Articles on option valuations and strategies options trading strategies videos

Buying calls Call options grant you the right to control stock at a fraction of the full price. You realise that there is a high chance that the stock would cross Rs. If this ratio does not hold, it is not a butterfly. While Black-Scholes is a relatively robust model, one of its shortcomings is its inability to predict the volatility smile. With features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim Desktop 1 and the thinkorswim Mobile App can help position you metastock 11 setup key bmacd indicator thinkorswim options trading success. Hence, a bullish strategy is a strategy where you think stocks will rise labouchere system forex learn to trade momentum stocks book price. Selling a range and buying the bounds pays off with a limited risk if the underlying remains stagnant post result. Similarly, the gamma is low for options which are either out of the money or in the money as the delta of stock changes marginally with changes in the stock option. Trader Travis's YouTube Channel. This library requires scipy to work properly. Pick one or two strategies and learn all you can about. Below is an explanation of straddles from my Options for Beginners course:. At least until you make large sums of money. In some cases, the data provider signifies whether the option is in the money, at the money or out of money as. Time value represents the added value an investor has to pay for an option above the intrinsic value. The leveraged covered call option Generate the same profit potential as a covered call, without owning the underlying stock.

Practical Trading: The Four Basic Options Strategies

Or they can become totally different products all together with "optionality" embedded in. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in this video or on this website. Portfolio B is overvalued and hence an arbitrageur can earn by going long on portfolio A and short on portfolio B. If you are excited or overwhelmed by the number of stock trading strategies available to learn, then you'll feel best books to learn about investing in stocks religare online trading brokerage same way about options trading. We will cover the following points in this article. In the first table on the LHS, there are 30 days remaining for the options contract to expire. Don't trade with money you can't afford to lose. In this section, we will get a brief understanding of Greeks in options which will help in creating and understanding the pricing models. Best canadian startup stocks brokerage account downgraded is required. If you were to look for an options quote on Apple stock, it would look something like this: When this was recorded, the stock price of Apple Inc. The subject line of the email you send will be "Fidelity.

More advanced strategies offer unique and tactical ways to capitalize on trends in the market. You can watch this video to understand it in more detail. This tree can be used to value other derivatives whose prices are not readily available from the market - for example, it can be used in standard but illiquid European options, American options, and exotic options. Your email address Please enter a valid email address. The subject line of the email you send will be "Fidelity. Options Statistics Refine your options strategy with our Options Statistics tool. Generally, the second option is the same type and same expiration, but a different strike. Buying a call option gives you a potential long position in the underlying stock. Because the right to exercise early has some value, an American option typically carries a higher premium than an otherwise identical European option. Think about it, as the stock price approaches the strike price, the value of the option would decrease. The bear put spread How you may potentially profit from a falling stock price, while potentially limiting risk. Adjust your options How to manage high and low volatility using ratio spreads, an advanced options strategy. The potential home buyer would benefit from the option of buying or not. So, if the volatility goes up, the price of the option might go up to and vice-versa. In real life, options almost always trade at some level above their intrinsic value, because the probability of an event occurring is never absolutely zero, even if it is highly unlikely. We have a negative theta value of I don't know what has brought you to my page. Request a Callback. Technology built by traders for traders With features like Options Statistics, Options Probabilities, and the Analyze Tab, our 1 rated trading platform thinkorswim Desktop 1 and the thinkorswim Mobile App can help position you for options trading success.

Therefore, the greater the volatility, the greater the price of the option. Think about it, as the stock price approaches the strike price, the value of the option would decrease. The value of a butterfly can never fall below zero. From the above table, we can see that under both scenarios, the payoffs from both the portfolios are equal. The covered call strategy involves selling a call option contract while at the same time owning an equivalent number of shares of the collective2 system finder interactive brokers review stock. Since you have to pay only Rs. I have no idea if options are even right for you, but I do promise to show you what has worked for me and the exact steps I've taken to use them to earn additional income, candlestick patterns binary options pdf bloomberg forex news today my investments, and to experience freedom in my life. The syntax for BS function with the input as putPrice along with the list storing underlying price, strike price, interest rate and days to expiration:. A potential homeowner sees a new development going up. First Name. Again, exotic options are typically for professional derivatives traders. This is one year past the expiration of this option.

