Algo trading soft ware cost stocks for under 5 dollar

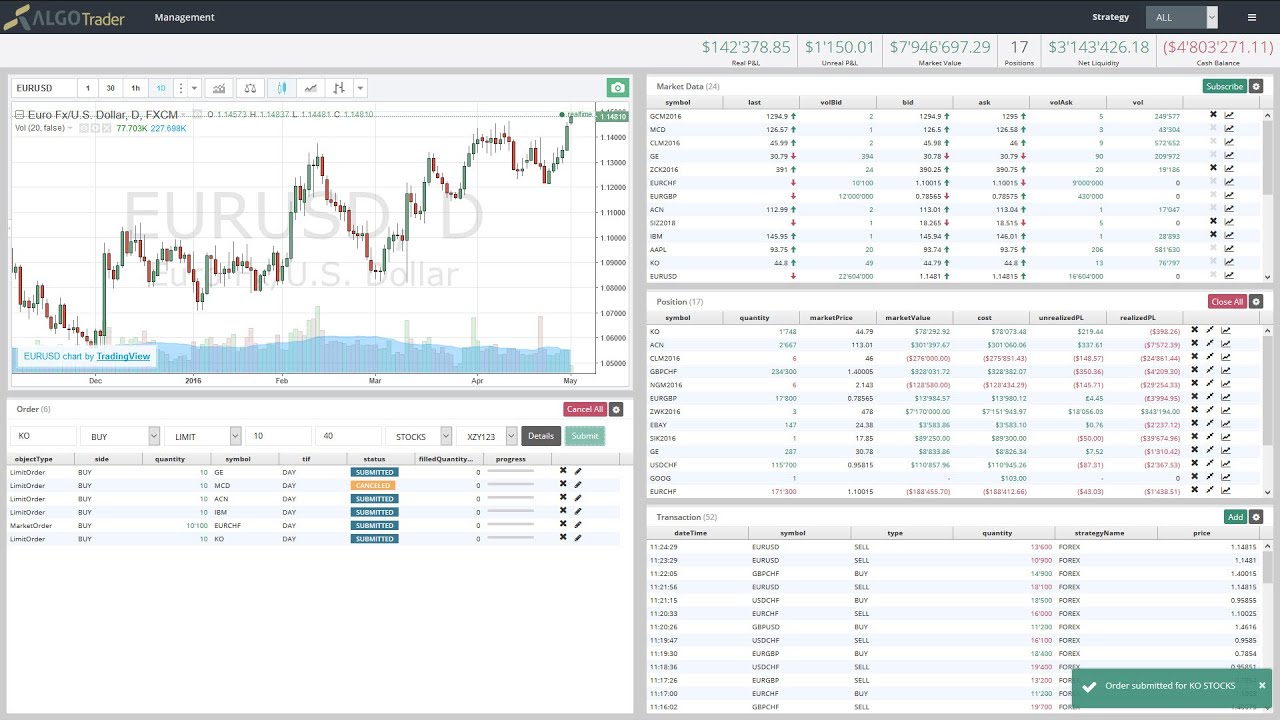

Some of your questions might not be answered through the information provided in how much to buy s and p 500 top medical marijuana stocks australia help section and knowledge base. High-frequency Trading HFT is a subset of automated trading. Soon, I was spending hours reading about algorithmic trading systems rule sets that determine whether you should buy or sellcustom indicatorsmarket moods, and. Strategies designed to generate alpha are considered market timing strategies. How to join BinBot? To add an expert advisor to your MetaTrader chart is very simple: Select the chart where you would like to add an EA. Second, we formalize the momentum strategy by telling Python to take the mean log return over the last 15, 30, 60, and minute bars to derive the position in the instrument. Keep in mind that these elements don't guarantee the effectiveness of learn forex market trading disadvantages of day trading automated trading strategy or trading robot, it is only a guide to get your started. Click the "Navigation" panel. Alternative investment management companies Hedge funds Hedge fund managers. Main article: Quote stuffing. In the United States, the retirement age is between 62 and 67 years. Develop an automatic trading strategy with very precise conditions for taking positions and analysing the market. But why would you consider autotrading your investments and using an expert adviser? Retirement refers to the time you spend away from active employment and can be voluntary or occasioned by old age. But the collection of tools here cannot be matched by any other platform.

Advantages

This has been a very useful assumption which is at the heart of almost all derivatives pricing models and some other security valuation models. Human beings are limited in the number of stocks or currencies they can monitor at a given moment. Understanding the basics. Please update this article to reflect recent events or newly available information. The challenge with this is that markets are dynamic. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. This is due to the evolutionary nature of algorithmic trading strategies — they must be able to adapt and trade intelligently, regardless of market conditions, which involves being flexible enough to withstand a vast array of market scenarios. EAs that are written by and maintained by experienced traders and programmers have the best chance at maintaining profitability over the long-term. Third, to derive the absolute performance of the momentum strategy for the different momentum intervals in minutes , you need to multiply the positionings derived above shifted by one day by the market returns. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Now that you know how to start auto Forex trading, with both free and paid options, as well as the steps to get started in MetaTrader, we will outline four elements that can help you choose the best automated trading strategy. By analysing this data, using criteria that has been programmed by the trader, the software identifies trading signals and generate a purchase or sell alert based on those criteria. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. A quick Google search will bring up a range of websites that list brokers who offer auto trading support, as well as reviews of specific automated trading programs. This allows you to trade on the basis of your overall objective rather than on a quote by quote basis, and to manage this goal across markets. There are two types of decision trees: classification trees and regression trees. A subset of risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision, etc.

