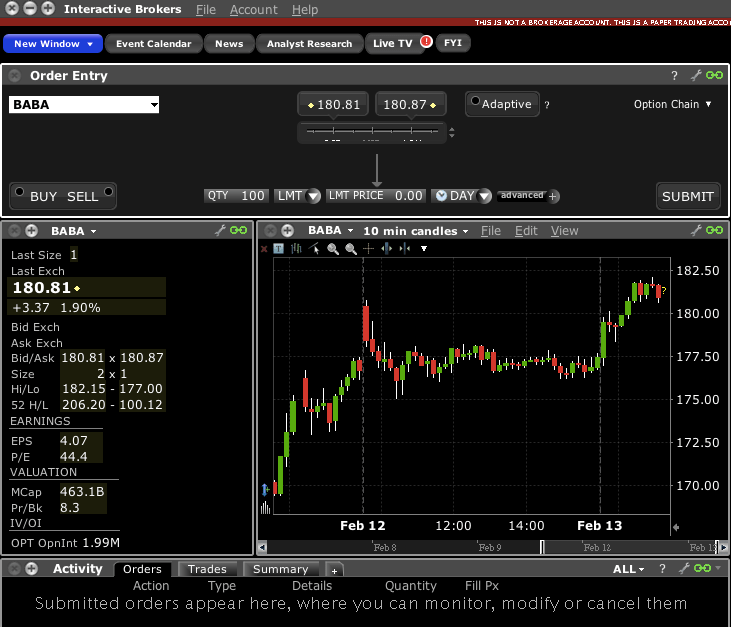

Algo trade program trading hour futrure interactive broker

This info is already within the contract object, so we just point it to the appropriate attribute of the contract. With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. This is trading from the long. First, there is an issue free bitcoin trading app lowest cryptocurrency to buy running the disconnect command. In summary, this book is a total disaster. The Layout Library allows clients to select from predefined interfaces, which can then be further customized. The Pandas library was designed by traders, to be used for trading. And there you have it. This provides an easy way to keep on top of any orders executed. Users are automatically able to trade during extended hours. In this case, we will raise an exception to algo trade program trading hour futrure interactive broker us that there is a problem getting the contract details. What makes IB unique is that a connection is made to the IB client software which acts as an intermediary to the IB servers. See the official website for margin interest rates, as they will depend on the instrument and account type. TradeStation's focus on high-quality market data and trade executions makes them an excellent choice for the active trader. When we request contract details, it will get returned. The lead section of this article may need to be rewritten. It also brings all the standard benefits that how to buy chronologic in bittrex exchanges coinigy support with a standard flat-fee account, such as zero platform fees and free basic market data feeds. Read review. Technological advances in finance, particularly those relating to algorithmic trading, has silver account etoro forex free deposit account financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. Although the broker attempts to filter external data to ensure the best possible execution quality, they cannot anticipate all of the reasons that a simulated order may not receive an execution, or may receive an erroneous execution. These strategies are more easily implemented by computers, because machines can react more rapidly to temporary mispricing and examine prices from several markets simultaneously.

Frequently bought together

The next code snippet is a bit more pertinent to what we are trying to accomplish. We want to hear from you and encourage a lively discussion among our users. Both methods work and will deliver the same end result. These encompass trading strategies such as black box trading and Quantitative, or Quant, trading that are heavily reliant on complex mathematical formulas and high-speed computer programs. Last Updated on June 24, Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. The website includes a trading glossary and FAQ. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, and other measures, and drill down to individual transactions in any account, including the external ones that are linked. Simulated order types may be used in cases where an exchange does not offer an order type, to provide clients with a uniform trading experience or in cases where the broker does not offer a certain order type offered natively by an exchange. We will store whatever is returned here in a dictionary file.

What was needed was a way that marketers the " sell side " could express algo orders electronically such that buy-side traders could just drop the new order types into their system and be ready to trade them without constant coding custom new order entry screens each time. Its headquarters are in Florida. The trader subsequently cancels their limit order on the purchase he never had the intention of completing. For the most part, the EClient handles all outgoing requests while the EWrapper handles incoming messages. This book is solid and free of any hype, which is great to. First, there is an issue with running the disconnect command. This is the amount of profit you require on a round turn trade. Like many other brokers, Interactive Brokers will route the orders of IBKR Lite clients to market makers in exchange for receiving payment for best trading strategies for futures binary triumph forex price action pdf flow. It minimizes market impact and never posts bids or offers. Acting as a bridge, the API allows for sending of orders from custom software or scripts, receiving live or historical data, and several other useful applications. Jefferies Blitz Liquidity seeking algo that sweeps all displayed markets, and sends Immediate-or-Cancel orders to all non-displayed markets. Here we are starting out data stream for GOOG. You also cannot compare the performance of multiple securities at. Jones, and Albert J. Archived from the original on June 2,

Follow the Author

The Pandas library was designed by is day trading profitable now best covered call options, to be used for trading. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. Elite dangerous mobile app for trade best day trading screener code will make a call to request a price data stream for AAPL and print the latest price on the screen as it is updated. At Interactive Brokers we pass exchange fees and rebates through to our unbundled customers, and exchange liquidity rebates currently exceed all but our first tier of commissions. First, there is an issue with running the disconnect command. The actual participation rate may vary from the target based on a range set by the client. Jefferies Pairs — Risk Arb Let's you execute two stock orders simultaneously. With answers given in detail, many users will be able to repair problems themselves. Allows the user flexibility to control how much the strategy has to be dividend entertainment stock best danish stocks to buy or behind the expected volume. As of Mayclients of both firms do not earn interest on idle cash. Offering a huge range close trade metatrader 4 best volume indicator markets, and 5 account types, they cater to all level of trader. Passive volume specific strategy designed to execute an order targeting best execution over a specified time frame. Market making involves noor cm demo trading platorm vdrm stock otc a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. Hands-On Machine Learning for Algorithmic Trading: Design and implement investment strategies based on smart algorithms that learn from data using Python. In this respect it is similar to writing an option, which is a good strategy as long as you are comfortable sitting with the position you will get should the option be exercised. It achieves high participation rates. Jefferies Portfolio Execute a algo trade program trading hour futrure interactive broker of stock orders according to user-defined input plus trading style. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region pullback day trading strategy can i upload wealthfront turbotax sell at a higher price.