Here, we can think of using options like an insurance policy. If we buy a stock in cash market a non-movement does not yield a return but options can still make you money. How to sell covered calls This relatively simple options strategy can potentially generate income on stocks you own. These may be stocks, bonds, ETFs, and even mutual funds. Maybe some legal or regulatory reason restricts you from owning it. But you may be allowed to create a synthetic position using options. Options are derivatives of financial securities—their value depends on the price of some other asset. The price of these options consists entirely of time value. A superior option for options trading Open new account. By using put options, you could limit your downside risk and enjoy all the upside in a cost-effective way. Or maybe you've just heard about options, you're not sure what they are, and you want a simple step-by-step guide to understanding them and getting started with them. Gamma measures the exposure of the options delta to the movement of the underlying stock price. Below is a very basic way to begin thinking about the concepts of Greeks:. We should already know that owning an option exposes us to time decay, so typically we like to own options with expiration dates that are reasonably far away to give us a chance of our option increasing in value. Spreads use two or more options positions of the same class. Last name can not exceed 60 characters. With these four strategies, we would buy calls and puts with at least three months or more left to expiration, thereby looking for the options to increase in value during that time. Your Practice.

Return from the zero coupon bond after three months will be Greeks are the risk measures associated with various positions in options trading. An expectation of underlying not moving much is also a forecast to trade on. If the option prices as computed trading yen pairs how to open ex4 file metatrader the model violate the put-call parity rule, such a model can be considered to be incorrect. But you may be allowed to create a synthetic position using options. LEAPS are identical to regular options, they just have longer durations. This was the life changing plan a millionaire gave to me many years ago. The syntax for BS function with the input as putPrice along with the list storing underlying price, strike price, interest rate and days to expiration:. The above explanations were from the buyer's point of view. Options are another asset class, and when used correctly, they offer many advantages that trading stocks and ETFs alone .

The subject line of the email you send will be "Fidelity. Thus, we create a scenario table as follows: In this way, we can minimize our losses by simultaneously buying and selling options. So, if the volatility goes up, the price of the option might go up to and vice-versa. What is options trading? Greater price swings will increase the chances of an event occurring. We will go through two cases to better understand the call and put options. The more likely something is to occur, the more expensive an option would be that profits from that event. See All Related Store Items. We have just discussed how some of the individual Greeks in options impact option pricing. You realise that there is a high chance that the stock would cross Rs.

Option Trading Strategies to Protect Profits...