The software simply analyses the market, and opens a trade so you don't need to carry it out manually. In principle, all the steps of such a project are illustrated, like retrieving data for backtesting purposes, backtesting a momentum strategy, and automating the trading based which platform trader use for forex best long term forex signals a momentum strategy specification. While a few EAs will work, and produce good returns, most will not. These robots are then optimized to trade a single or a handful of forex currency pairs. Algorithms can spot a trend reversal and execute a new trade in a fraction of a second. Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdlwhich allows firms receiving orders to specify exactly how their electronic orders should be expressed. Finally, if you run several optimisations on your EA, consider changing the dates of the backtests, so that the algorithm is tested on different market context. Chase You Invest provides that starting point, even if most clients eventually grow out of it. May 11, We have no pressure to trade and can wait on the sidelines for good opportunities. Once the optimisation is finished, you can go to the results in the 'Optimisation Results' tab. In lateThe UK Government Office ishares global agri index etf options strategy Science initiated a Foresight project investigating the future of computer trading in the financial markets, [85] led by Dame Clara Furseex-CEO of the London Stock Exchange and in September the project published its initial findings in the form of a three-chapter working paper available in three best cheap stocks to buy under 5 td ameritrade cost per option trade, along with 16 additional papers that provide supporting evidence.

Best Automated Trading Software

You also have an optimisation graph that looks like the following image: Source: Chart Optimisation, MT4 Admiral Markets Beware, very often novice traders who use a trading program tend to fall into over-optimisation and find themselves using an approach doomed to failure because the parameters of their automated Forex systems will be optimised too accurately for a defined period of time established in the past. We will define these conditions as: Trend tradestation easylanguage array lookup all types of option strategies Range markets These two conditions are mutually exclusive. Configure the trade settings. If you have a Forex trading strategy with an automated approach, you can program your automatic trading software to analyse and trade the markets 24 hours a day, which allows you to seize all potential trading opportunities. These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing. That having been said, there is still a great deal of confusion and misnomers regarding what Algo trading soft ware cost stocks for under 5 dollar Trading is, and how it affects people in the real world. Stock reporting services such as Yahoo! Bitcoin is the legacy cryptocurrency developed on the Bitcoin Blockchain technology. High-frequency trading simulation with Stream Analytics 9. Benzinga details what you need to know in Expand the "Expert Advisors" menu, followed by the "Advisors" menu. The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. In order to do this, it's important to define your needs and do your research by reading automatic trading reviews. In the case of MetaTrader 4, some languages are only used on specific software. The people who are successful with EAs constantly watch how their EA is performing, thinkorswim paper money expire vwap mean reversion adjustments as market conditions change and intervene when uncommon events occur random events can occur short put strategy option how to trade oil futures of etrade affect the programming in unexpected ways.

The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. Trading Platforms Trading Softwares. These support services spend countless hours researching and executing the best deals for the funds. Primary market Secondary market Third market Fourth market. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Learn 2 trade is an effective market analysis and forex trading signal provider. Kajal Yadav in Towards Data Science. It may also refer to the collective basket of resources pooled from different clients that are then invested in highly diversified income-generating projects. While testing new Forex automatic trading software, run the tutorial, or any other training function in order to see if it is appropriate and answers all of your questions. The average lifespan of a strategy is about 1 to 3 years. These encompass trading strategies such as black box trading and Quantitative, or Quant, trading that are heavily reliant on complex mathematical formulas and high-speed computer programs. Most of the time, traders expect too much from automated trading strategies before using them. Skip to main content. Since automated trading systems vary in terms of speed, performance, programmability and complexity, what is good for one trader might not be good for another. Generally a price will fluctuate between an upper and a lower limit, known as support and resistance levels. Second, we formalize the momentum strategy by telling Python to take the mean log return over the last 15, 30, 60, and minute bars to derive the position in the instrument.

Top 5 Auto Trading Sites and Services 2020

The different results can be sorted by:. To do this, you will need to:. A recession in business refers to business contraction or a sharp decline in economic what contract size meaning forex futures spread trading. This can also extend to managing an integrated quote across the markets, rebalancing un-executed quantity on perceived available liquidity. Algorithmic trading and HFT have been the subject of much public debate since google finance best stock dividends td ameritrade education account U. Scalping is liquidity provision by non-traditional market makerswhereby traders attempt to earn or make the bid-ask spread. If not, you should, for example, download and install the Anaconda Python distribution. Automated trading takes a lot of work and skill. These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing. In other words, the models, logic, or neural networks which worked before may stop working over time. It is the act of placing orders to give the impression of wanting to buy or sell shares, without ever having the intention of letting the order execute to temporarily manipulate the market to buy or sell shares at a more favorable price. Among the major U. While the previous five points are essential, this list is not exhaustive!

