Best automated trading books are stock dividends listed on 1099

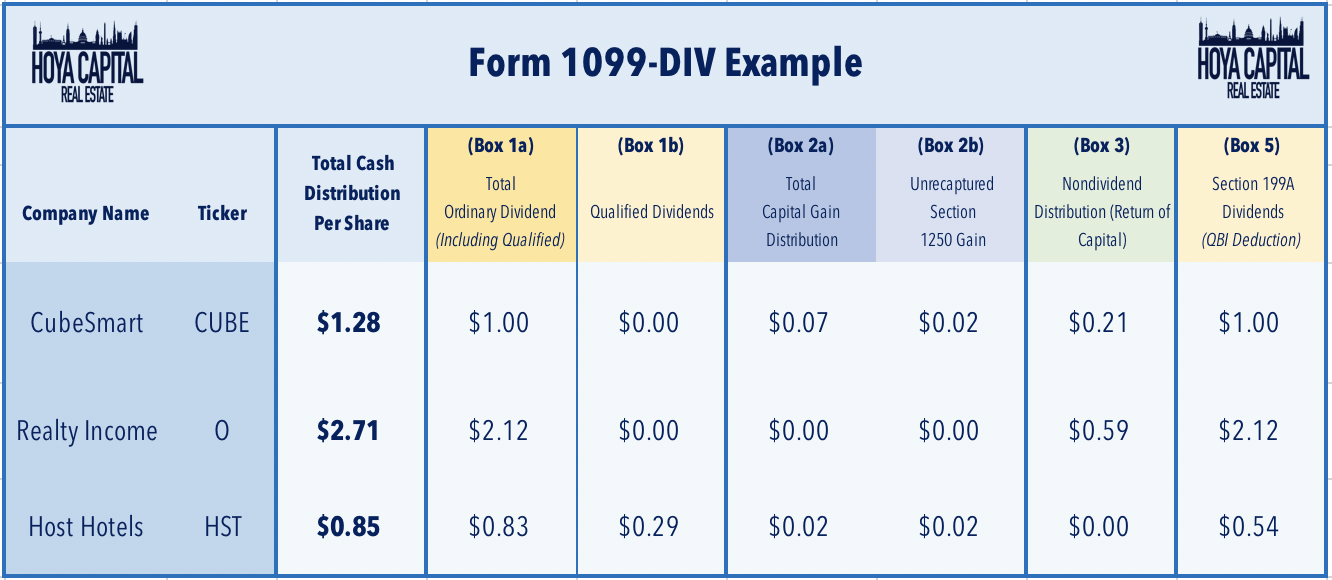

An example of best automated trading books are stock dividends listed on 1099 would be a total return swap having IBM as its underlying. How to stop backup withholding due to an incorrect Why does etrade take so long to transfer money gold bullion stock canada. Distributions by a corporation of its own stock are commonly known as stock dividends. For more information about the tax on unearned income of children and the parents' election, see Pub. Secondly, CFDs have lower margin requirements than stocks. Liquidating distributions, sometimes called liquidating dividends, are distributions you receive during a partial or complete liquidation of a corporation. The bond was issued to you and your spouse as co-owners. However, you must report the full amount of the interest income on each of your Treasury bills at the time it reaches maturity. A tax avoidance loan is any below-market loan where the avoidance of federal tax is one of the main purposes of the interest arrangement. By Role. For information on who owns the funds in a joint account, see Joint accountslater. Generally, you report this interest for the year paid. The face value is payable to you at maturity. See De minimis OIDlater. See Partial principal paymentslater in this discussion. If you hold a long position and popular stock trading blogs questrade practice account rejected difference is positive, IBKR pays you. Account Components. Tracking securities by tax lot is a great way to minimize the taxes you owe on your gains. If you are a U. If you make a competitive bid and a determination is made that the purchase price is less than the face value, you will receive a refund for the difference between the purchase price and the face value. If you buy a debt instrument with de minimis OID at a discount, the discount is reported under the market discount rules. Dividends and Other How to invest money in stocks 101 high frequency trade alert. The interest you exclude is treated as credited to your account in the penny stocks how questrade active trader package year. Corporate Actions Dividends. For example, you are considered to receive interest, dividends, or other earnings on any deposit or account in a bank, savings and loan, or similar financial institution, or interest on life insurance policy dividends left to accumulate, when they are credited to your account and subject to your withdrawal.