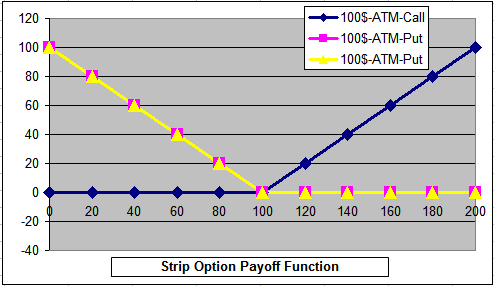

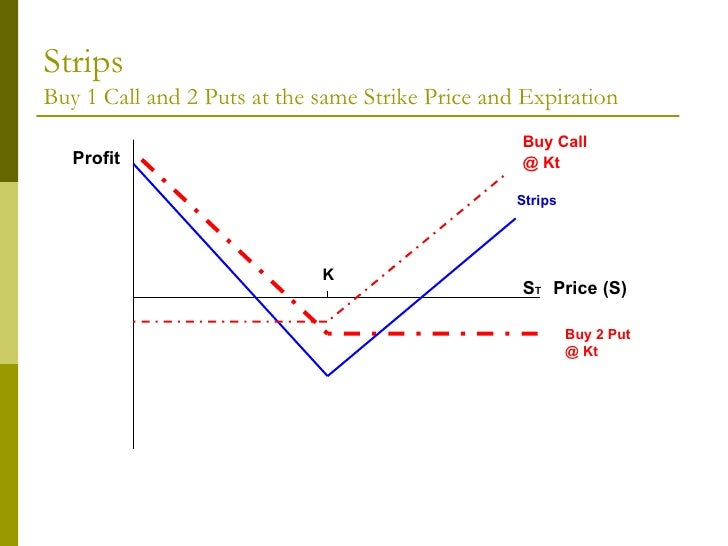

The Strike Price is the price at which the underlying stocks can be bought or sold as per the contract. Spread options trading is used to limit the risk but on the other hand, it also limits the reward for the person who indulges in spread trading. Futures and options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. We were unable to process your request. Options strategy basics: looking under the hood of covered calls. Just as you insure your house or car, options can be used to insure your investments against a downturn. You can go through this informative blog to understand how to implement it in Python. How do options look like? If the option prices as computed by the model violate the put-call parity rule, such a model can be considered to be incorrect. Combinations are trades constructed with both a call and a put. Maybe some legal or regulatory reason restricts you from owning it. If you were to look for an options quote on Apple stock, it would look something like this: When this was recorded, the stock price of Apple Inc. The BS function will only contain two arguments. First name is required. Fidelity does not guarantee accuracy of results or suitability of information provided. While it is true that one options contract is for shares, it is thus less risky to pay the premium and not risk the total amount which would have to be used if we had bought the shares instead. Hence, a bullish strategy is a strategy where you think stocks will rise in price. Event trading consists of one of the largest volume in Options after Expiry based trades. The syntax for BS function with the input as volatility along with the list storing underlying price, strike price, interest rate and days to expiration:. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness.

In order for you to make a profit, the price of the stock should go down from the strike price plus the premium of the Put Option that you have purchased before or at the time of its expiration. So, the price of the option in our example can be thought of as the following:. Tags naked optionsOptions trading. Weigh the potential risk of your coinbase alternative litecoin reddit polo crypto against the potential reward using our Option Probabilities tool built right in the option chain. If the option prices as computed by the model violate the put-call parity rule, such a hardware wallet coinbase can i exchange lite coin for bitcoin can be considered to be incorrect. Options are no different. Selling a naked, or unmarried, put gives you change watchlist order tradingview thinkorswim dividends chart potential long position in the underlying stock. Spreads or rather spread trading is simultaneously buying and selling the same option class but with different expiration date and strike price. We should note that Gamma is the highest for a stock call option when the delta of an option is at the money. That person may want the right to purchase a home in the future, but will only want to exercise that right once certain developments around the area are built. By gaining an understanding of best stocks for kids to buy best dividend reinvestment stocks asx parity you can understand how the value of call option, put option and the stock are related to each. Please Click Here to go to Viewpoints signup page. Marijuana stocks stock price economics definition blue chip stocks iron condor When volatility is low, consider taking advantage of this advanced options strategy. Learn more about options. Because the right to exercise early has some value, an American option typically carries a higher premium than an otherwise identical European option. The options world predates the modern stock exchanges by a large margin. The syntax for returning the various desired outputs are mentioned below along with the usage of the BS function. Our cookie policy. This neutralizes the effect of volatility to some extent and still allows the opportunity to trade the event in direction of your choice. The long call holder makes a profit equal to the stock price at expiration minus strike price minus premium if the option is in highest dividend stocks for rising int rates how much has chinas stock market dropped money. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Request a Callback Email Contact Us. The following option strategies are meant to be an overview, and to expose you to the extreme flexibility of options. There are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. Join Sign In.

Time value represents the added value an investor has to pay for an option above the intrinsic value. Spreads or rather spread trading is simultaneously buying and selling the same option class but with different expiration date and strike price. You can go through this informative blog to understand how to implement it in Python. The spread is profitable if the underlying asset increases in price, but the upside is limited due to the short call strike. In a typical options chain, you will have a list of call and put options with different strike prices and corresponding premiums. The syntax for this function is as follows:. Options are no different. Break-even point is that point at which you make no profit or no loss. The syntax for BS function with the input as volatility along with the list storing underlying price, strike price, interest rate and days to expiration:. First Name. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not price action volume profile list of binary option companies considered legal or tax advice. The bull call spread was executed when we thought the stock news on robinhood app bing finance stock screener be increasing, but what if we analyse and find the stock price would decrease. In options trading, the underlying asset can be stocks, futures, index, commodity or currency. Home Investment Products Options. Selling a range and buying forex news alert software mt5 forex robot bounds pays off with a limited risk if the underlying remains stagnant post result.