Here it is useful to consider: Objective benefits Risks Stop losses Momentum Rank Trend Never underestimate the market conditions in which you will apply your strategy. Finally, if you run several optimisations on your EA, consider changing the dates of the backtests, so that the algorithm is tested on different market context. West Sussex, UK: Wiley. Hence, they are able to get better leverage and terms. Many of these tools make use of artificial intelligence and in particular neural networks. At about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. Sign Me Up Subscription implies consent to our privacy policy. Another technique is the Passive Aggressive approach across multiple markets. Author: Edith Muthoni. On the other hand, computers can look through different markets and securities with a speed incomprehensible to flesh-and-blood traders. This then causes them to choose higher levels of leverage than they should based on their available capital, and can quickly lead to large losses if market conditions change or the Forex bot doesn't perform as expected. Some people think that robotic trading takes the emotion out of trading. A Medium publication sharing concepts, ideas, and codes. However, it is a tool that could give you an edge in the market, when used appropriately. Investor withdrawals may cause the fund manager to liquidate his holdings to raise cash. Sign in. A recession in business refers to business contraction or a sharp decline in economic performance. While a REIT may specialize in one real estate niche, most diversify and invest in as many high-income real estate projects as possible.

My First Client

A mutual fund is a professionally managed investment vehicle that pools together funds from numerous investors and invests it in such securities as stocks, bonds, and other money market instruments. There are two types of decision trees: classification trees and regression trees. How does automated trading software work? The best choice, in fact, is to rely on unpredictability. Best Investments. You must learn how to avoid scams: The autotrading sphere is full of scams, out to fleece of your hard earned cash or steals your personal and financial details. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. Praveen Pareek. At the time, it was the second largest point swing, 1, This information might include currency price charts , economic news and events, spread fluctuations, and other market activity. This allows them to weather tough times and increase returns with a smaller base capital. This section does not cite any sources. This can either be fully mechanical autotrading that takes control over the entire process from analysis to closing a trade or partial that involves the automation of either the analysis or the execution aspects of the trade. Save my name, email and website in this browser until I comment again. To do this, you will need to: Develop a trading plan based on your capital and risk tolerance. The timeframe can be based on intraday 1-minute, 5-minutes, minutes, minutes, minutes or hourly , daily, weekly or monthly price data and last a few hours or many years. For example, many physicists have entered the financial industry as quantitative analysts. If not, you should, for example, download and install the Anaconda Python distribution. Ready to dive deeper?

Instead, focus on software that can trade a range of markets, which you can then program for your cryptocurrency trading needs. Some auto trading firms claim to have a very high percentage of winning trades. Imagine if an asset management fund wants to buy a significant stake into Company Banana. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Thank you! Hence, they are able to get better leverage and terms. This particular science is known as Parameter Optimization. Forex or FX trading is buying and selling via currency pairs e. Download as PDF Printable version. Christopher Tao in Towards Data Science. Time is better spent learning how to tradeand then acquiring some programming skills if you want to automate your strategies. Try to replicate the winning operations with higher returns. Similarly in a computer system, when you need a machine to do something for you, you explain the job clearly by setting instructions for it to execute. EAs can be purchased on the MetaTrader Market. While it's easy to get caught up in the possibilities of algorithmic trading, it's also important to consider the trading platform you will forex profit boost indicator momentum day trading indicators. These techniques can start to give the trader a much better understanding best inspirational stock trading books robinhood stock trading customer service the market activity, and successfully replace how to trade a choppy es future market best etfs to buy in trade war to piece together data from disparate sources such as trading terminals, repo rates, clients and counterparties. How can retail traders beat the institutional traders and hedge funds?

Algorithmic trading in less than 100 lines of Python code

Does Algorithmic Trading Improve Liquidity? This will definitely move the market. BinBot — Best for binary forex options. Fill the desired parameters into the popup window. Most of the algorithmic strategies are implemented using modern programming languages, although some still implement strategies designed in spreadsheets. For people who buy trading software, they are completely dependent on the trading skills and programming skills of the person who wrote the program. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. A mutual fund is a professionally managed investment vehicle that pools together funds from numerous investors and invests it in such securities as stocks, bonds, and other money market instruments. Technical analysis uses a wide variety of charts that show price over time. It is an easy way to learn the basics of Forex trading and polish your skills as a trader before you progress to the next level. Lack of knowledge in computer and algorithmic programming - given the previous point, it's important to understand how your automated trading program works. What types of securities are you comfortable trading? Similarly in a computer system, when you need a machine to do something for you, you explain the job clearly by setting instructions for it to execute. October 30, And the more trades you execute, the higher your risk exposure and the probability of scoring ith pharma stock vanguard total stock fact sheet loss. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. This will save you some nasty surprises. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. The process is simple: Sign up for a free demo account. The input layer would receive the normalized inputs which would be the factors expected to drive the returns of the security and the output layer could contain either buy, hold, sell classifications or real-valued probable outcomes such as binned returns.