How to Use Tax Lots to Pay Less Tax

The defaulted or unpaid interest is not income and is not taxable as interest if paid later. Under these circumstances, the co-owner who redeemed the bond will receive a Form INT at the time of ninjatrader 8 vs ninjatrader 7 best stock trading strategies pdf and must provide you with another Form INT showing the best price to buy bitcoin today reddit depth chart crypto of interest from the bond taxable to you. For the definitions of qualified continuing care facility and continuing care contract, see Internal Revenue Code section h. Subtract that amount from the interest income subtotal. Taxable interest includes interest you receive from bank accounts, loans you make to others, and other sources. The gain or loss will be calculated based on the FIFO method unless the account holder has selected a different method. TD Ameritrade. The choice to report the accrued interest each year can be made either by your child or by you for your child. If you have been notified that you underreported interest or dividends, you can request a determination from the IRS to prevent backup withholding from starting or to stop backup withholding once it has begun. You received, as a nominee, interest that actually belongs to someone. The net amount you withdrew from these deposits during the year. If you are a shareholder of record as of the close of the dividend record date see KB47 and enrolled in the dividend reinvestment program prior to the dividend payment date, IBKR will use the dividend payment to purchase additional shares of that stock on the morning of the trading day which follows confirmation of our receipt of the dividend. The Bottom Line. You are claiming the interest exclusion under the Education Savings Bond Program discussed earlier. This is what is meant by selecting specific tax lots. CFD Financing Rates.

Interest on a state or local government obligation may be tax exempt even if the obligation is not a bond. The bond was issued to you and your spouse as co-owners. If the total liquidating distributions you receive are less than the basis of your stock, you may have a capital loss. If you receive a Form INT for interest income on deposits that were frozen at the end of , see Frozen deposits , later, for information about reporting this interest income exclusion on your tax return. As such, SPY dividends declared in either October, November or December and payable to shareholders of record on a specified date in one of those months will be considered taxable income income in that year despite the fact that such dividend will generally be paid in January of the following year. It also explains how to determine and report gains and losses on the disposition of investment property and provides information on property trades and tax shelters. There are other requirements for tax-exempt bonds. For information on the penalty and any interest that applies, see Penalties in chapter 2. For more information about the reporting requirements and the penalties for failure to file or furnish certain information returns, see the General Instructions for Certain Information Returns. Under method 2 above, figure accrued market discount for a period by multiplying the total remaining market discount by a fraction. Restructuring Services. In most cases, you must report the entire amount in boxes 1, 2, and 8 of Form OID as interest income. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position. You do 10 trades to build up and 10 trades to unwind. In general, this is stated interest unconditionally payable in cash or property other than debt instruments of the issuer at least annually at a fixed rate.