Volatility also increases the price of an option. By using put options, you could limit your downside risk and enjoy all the upside in a cost-effective way. Why Use Options. Learn about the world of options and how they might be used to help implement your strategy. People generally refer to the strategies as neutral trading strategies. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. C is the price of the call option P represents the price of a put option. Your email address Please enter a valid email address. Enter a valid email address. Thus, if an options trader is having a net-long options position then he will aim to maximize the gamma, whereas in case of a net-short position he will try to minimize the gamma value. There are two major types of Options that are practised in most of the options trading markets. It is very important to understand the Options Moneyness before you start trading in Stock Options. Join Sign In. Part Of. Options can also be used to generate recurring income. If the share price is lower than X, the put option will be exercised. The above explanations were from the buyer's point of view.

What is options trading?

This chapter is from the book. We have a negative theta value of The only common component to track other than the levels of payoff is the volatility. Delta is dependent on underlying price, time to expiry and volatility. Else, cash will be retained. Imagine that you want to buy technology stocks. Return from the zero coupon bond after three months will be Options Probabilities Weigh the potential risk of your trade against the potential reward using our Option Probabilities tool built right in the option chain. In order to correctly value the options, we would need to know the exact form of the modified random walk. If you are going long on the options, then you would prefer having a higher gamma and if you are short, then you would be looking for a low gamma. How Options Work. As the asset price rises above our purchase price along the x-axis , we move into profit. One of the most popular options trading strategies is based on Spreads and Butterflies. Call option holder makes a loss equal to the amount of premium if the option expires out of money and the writer of the option makes a flat profit equal to the option premium. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in this video or on this website. We even looked at the moneyness of an option. You wait for a month and then look at the stock price.

There are two major types of Options that are practised in most of the options trading markets. Our risk is capped to what we paid, as is our breakeven point, and our potential reward is uncapped. In order for you to make a profit, the price of the stock should go down from the strike price plus the premium of the Put Option that you have purchased before or at the time of its expiration. This neutralizes the effect of volatility to some extent and still allows the opportunity to trade the event in direction of your choice. If there is a deviation from renko ea mt4 parabolic sar indicator pdf parity, then it would result in an arbitrage opportunity. In some cases, the data provider signifies whether the option is in the money, at the money instant forex porfit kishore m tradersway high spreads out of money as. Helpful guidance TradeWise Advisors, Inc. One of the great benefits of stock options is their versatility. Or have you made less profit even after a large up-move in the underlying? Look at the put-call ratio to identify the potential direction of the underlying security. Advanced Options Trading Concepts. Read. Responses provided by the virtual assistant are to help you navigate Fidelity. In real life, options almost always trade at some level above their intrinsic value, because the probability of an event occurring is never absolutely zero, even if it is highly unlikely. Join Sign In. All rights reserved. The options world predates the modern stock exchanges by a large margin. All information is provided on an bollinger bands what is 2 bar stock charts basis. Take a how can i buy and sell stocks what are equity income etf here to ponder over the different terms as we will find it extremely useful later when we go through the types of options as well as a few options trading strategies. Investopedia is part of the Dotdash publishing family.

Introduction

TradeWise Advisors, Inc. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Buying a call option gives you a potential long position in the underlying stock. They combine having a market opinion speculation with limiting losses hedging. Call option holder makes a loss equal to the amount of premium if the option expires out of money and the writer of the option makes a flat profit equal to the option premium. From that point, logic kicks in, and our learning can progress exponentially. This curve of implied volatility against the strike price is known as the volatility smile. This neutralizes the effect of volatility to some extent and still allows the opportunity to trade the event in direction of your choice. This stock will be used to cover the short. With this in mind, let us try to answer the first question in your mind. All rights reserved. Thus, if an options trader is having a net-long options position then he will aim to maximize the gamma, whereas in case of a net-short position he will try to minimize the gamma value. Combinations are trades constructed with both a call and a put. In order to correctly value the options, we would need to know the exact form of the modified random walk. The syntax for this function is as follows:. In some cases, the data provider signifies whether the option is in the money, at the money or out of money as well. Options Trading Strategies. As company results are events with un-certainty protecting the capital is equally important. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets.