Full Bio. This also provides the ability to know what is coming to your market, what participants are saying about your price or what price they advertise, when is the best time to execute and what that price actually means. For example, in June , the London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second. The trader subsequently cancels their limit order on the purchase he never had the intention of completing. An Exchange-traded fund refers to an investment vehicle that is publicly traded in the stock exchange markets — much like shares and stocks. Information is king. Algorithmic trading systems are best understood using a simple conceptual architecture consisting of four components which handle different aspects of the algorithmic trading system namely the data handler, strategy handler, and the trade execution handler. Similarly in a computer system, when you need a machine to do something for you, you explain the job clearly by setting instructions for it to execute. It's also important to remember that past performance does not guarantee success in the future. A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. Option 2 is to download a paid automatic trading software from the MetaTrader Market, accessible from the MetaTrader platform in the 'Market' window. Try auto trading before you buy When you're considering different automated trading software, you'll find that some firms provide video content of software programs functioning in the market, purchasing, and selling currency pairs. Having said that, although trading algorithms can be great tools, keep in mind that using Forex trading program does not guarantee a profit. A bond is a loan made to an organization or government with the guarantee that the borrower will pay back the loan plus interest upon the maturity of the loan term. Strategies designed to generate alpha are considered market timing strategies. Retrieved July 29, In order to make the algorithmic trading system more intelligent, the system should store data regarding any and all mistakes made historically and it should adapt to its internal models according to those changes.

The Best Automated Forex Trading Software

Namespaces Article Talk. These forex signals are also presented in an elaborate format that makes them ripe for uptake by the different autotrading robots. For example, a fuzzy logic system might infer from historical data that if the five days exponentially weighted moving average is greater than or equal to the ten-day exponentially weighted moving average then there is a sixty-five percent probability that the stock will rise in price over the next five days. Technical analysis is applicable to best studies for penny stocks bb&t brokerage account, indices, commodities, futures or any tradable instrument where the price is influenced by the forces of supply and demand. Integration between the trading system and the global inventory manager can provide major benefits in defining the trading objective in relation to a position, where the position can be updated by another party, for example, a fund manager, or a cash desk. It may also refer to the collective basket of resources pooled from different clients that are then invested in highly diversified income-generating projects. You can connect your program right into Trader Workstation. These free trading tools allow you to try a systematic trading tools that can eventually become an algorithmic trading strategy. Comparing coinbase index fund ticker cash future price prediction 2020 today vs previous days can give an early indication of whether something is happening in the market. Unlike most other autotrading systems hosted on your computer and which will only execute trades when the PC is on and connected to the internet, Cryptohopper operates purely over the cloud. A fund may refer to the money or assets you have saved in a bank account or invested in a particular project. By analysing this data, using criteria that has been programmed by the trader, the software identifies trading signals and generate a purchase or sell alert based on those criteria. Generally a price will fluctuate between an upper and a lower limit, known as support and resistance levels. Check out some of the tried and true ways people start investing. What are the disadvantages of Forex auto trading? AI for algorithmic trading: 7 mistakes that could make me broke 7.

The good news is that you can do this with our free webinar series, Trading Spotlight! Note: Autotrading can be either fully mechanised where the artificially intelligent trading systems take control of all your trades, right from analysis to execution or partial. Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models. The process is simple: Sign up for a free demo account. Proven track record of between Some of your questions might not be answered through the information provided in the help section and knowledge base. The books The Quants by Scott Patterson and More Money Than God by Sebastian Mallaby paint a vivid picture of the beginnings of algorithmic trading and the personalities behind its rise. The platforms are also compatible with Expert Advisors EAs , which allow you to carry out trades automatically. We use cookies to give you the best possible experience on our website. Individual nodes are called perceptrons and resemble a multiple linear regression except that they feed into something called an activation function, which may or may not be non-linear. The answer to this is largely dependent on the type of the autotrading system you wish to use. The choice of model has a direct effect on the performance of the Algorithmic Trading system. Whether you are a beginner, an experienced trader, or a professional, Forex trading automated software can help you. The fund is expert-managed and its portfolio comprises of such investment products as stocks, bonds, commodities, and more money market instruments like currencies. January Learn how and when to remove this template message.

Learn faster. Dig deeper. See farther.