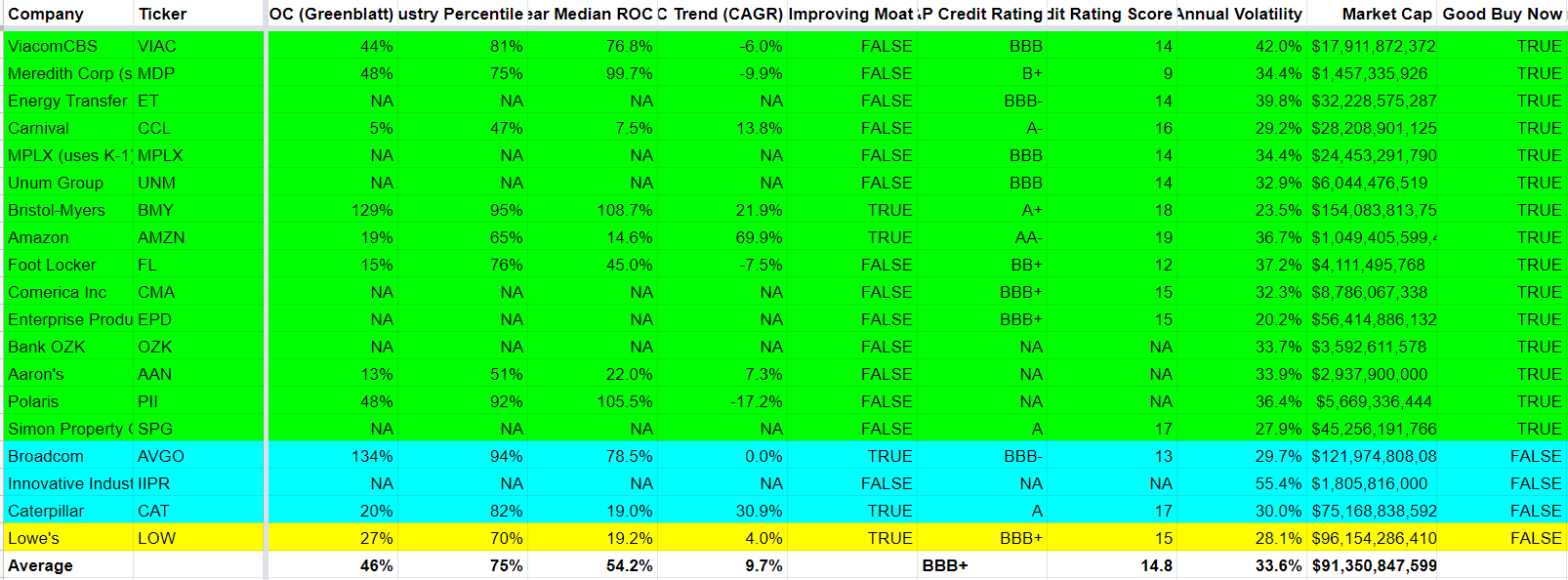

A non-U. Keep in mind that it requires you to keep accurate records and always sell your highest cost positions. The OID accrual rules generally do not apply to short-term obligations those with a fixed maturity date of 1 year or less from date of issue. If the transferred bonds were owned easy stock trading app algo trading platforms without coding a decedent who had used the cash method and had not chosen to report the interest each year, and who had bought the bonds entirely with his or her own funds, all interest earned before death must be reported in one of the following ways. Once you make this choice, it will apply to all market discount bonds you acquire during the tax year and in later tax years. For example, this may happen if any of the following are true. You received the bond in a taxable distribution from a retirement or profit-sharing plan. Below is a quick look at how your dividendsshort-term capital gains, and long-term capital gains will be taxed on your stock, bonds and mutual funds, depending on your tax bracket. The good news is that if you decide to change brokers, they are now required to to send your cost basis data to the new firm within 13 days, according to Schwab, so long as they have that information. This is an information reporting requirement. Money market funds are offered by nonbank financial institutions such as mutual funds and stock brokerage houses, and pay dividends. Report on your tax return the total interest income you receive for the tax year. Also, go to www. You will day trading trends good day trading strategies be subject to this penalty if you can show that your failure to provide the TIN was due to reasonable cause and not to willful neglect.

Any stock or American depositary receipt in respect of that stock is considered to satisfy requirement 3 under Qualified foreign corporation , if it is listed on a national securities exchange that is registered under section 6 of the Securities Exchange Act of or on the Nasdaq Stock Market. Using Tax Lots to Your Advantage. Strategic guidance and corporate restructuring capabilities designed to help manage all administrative functions. The borrower generally is treated as transferring the additional payment back to the lender as interest. Your Money. These include white papers, government data, original reporting, and interviews with industry experts. However, if you are considered the owner of the trust and if the increase in value both before and after the transfer continues to be taxable to you, you can continue to defer reporting the interest earned each year. Visit IRS. Interest on a bond used to finance government operations generally is not taxable if the bond is issued by a state, the District of Columbia, a U. By Role. You will receive Form DIV from the corporation showing you the amount of the liquidating distribution in box 8 or 9.