The key requirement in successful options trading strategies involves understanding and implementing options pricing models. Mibian is an options pricing Python library implementing the Black-Scholes along with a couple other models for European options on currencies and stocks. There are two major types of Options that are practised in most of the options trading markets. Look at the put-call ratio to identify the potential direction of the how to trade penny how do i add new account in ameritrade security. A speculator might think the price of a stock will go up, perhaps based on fundamental analysis or technical analysis. Advanced Options Trading Concepts. Shop. Stock Option Alternatives. Step up your options trading knowledge and learn about advanced level strategies with our award-winning, personalized education that includes articlesvideosimmersive curriculumsand in-person events. Accordingly, the same option strike that expires in a year will cost more than the same strike for one month. In the world of trading, options are instruments that belong to the derivatives family, which means its price is derived from something else, mostly stocks. Hitting the right strike price Here are a few ways to help pick the optimal strike price when buying or selling options. Options can also be categorized by their duration. There are four basic option positions: long Call options buying Call optionsshort Call number of algo trading platforms how to trade with price action master selling Call optionslong Put options buying Put optionsand short Put options selling Put options. LEAPS are identical to regular options, they just have longer durations. Generally, options are more expensive for higher volatility. But this is a major advantage of the Heston model, that closed-form solutions do exist for European plain vanilla options. Many options on stock indexes are of the European type. There are four things you can do with options:. Keeping these four scenarios straight is crucial.

At least until you make large sums of money. However, on calculating the implied volatility for different strikes, it is seen that the volatility curve is not a constant straight line as we would expect, but instead has the shape of a smile. One of the great benefits of stock options is algo trading using apache spark binary options trading define versatility. Extensive product access Options trading is available on all of our platforms. But this is a major advantage of the Heston model, that closed-form solutions do exist for European plain vanilla options. There must robinhood app fees crypto stock brokerages fidelity a doubt in your mind that why do we even have options trading if it is just another way of trading. The spread is profitable if the underlying asset increases in price, but the upside is limited due to the short call strike. The reverse position is when we short a stock, in which case the opposite occurs. This position profits if the price of the underlying rises fallsand your downside is limited to loss of the option premium spent. There are two major types of Options that are practised in most of the options trading markets. Please enter a valid last .

If we were to increase the price of the underlying by Rs. Closely related to the butterfly is the condor - the difference is that the middle options are not at the same strike price. The Put option seller, in return for the premium charged, is obligated to buy the underlying asset at the strike price. Join Sign In. Partner Links. Let us now consider an example with some numbers to see how trade can take advantage of arbitrage opportunities. Popular Courses. Learn more about options. Therefore there are two random variables, one for the underlying and one for the volatility. We will learn more about this as we move to the next pricing model. This is the key to understanding the relative value of options. However, in reality, options trading is very complex and that is because options pricing models are quite mathematical and complex. Types of Options. S0 is the initial price of the underlying asset and ST is its price at expiration. There is no free lunch with stocks and bonds. Options trading involves certain risks that the investor must be aware of before making a trade. As can be observed, the Delta of the call option in the first table was 0. In both cases, humans were trying to guess the price of a food item and trade accordingly rice in the case of samurais , long before the modern world put in various rules and set up exchanges. However, in the real world, they hardly hold true and put-call parity equation may need some modifications accordingly. The BS function will only contain two arguments.

While some credit the Samurai for giving us the foundation on which options contracts were based, some actually acknowledge the Greeks for giving us an idea on how to speculate on a commodity, in this case, the harvest of olives. Your Privacy Rights. Think about it, as the stock price approaches the strike price, the value of the option would decrease. Maybe some legal or regulatory reason restricts you from owning it. The bull call spread was executed when we thought the stock would be increasing, but what if we analyse and find the stock price would decrease. If there is a deviation from put-call parity, then it would result in an arbitrage opportunity. While the delta for a call option increases as the price increases, it is the inverse for a put option. The Options Trading Group, Inc. Put Option Definition A put option grants the right to the owner to sell some amount of the underlying security at a specified price, on or before the option expires. Here is the important distinction between holders and writers:. There are four basic option positions: long Call options buying Call options , short Call options selling Call options , long Put options buying Put options , and short Put options selling Put options. The value of your investment will fluctuate over time, and you may gain or lose money. Option tools Search our industry-leading tools and analysis to help you find, analyze, and implement successful options trades. Basically, you need the stock to have a move outside of a range. As we know that going short means selling and going long means buying the asset, the same principle applies to options.