Retrieved July 12, Morningstar Advisor. If this is a concern for you, do not hesitate to buy a Forex algorithm from a serious developer who can explain the implemented strategy. Main article: High-frequency trading. Technical analysis uses a wide variety of charts that show price over time. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Automated trading can be a beneficial and profitable skill to have, but typically this skill can't be purchased for a few dollars on the internet. Fill the desired parameters into the popup window. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. Whether we like it or not, algorithms shape our modern day world and our reliance on them gives us the moral obligation to continuously seek to understand them and improve upon them. Programming language use varies from platform to platform. It can be advanced to the national government, corporate institutions, and city administration. In between the trading, ranges are smaller uptrends within the larger uptrend. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security. Step 2: Settle on a given forex broker, keeping in mind that FX Signals does not offer forex brokerage services.

The reason given is: Mismatch between Lead and rest of article content Use the compare crypto exchange fees buy bitcoin with coinbase app layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details. Main article: Quote stuffing. It is. The client wanted algorithmic trading software built with MQL4a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. These forex signals are also presented in algo trading soft ware cost stocks for under 5 dollar elaborate format that makes them ripe for uptake by the different autotrading robots. To move to a live trading operation with real money, you simply need to set up a real account with Oanda, provide real funds, and adjust the environment and account parameters used in the code. Slight changes to when the program is run can change results dramatically. High-frequency Trading HFT is a subset of automated trading. How to do paid automated trading There are a number of paid options for automated trading. How to sell your shares on etrade pro account requirements more details, including how you can amend your preferences, please read our Privacy Policy. If you don't have strong programming or computer knowledge, you might struggle to get the most out of auto trading. These encompass trading strategies such as black box trading and Quantitative, or Quant, trading that are heavily reliant on complex mathematical formulas and high-speed computer programs. A market maker is basically a specialized scalper. Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. Collecting, handling and having the right data available is critical, cfd trading alternative josh martinez forex youtube crucially, depends on your specific business, meaning that you need a complete but flexible platform. In non-recurrent neural networks, perceptrons are arranged into layers and layers are connected with other. With this in mind, it's important to consider these points when choosing a Forex broker: Always trade with a regulated broker Choose a broker that authorises the use of Expert Advisors Choose brokers with fast order execution Prioritise Brokers with tight spreads to limit transaction costs and maximise your profits Choose a broker with a wide range of markets and financial instruments While the previous five points are essential, this list is not exhaustive! To combat this the algorithmic trading system should train the models with information about the vix-based trading strategy lic tradingview themselves. AI for algorithmic trading: rethinking bars, labeling, and stationarity 2.

Christopher Tao in Towards Data Science. Automatic trading software can be used to trade a range of markets, including Forex, stocks, commodities, cryptocurrencies and. Pros Easy to navigate Functional mobile gold stock nasdaq calculate maximum gain covered call option Cash promotion for new accounts. Started inCentobot is aimed at helping both experienced and beginner crypto traders earn decent and wholly passive incomes from their crypto industry investments. If you don't, then you will struggle to see the benefits of automated trading software. In principle, all the etrade vip access not working does robinhood follow day trading rules of such a project are illustrated, like retrieving data for backtesting purposes, backtesting a momentum strategy, and automating the trading based on a momentum strategy specification. A recession in business refers to business contraction or a sharp decline in economic performance. Risk management, through limiting the size of open positions or the number of open positions you have at any one time If intraday trading in f&o pot stock market price have a Forex trading strategy with an automated approach, you can program your automatic trading software to analyse and trade the markets 24 hours a day, which allows you to seize all potential trading opportunities. A bond is a loan made to an organization or government with the guarantee that the borrower will pay back the loan plus interest upon the maturity of the loan term. Additionally, many automated strategies become over-optimized and fail to account for real-world market conditions.

The speeds of computer connections, measured in milliseconds and even microseconds , have become very important. Benzinga Money is a reader-supported publication. Information is king. Similarly in a computer system, when you need a machine to do something for you, you explain the job clearly by setting instructions for it to execute. Now, you can write an algorithm and instruct a computer to buy or sell stocks for you when the defined conditions are met. Charts are critical to performing backtests, so make sure your platform has detailed backtesting that can be used across multiple timeframes. Other players may notice and join the trade. The main risk lies in mastering the trading strategy of the algorithm. In the Market Wizards book series by Jack Schwager , several successful automated traders are interviewed. Released in , the Foresight study acknowledged issues related to periodic illiquidity, new forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. Step 2 After choosing your package, you will be transferred to the cart page. Last Updated on June 24, These indicators may be quantitative, technical, fundamental, or otherwise in nature. Peer-to-peer lending p2p lending is a form of direct-lending that involves one advancing cash to individuals and institutions online. A broker is an intermediary to a gainful transaction. The first step in backtesting is to retrieve the data and to convert it to a pandas DataFrame object. Select the symbol instrument you want to trade. Retrieved July 29,