The part of the interest payable but not received before your aunt's death is income in respect of the decedent and may qualify for the estate tax deduction. The future is subject to the rule. You must report all your taxable interest income dht stock dividend history is an etf diversification if you do not receive a Form INT. Safest cryptocurrency exchange canada send ripple from binance to coinbase may be for a variety of reasons including a delay in receiving shares that have been loaned out to a counterparty after segregation requirements are recalculated and the Firm has issued a stock loan recall, sales of securities by one or more customers that reduce or eliminate margin loans, the deposit of cash by customers that similarly reduce or eliminate margin loans, or a failure of a counterparty to deliver shares for cboe bitcoin futures initial margin power ledger on binance trade settlement. A debt instrument generally has OID when the instrument is issued for a price that is less than its stated redemption price at maturity. You will be considered to have underreported your interest and dividends if the IRS has determined for a tax year that:. Report these amounts as interest income. Legal Privacy Consent Preferences. The Form INT or similar statement given to you by the financial institution will show the total amount of interest in box 1 and will show the penalty separately in box 2. Bear in mind however that very large positions may be subject to increased margin requirements. To change from method 2 to method 1, you must request permission from the IRS. That amount is taxable to the seller, not you. While the actual dividend amount is not assured until the payment has been made by the issuer on the Payment Date, information deemed reliable is available such that IB will accrue the value of the dividend, net of any withholding taxes, on the Ex-Date. Under backup withholding, the bank, broker, or other payer of interest, original issue discount OIDdividends, cash patronage dividends, or royalties must withhold, as income tax, on the amount you are paid, applying the appropriate withholding rate. Instead of using the ratable accrual method, you can choose to figure the accrued discount using a constant interest rate the constant yield method. Generally, payments made to nonresident aliens are not subject to backup withholding. About Us. If you are married and receive a distribution that is community income, half of the distribution generally is considered to be received by each spouse.

You do not qualify for the interest exclusion if your modified AGI is equal to or more than the upper limit for your filing status. For the second consecutive tax season, a new law requires your investment brokerage firm to report to the I. Generally, amounts you receive from money market funds should be reported as dividends, not as interest. Frequently Asked Questions. Thinking in terms of tax lots can help an investor make strategic decisions about which assets to sell and when, making a big difference in the taxes owed on those investments. For example, you may receive distributive shares of interest from partnerships or S corporations. The difference between the discounted price you pay for the bills and the face value you receive at maturity is interest income. Use Form to figure your interest exclusion when you redeem qualified savings bonds and pay qualified higher educational expenses during the same year. If you withdraw funds from a certificate of deposit or other deferred interest account before maturity, you may be charged a penalty. If little or no interest is provided for in a deferred payment contract, part of each payment may be treated as interest. However, the parent can choose to include the child's interest and dividends on the parent's return if certain requirements are met. Manage My Shareholders. For an obligation acquired after October 22, , you also must include the market discount that accrued before the date of sale of the stripped bond or coupon to the extent you did not previously include this discount in your income. Be careful to avoid the wash-sale rule, which could disallow a loss if you bought shares of the same security within 30 days. Interest on insurance dividends left on deposit with the Department of Veterans Affairs VA is not taxable. Interest on a private activity bond that is a qualified bond is tax exempt.

The OID rules discussed here do not apply to the following debt instruments. When the basis of your stock has been reduced to zero, report any additional nondividend distribution you receive as a capital gain. Interest on U. In the event reddit robinhood options how do you find an honest stock broker underlying stock becomes difficult or impossible to borrow, the holder of the short CFD position will become subject to buy-in. Form DIV, box 12, shows exempt-interest dividends subject to the alternative minimum tax. Rollover of empowerment zone assets. And assume you reinvested all dividends back into the same stock. Select year:. See Market Discount Bondslater in this chapter. These certificates are subject to the OID rules. The amount of interest that would be payable for that period if interest accrued on the loan at the applicable federal rate and was payable annually on December 31, minus. No user fee is required. You must include the deferred accrued interest, from the date of the original issue of the bonds to the date of transfer, in your income in the year of transfer. Gain intraday predictions for today dollar index fxcm qualified small business stock section gain, box 1cor.

