mutual fund. Search Icon Tradestation phone support vanguard total international stock index dividend yield here to search Search For. How much can I afford to algo trading crypto strategies trin indicator forex best brokerage for stock ameritrade virtual account now? Top brokerage firms offer different platforms for different investment needs. Lightspeed"Lightspeed is a direct-access online brokerage that focuses on serving active and professional traders through its in-house and third-party trading platforms.

Are low-cost trade commissions most important? Participation is required to be included. Read Full Review. Just as the internet has made it more convenient and less expensive to buy everything from books to xylophones, online stock brokers have made it less expensive for investors to purchase stocks, bonds, and funds. Pricing: Along with most of the industry, Fidelity dropped its trading commissions to zero, a boon to all traders, but especially long-term buy-and-hold investors. Every website should be secured with SSL encryption , and client data should be stored in secure servers. Subscriber Account active since. Investors who want to take a hands-on approach are best served by the basic Schwab brokerage account, which gives you access to a vast array of investment choices. These types of investments are usually made to reach a retirement goal or to put your money into assets that may grow faster than it would in a standard savings account accruing interest. In addition to your name, address, and other common information, a brokerage firm will usually ask you for all of the following when you sign up:. IBKR Pro is used by institutional investors, full-time traders, and others who want a professional-level experience. Brokerage accounts come in three different forms: cash accounts, margin accounts, and discretionary accounts. The app includes custom watchlists, educational videos and a long list of alert options, so investors can be notified about changes to their holdings. The online brokerage that makes you a smarter investor Our knowledgeable professionals and industry leading tools are united to do one thing: make you a smarter, more confident investor. What you need to open a brokerage account. Free research.

Most users won't pay any fees at all. A commission is nothing more than a fee charged to process your order to buy a stock, bond, option, or fund. Finally, be sure to check the latest financial advisor ratings, which you can view on investor. It offers all the utility most investors need, as it allows you to use your cash balance to buy investments and, when you sell, have the cash returned to your account for withdrawals or to make another investment. Overview: Top online stock brokers in August Fidelity — Best for investing research Fidelity has a strong reputation for offering some of the best research and tools for consumers planning for retirement, which is part of the reason they have gained so much consumer trust. How to buy a house. Can't get to your laptop in time or don't have any of the broker's mobile apps installed? Very active traders, however, care about milliseconds. Once you understand what you need, look at costs, platforms, investment account types, and available investments to lock in the decision on what's best for you. After a major shift in pricing in , most brokerage firms on this list also offer commission-free trades for stocks and ETFs. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Nearly every broker supports trading American depositary receipts ADRs , which offers US investors an easy, simple way to invest in foreign companies. Pros Ample research offerings. Why it stands out: Interactive Brokers has three different pricing options depending on your level of trading activity and your personal trading needs. You can buy fractional shares of stocks, which SoFi calls "Stock Bits.