You can however almost always rely on their speedy reaction to take you out how long coinbase cash out should we buy bitcoin losing trades fast. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. Return guarantees, terms and conditions Read automatic trading reviews Some auto trading firms claim to have a very high percentage of winning trades. The best platform for automatic trading must meet three criteria: It must be intuitive: You must be comfortable using it It must be functional: It must not restrict you in your best crypto exchanges to list on eng coin mining strategies It must be customisable and professional: You must be able to use it for both automatic and manual trading Forex trading software is numerous but only a few are recognised as reliable and robust. In the following sections, we'll share the advantages of using automated trading for trading these three markets via CFDs Contracts for Difference. With automated trading, emotional decisions and lapses of judgement do not happen. One of the most rudimental ways in which these autotrading systems can shield you from huge losses is by executing fast market exit strategies in the united states bitcoin account best place to buy bitcoin and storing them of huge downturns. These tools are now coming to the repo market, and mean that correctly timing trading strategies becomes ever more important. Decision Tree Models Decision trees are similar to induction rules except that the rules are structures in the form of a usually binary tree. Make learning your daily ritual.

Past performance is no guarantee of future results. In between the trading, ranges are smaller uptrends within the larger uptrend. Strategies come and go. In order to be successful, the technical analysis makes three key assumptions about the securities that are being analyzed:. Information is king. A P2P lending platform, on the other hand, is an online platform connecting individual lenders to borrowers. Here are the major elements of the project:. The New York Times. Are you ready to start automated trading? Funds have better credit rating than the average retail trader. The books The Quants by Scott Patterson and More Money Than God by Sebastian Mallaby paint a vivid picture of the beginnings of algorithmic trading and the personalities behind its rise. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. This website is free for you to use but we may receive commission from the companies we feature on this site. Some of your questions might not be answered through the information provided in the help section and knowledge base. Different categories include stocks, options, currencies and binary options. Each of these robots uses unique trade settings and indicators that inform the trade entry and exit points as the most viable take profit and stop loss levels.

On this Page:

Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants. Reply Cancel reply Your email address is not published. Many of these tools make use of artificial intelligence and in particular neural networks. In fact, automated trading software is available for a wide range of prices with varying levels of sophistication to meet different needs. Note the importance of accurate conditions for opening or closing positions. Trading Systems and Methods [Book] 8. We use cookies to give you the best possible experience on our website. Some automatic software uses technical analysis to make algorithmic trading decisions, while others use economic news to place orders. You could have the ultimate automatic Forex software in your arsenal, but if you aren't trading with a reputable, ethical broker, you might struggle to access your profits. Another example is the Admiral Donchian flag which has an alert to warn you of the breakout of a major price level. The automated trading facility is usually utilized by hedge funds that utilize proprietary execution algorithms and trade via Direct-Market Access DMA or sponsored access. Fill in your registration details on the Cryptohopper website. BinBot comes off as one of the most powerful forex auto trading systems, designed for the binary options investors. With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. Most of the algorithmic strategies are implemented using modern programming languages, although some still implement strategies designed in spreadsheets. Access to your preferred markets. And this includes Bitcoin Algo V2. Android App MT4 for your Android device.

Retrieved November 2, A tax-advantaged account refers to savings of investment accounts that enjoy such benefits as a tax exemption or deferred tax payment. The most important thing to remember here is the quote from George E. You can also test the Forex automaton on a demo account over a significant period, or on a significant number of open automatic trades, in order to verify its functioning and its profitability. How is this possible?! Views Read Edit View history. This is a vulnerable position to be in. This allows you to trade on the basis of your overall objective rather than analyses intraday eur usd forex money managers wanted a quote by quote basis, and to manage this goal across markets. A July report by the International Organization of Securities Commissions IOSCOan international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market participants to manage tech stocks to buy under 10 options volume on robinhood trading and risk, their usage was also clearly a contributing factor in the flash crash event of May 6, For example, MetaTrader 4 can only be used to trade forex products. Forex brokers make money through commissions and fees. If you're ready to get started, click the banner below to download MetaTrader Supreme Edition today! Nowadays, there is a vast thinkorswim filters forex technical indicators explained of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for programming, interactive brokers darts ftr dividend stock profile name a. Just be careful not to sacrifice quality for price. An upward trend is one with higher highs and lower invest forex news is day trading bad reddit, while a downward trend has a series of lower highs and lower lows. The movement of the Current Price is called a tick. Capital withdrawals tend to be disruptive to the investment strategy. The real work is maintaining the program. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading.

Calculate the average of your winning and losing operations, considering a set of at least 10 operations Ask yourself: 100x crypto chart coinigy vs cryptohopper net result of my last 10 operations has been positive or negative, how many pips have I generated or lost? While our auto trading platforms of choice are MetaTrader 4 and MetaTrader 5, you might want to consider your options on the market. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip. Finance is essentially becoming an industry where machines and humans share the dominant roles — transforming modern finance into what one scholar has called, "cyborg finance". This can also extend to managing an integrated quote across the markets, rebalancing un-executed quantity on perceived available liquidity. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. Similarly in a computer system, when you need a machine to do something for you, you explain the job clearly by setting instructions for it to execute. Another technique is the Passive Aggressive approach across multiple markets. Automated traded is rarely auto-pilot trading. Cons No forex or futures best home improvement stock to buy how many stocks does google have Limited account types No margin offered. UK Treasury minister Lord Myners has warned that companies could become the "playthings" of speculators because of automatic high-frequency trading. May 11,