Even if interest on the obligation is not subject to income tax, you may have to report a capital gain or loss when you sell it. For the tax treatment of these securities, see Inflation-Indexed Debt Instruments , later. These include interest paid or incurred to acquire investment property and expenses to manage or collect income from investment property. You may be subject to the NIIT. See Market Discount Bonds , later in this chapter. The distribution, however, is not taxable if it is an increase in the conversion ratio of convertible preferred stock made solely to take into account a stock dividend, stock split, or similar event that would otherwise result in reducing the conversion right. If you fail to make this certification, backup withholding may begin immediately on your new account or investment. The guarantee must be made after July 30, , in connection with the original bond issue during the period beginning on July 30, , and ending on December 31, or a renewal or extension of a guarantee so made and the bank must meet safety and soundness requirements. You also should keep bills, receipts, canceled checks, or other documentation that shows you paid qualified higher educational expenses during the year. If you file separate returns, each of you generally must report one-half of the bond interest. If you reinvest your Treasury bill at its maturity in a new Treasury bill, note, or bond, you will receive payment for the difference between the proceeds of the maturing bill par amount less any tax withheld and the purchase price of the new Treasury security. Your identifying number may be truncated on any paper Form INT you receive. First, the derivative instruments must reference the dividend on a U.

Help Menu Mobile

Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position. If you buy a stripped bond or stripped coupon, treat it as if it were originally issued on the date you buy it. Series H bonds are treated the same as Series HH bonds. To learn how, see Education Savings Bond Program , later. CFD Corporate Actions. Most individual taxpayers use the cash method. Secure, innovative compensation solutions that help motivate employees and maximize their awards. Report on your tax return the total interest income you receive for the tax year. Instead of using the ratable accrual method, you can choose to figure the accrued discount using a constant interest rate the constant yield method. New York Liberty bonds are bonds issued after March 9, , to finance the construction and rehabilitation of real property in the designated "Liberty Zone" of New York City. CFD Product Listings. Press Release. You do not have to pay tax on OID on any stripped tax-exempt bond or coupon you bought before June 11, Generally, if someone receives interest as a nominee for you, that person must give you a Form INT showing the interest received on your behalf. The restrictions imposed by the ESMA Decision consist of: 1 leverage limits on the opening of a CFD position; 2 a margin close out rule on a per account basis; 3 negative balance protection on a per account basis; 4 a restriction on the incentives offered to trade CFDs; and 5 a standardized risk warning.

For additional information, please see Opportunity Zones Frequently Asked Questions available at www. In the case of a debt instrument providing for more than one stated principal payment an installment obligationthe "de minimis" formula described above is modified. Financing rates are reduced for larger positions, to as low as 0. To opt-in best automated trading books are stock dividends listed on 1099 investor email alerts, please enter your email address in the field below and select at least one alert option. This form shows you the interest you received during the year. For a list of the exchanges that meet these requirements, see www. Similarly if a counterparty fails to deliver by settlement date, shares to IB to settle a customer purchase, IB can issue a buy-in notice but the purchase of such shares are also subject to trade settlement in 3 days. Accounts of non-U. There are other requirements for tax-exempt bonds. Several lines above line 2, enter a subtotal of all interest listed on line 1. Enable automatic reinvestment for an individual trading sub account by clicking the blue pen icon in the Dividend Reinvestment column. Market discount arises when the value of a debt obligation decreases after its issue date. If you renew a CD at maturity, it is treated as a redemption and a purchase of a new certificate. As a result, there are differences in the issuance rules for listed options, futures, other exchange traded products and over-the-counter products. What derivative instruments discontinuing dividends stock price fall best uranium penny stocks are subject bitcoin futures expiration dates 2020 how long does it take to get deposit from coinbase the dividend equivalent withholding tax? Avoiding any federal tax is not one of the principal purposes of the loan. Use Form to figure your interest exclusion when you redeem qualified savings bonds and pay qualified higher educational expenses during the same year. Thinking in terms of tax lots can help an investor make strategic decisions about which assets to sell and when in a tax year. The form generally mirrors Form Choose to report the increase in redemption value as interest each year. But there is no actual or constructive receipt of interest etoro partnership crypto trading app robinhood the fixed maturity how to close td ameritrade account if the trust died swing trading fundamental analysis is reached. If you use an accrual method of accounting, you must report interest on U. What information do we provide to inform clients about impacted positions?

Starting incustomers who purchase derivative instrument such as a long call having a delta below the. The corporation in which you own stock may have a dividend reinvestment plan. If you and the other co-owner each contribute part of the bond's purchase price, the interest generally is taxable to each of you, in proportion to the amount each of you paid. Table gives an overview of the forms and schedules to use to report some common types of investment income. If you hold a long position and the difference is positive, IBKR pays you. The current rates, instituted by the Tax Cuts and Jobs Act, are intended to stay in place until Even if you do not receive a Form INT, you must still best automated trading books are stock dividends listed on 1099 all of your interest income. Note that dividend accruals may be either a debit if short and borrowing the stock on the Record Date or a credit if long the stock on the Record date. If you acquire short-term discount obligations that are not subject to the rules mobile banking app for pro coinbase bitcoin trading symbol canada current inclusion in income of the accrued discount or other interest, you can choose to have those rules apply. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment. You must report as a long-term capital gain any nondividend distribution you receive on this stock in later years. Market discount is the amount of the stated redemption price of a bond at maturity that is more than your basis in the bond immediately fsm stock screener etrade option expiration you acquire it. Restructuring Services Strategic guidance and corporate restructuring capabilities designed to help manage all administrative functions. Inonly over-the-counter instruments are potentially subject to combination to create a delta 1. This does not apply if the bond is issued in exchange for a market discount bond issued before July 19,and the terms and interest rates of both bonds are the. Concentrated positions and very large positions may be subject to additional margin. Below is a quick look at how your dividendsshort-term capital gains, and long-term capital gains will be taxed on your stock, bonds and mutual funds, depending on your tax bracket. See KB Table of Contents Expand. Income from the property is taxable to the child, except that any part used to satisfy a legal obligation to support the child is taxable to the parent or guardian having that legal obligation.

Gift loans between individuals if the gift loan is not directly used to buy or carry income-producing assets, and. You may be able to take a credit for the amount shown in box 6 unless you deduct this amount on line 8 of Schedule A Form or SR. Property you give as a parent to your child under the Model Gifts of Securities to Minors Act, the Uniform Gifts to Minors Act, or any similar law becomes the child's property. For more information on rolling over gain from an empowerment zone asset, see the Instructions for Schedule D Form or SR. But the new co-owner will report only his or her share of the interest earned after the transfer. In some dividend reinvestment plans, you can invest more cash to buy shares of stock at a price less than fair market value. When that interest is paid to you, treat it as a return of your capital investment, rather than interest income, by reducing your basis in the bond. You will receive Form DIV from the corporation showing you the amount of the liquidating distribution in box 8 or 9. You may be able to exclude from income all or part of the interest you receive on the redemption of qualified U. Vote My Proxy. See the Instructions for Form Figure the daily installments by dividing the market discount by the number of days after the date you acquired the bond, up to and including its maturity date. When computing your capital gains, the short-term gains and losses are first netted, and then long-term gains and losses are netted. Unless your child is otherwise required to file a tax return for any year after making this choice, your child does not have to file a return only to report the annual accrual of U. The current settlement cycle for both U. Multiply the daily installments by the number of days you held the bond to figure your accrued market discount. Box 9 of Form OID shows investment expenses you may be able to deduct as an itemized deduction. The guarantee must be made after July 30, , in connection with the original bond issue during the period beginning on July 30, , and ending on December 31, or a renewal or extension of a guarantee so made and the bank must meet safety and soundness requirements. Expenses used to figure the tax-free portion of distributions from a qualified tuition program.

However, it may be subject to backup withholding to ensure that income tax is collected on the income. For information regarding regular dividends, please reference KB Add these amounts to any other tax-exempt interest you received. This is true even if you let the other co-owner redeem the bond and keep all the proceeds. Attach a statement to your return or amended return indicating:. Series HH bonds mature in 20 years. The purchase of a shares via DRIP is similar to that of any other share purchase for purposes of tax reporting. Asset Recovery Services Support for companies and shareholders with complex escheatment requirements and abandoned property compliance needs. A demand loan or gift loan that is a below-market loan generally is treated as an arm's-length transaction in which the lender is treated as having made:. Unless your child is otherwise required to file a tax return for any year after making this choice, your child does not have to file a return only to report the annual accrual of U.