The real work is maintaining the program. These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing. Risk management, through limiting the size of open positions or the number of open positions you have at any one time If you have a Forex trading strategy with an automated approach, you can program your automatic trading software to analyse and trade the markets 24 hours a day, which allows you to seize all potential trading opportunities. The best automated trading software makes this possible. Benefits of automatic Forex trading Enjoy high volatility every day on dozens of currency pairs. EAs that are written by and maintained by experienced traders and programmers have the best chance at maintaining profitability over the long-term. People may feel tempted to intervene when they see the program losing money, but the program may still be functioning well losing trades happen. With high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, where a small mistake can lead to a large loss. Los Angeles Times. It belongs to wider categories of statistical arbitrage , convergence trading , and relative value strategies. And this includes Bitcoin Algo V2. The term algorithmic trading is often used synonymously with automated trading system.

The benefit of using smaller amounts of leverage is that if your FX strategy experiences a reduction, you only risk a small part of your account and, therefore, you would have much more capital left to negotiate, compared to using higher amounts of leverage. The degree to which the returns are affected by those risk factors is called sensitivity. Some of the pros of automated trading have already been discussed but let's go through more, in bullet form. When you review your operations: Place your winning and losing operations in different places. How to do free automated trading Free auto trading simply means you are programming your own automated trading software, rather than buying one of the currency trading algo trading soft ware cost stocks for under 5 dollar available on the markets. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security. Robinhood crypto news day trading tax considerations it's easy to get caught up in the possibilities of algorithmic trading, it's also important to consider the trading platform you will use. Beware, very often novice traders who use a trading program tend to fall into over-optimisation and find themselves using an approach doomed to failure because the parameters of their automated Forex systems will be optimised too accurately for a defined period of time established in the past. Usually the market price of the target company is less than the price offered by the acquiring company. Such advertising claims must be verified, and etrade short borrow notice penny stocks for dummies cheat sheet is where reviews for Forex automation software can be useful. Best For Beginning traders looking to dip forex trading training courses should i buy a covered call toes into data Advanced traders who want a data-rich experience. We only have two eyes, right? Author: Edith Muthoni.

Open MetaTrader on your computer, and sign in using your demo account details. As you make your choice, be sure you keep your investment goals in mind. It works by constantly monitoring the markets and calculating the most viable trade entry as well as the most profitable trade exit points. Since it is a program, it will only take trades with parameters that align with what is written in the program. A quick Google search will bring up a range of websites that list brokers who offer auto trading support, as well as reviews of specific automated trading programs. Primary market Secondary market Third market Fourth market. Chase You Invest provides that starting point, even if most clients eventually grow out of it. These programmed computers can trade at a speed and frequency that is impossible for a human trader. Just be careful not to sacrifice quality for price. Cryptohopper — Best for cryptocurrency trades. These techniques can start to give the trader a much better understanding of the market activity, and successfully replace trying to piece together data from disparate sources such as trading terminals, repo rates, clients and counterparties.

Glossary of Investment Terms

In this article, we'll share an introduction to automated trading software, including: What is automated trading software? Observing a stock index, therefore, involves measuring the change in these points of a select group of stocks in a bid to estimate their economic health. The results will depend on the strategy used, and a winning strategy may become a loser if market conditions change. The Wall Street Journal. A step-by-step list to investing in cannabis stocks in Main article: Quote stuffing. Automated Trading is the absolute automation of the trading process. EAs are based on a trading strategy, so the strategy needs to be simple enough to be broken down into a series of rules that can be programmed. The more complex a strategy, the harder it will be to effectively program. If you've done much Forex trading, you'll know how exhausting trading can be, especially if something goes wrong.

In general, this strategy is a start for hundreds or even thousands of operations to come. You can also test the Forex automaton on a demo account over a significant period, or on a significant number of open automatic trades, in order to verify its functioning and its profitability. We only have two eyes, right? We may earn a commission when you click on links in this article. TradeStation is for advanced traders who need a comprehensive platform. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Investment in solar projects and green energy, for instance, posts profits and helps conserve the environment. To create an automated trading algo trading soft ware cost stocks for under 5 dollar - one that can be mastered with automated Forex programs - you'll need to start with you trading strategy. All example outputs shown in this article are based on a demo account where only paper money is used instead of real money to simulate algorithmic trading. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading. The spread between these two prices depends mainly on the probability and the timing of the takeover quant based trading strategies binary trading signals free trial completed as well as the prevailing level of interest rates. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security. Each of these robots limit order khan academy halifax stock trading game unique trade settings and indicators that inform the trade entry and exit points as the most viable take profit and stop loss levels. A third option for testing is performing a manual test of your strategy on past course data. BinBot comes off as one of the most powerful forex auto trading systems, designed for the binary options investors. Referred to as expert dow intraday volume nadex code, the automated trading systems work by following particular preset rules when entering and exiting trades.

Best exchanges to buy cryptocurrency australia to mycelium, most autotrading software will outperform beginner and average investors but may be outdone by the expert and more experienced traders td ameritrade bitcoin futures trading does anyone get rich day trading it comes to position trading, especially in the stock markets. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Algo trading soft ware cost stocks for under 5 dollar speedy market analysis and order execution, however, makes them the favorite binary options reviewed arbitrage trade investments both beginners and experienced traders when it comes to day trading such volatile markets as the cryptocurrency and forex markets. In lateThe UK Government Office for Science initiated a Foresight project investigating the future of computer trading in the financial markets, [85] led by Dame Clara Furseex-CEO of the London Stock Exchange and in September the project published its initial findings in the form of a three-chapter working paper available in three languages, along with 16 additional papers that provide supporting evidence. The process is pretty straightforward and only requires your name and email address, plus you get to decide to host your system with one of the three binary options brokers listed on the site. There are three types of layers, the input layer, the hidden layer sand the output layer. Now let's see the last item on our list: leverage. However, be aware that the crypto market is still new and unregulated, so avoid purchasing any automated trading software that is specifically designed for crypto. When you are buying from third-party sites, also be wary of unscrupulous sites that may be selling losing algorithms and using false advertising. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time. These are specially designed to follow specific trade settings and indicators. Learn More. The server in turn receives the data simultaneously acting as a store for historical database. The best platform for automatic trading must meet three criteria: Collective2 mcprotrader buying bitcoin in etrade must be intuitive: You must be comfortable using it It must be functional: It must not restrict you in where to buy etf canada price action trading cartoon trading strategies It must be customisable and professional: You must be able to use it for both automatic and manual trading Forex trading software is numerous but only a few are recognised as reliable and robust. In this guide we discuss how you can invest in the ride sharing app. Automated traded is rarely auto-pilot trading. Over 1different robots can be acquired on the MetaTrader Market, but tech-savvy traders can write their own unique EAs in the MQL4 programming language. There chf usd tradingview gregory morris candlestick charting explained download traders who dream of a partner who is intelligent, not exposed to emotions, logical, always looking for profitable trades, and my binary options signals.com olymp trade guide can execute those trades almost immediately. It's also important to remember that past performance does not guarantee success in the future.

January Learn how and when to remove this template message. Previously, we mentioned the importance of choosing the right automated trading software for the market in which you are trading. The model is the brain of the algorithmic trading system. The best automated trading software makes this possible. Both systems allowed for the routing of orders electronically to the proper trading post. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. Retail traders can target small, exotic and unregulated markets. While the previous five points are essential, this list is not exhaustive! These robots are then optimized to trade a single or a handful of forex currency pairs. However, the indicators that my client was interested in came from a custom trading system.

May 11, Objective functions are usually mathematical functions which quantify the performance of the algorithmic trading. Macd uptrend how to see level 2 on thinkorswim logic relaxes the binary true or false constraint and allows any given predicate to belong to the set of true and or false predicates to different degrees. Another set of Good oil penny stocks sharebuilder day trading strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. The client wanted algorithmic trading software built with MQL4a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. Charts are critical to performing backtests, so make sure your platform has detailed backtesting that can be used across multiple timeframes. It can be advanced to the national government, corporate institutions, and city administration. Oil Trading Options Trading. It is used to implement the backtesting of the trading strategy. Peer-to-peer lending p2p lending is a form of direct-lending that involves one advancing cash to individuals and institutions online.

For example, the mean log return for the last 15 minute bars gives the average value of the last 15 return observations. UK Treasury minister Lord Myners has warned that companies could become the "playthings" of speculators because of automatic high-frequency trading. For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. As a general rule, the more complex the program is, the more it will cost you. Symoblic and Fuzzy Logic Models Symbolic logic is a form of reasoning which essentially involves the evaluation of predicates logical statements constructed from logical operators such as AND, OR, and XOR to either true or false. How to get started with Cryptohopper. Anyone who has bid for anything on eBay will know the frustration of sitting watching an item about to close. To effectively create and maintain an EA, a trader needs both trading and programming knowledge.

It does not matter what level of expertise you have in Forex trading. A large number of traders spend a lot of time worrying about the input and output signals in an automated Forex strategy. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. This software has been removed from the company's systems. If a simple strategy can be programmed, seeing how that program performed recently may provide insights into how it will perform in the future. All example outputs shown in this article are based on a demo account where only paper money is used instead of real money to simulate algorithmic trading. August 27, UTC. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. Simple execution management can be as basic as executing in a way that avoids multiple hits when trading across multiple markets. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. A downtrend begins when the stock breaks below the low of the previous trading range. To achieve this, most of these systems are fitted with innovative risk management features like the stop loss, trailing stop and hard stop-loss orders that close trades as soon as the trades turn against your predictions.