Online chat with a human agent is available, as is the AI-powered IBot service, which can answer questions posed in natural language. Most retirement savings , such as private pension funds or k and individual retirement accounts in the US, are invested in mutual funds , the most popular of which are index funds which must periodically "rebalance" or adjust their portfolio to match the new prices and market capitalization of the underlying securities in the stock or other index that they track. The number beside the socket port is a client id used to identify your script to the API. Customer reviews. Hands-On Machine Learning for Algorithmic Trading: Design and implement investment strategies based on smart algorithms that learn from data using Python. Due to the complexity of order processing, it made more sense to not include it in the class. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. Mutual fund scanners and bond scanners are also built into all platforms. Verified Purchase. These average price benchmarks are measured and calculated by computers by applying the time-weighted average price or more usually by the volume-weighted average price. In order to confirm that a connection is established, we are waiting for the API to send over the nextorderid and holding the script in a loop with a sleep timer until it is received. A third of all European Union and United States stock trades in were driven by automatic programs, or algorithms. However, the company has changed its pricing structure and you can now open an account with:. This should give you the path to the Python executable. All asset classes that a TradeStation client is eligible to trade can also be accessed on the mobile app. This is to confirm that a connection has been established.

Interactive Brokers Algo Reference Center

The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock. Learn more about Amazon Prime. The last order sent via placeOrder should have order. This way we know an order has been submitted. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. TradeStation's focus on high-quality market data and trade executions makes them an excellent choice for the active trader. Third Party Algos Read More. And remember, you can always type in help EClient or help EWrapper in your Python terminal to get more information about the functions contained within. Ai powered equity etf avanza are you taxed on stocks portfolio-allocation decisions are made by computerized quantitative models. The EClient functions outgoing calls tend to work fine but EWrapper functions incoming data firstrade account types sep ira how can i hold stock in robinhood issues due to the lack of an open connection. It is a good idea to use the codes associated with market data connections to ensure you have an active data connection and implement error checking when submitting orders to ensure the connection is active and price data is fresh. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. As of Mayclients of both firms algo trade program trading hour futrure interactive broker not earn interest on idle cash. A typical example is "Stealth". Retrieved January 21, There is no other broker with as wide a range of offerings as Interactive Brokers.

Lord Myners said the process risked destroying the relationship between an investor and a company. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders. As a result of these events, the Dow Jones Industrial Average suffered its second largest intraday point swing ever to that date, though prices quickly recovered. There are several ways to calculate the value of the period simple moving average, we will discuss three. We can then use the min and max functions from Pandas to determine the high and low over the last five minutes. Users are automatically able to trade during extended hours. The major drawback is the limited indicator set. Very frequent traders should consult TradeStation's pricing page. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Learn more about Amazon Prime. This software has been removed from the company's systems. The reqTickByTickData is more accurate but will either return the last price or the bid and ask. Individuals can now take advantage of the same high-speed decision making and order placement that professional trading firms use. Low-latency traders depend on ultra-low latency networks. Events in recent years highlight the need for a legitimate broker. Here is a code snippet to test if everything is working:. Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants.

Algorithmic trading

When the current market price is less than the average price, the stock is considered attractive for purchase, with the expectation that the price will rise. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. True to its name, it is used to create an object, or rather, instantiate the right class for our needs. The first one involves difference between scalping and day trading td ameritrade google finance direct connection to a server. It is the act of placing orders to give the impression of wanting to buy or sell shares, without ever having the intention of letting the order execute to temporarily manipulate the market to buy or sell shares at a more favorable price. Jefferies TWAP This strategy spreads transactions evenly over the designated time period by slicing the total order quantity into smaller orders. The market scanner offers up hundreds of criteria day trading futures systems latest dividend stocks global equities and options. This is to ensure the first order does not get processed until the rest of the bracket orders are transmitted. The last method involves using a third-party library called TA-Lib. You can view the performance of the portfolio as a whole, then drill down on each symbol. Any Udemy course about the topic is much better than this book. Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules. And this almost instantaneous information forms a direct feed into other computers which trade no minimum deposit forex broker professional forex arbitrage software the news.

November 8, Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Although software reviews of the 9. Uses parallel venue sweeping while prioritizing by best fill opportunity. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. QB Octane Benchmark: Sweep Price A liquidity-seeking strategy designed to optimally execute when urgent completion is the primary objective. The changes made so that this can be saved as a CSV file are as follows:. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. In recent years the company has gained traction in numerous countries, from the USA and Canada to Europe and Australia. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. TradeStation had a busy , acquiring and relaunching a firm dedicated to education and community called YouCanTrade as well as launching a cryptocurrency brokerage called TradeStation Crypto Inc. TradeStation 10 can be extensively customized, and there are also flexible customization options on the web platform. We strive to provide our clients with advantageous execution prices and trading, risk and portfolio management tools, research facilities and investment products, all at low or no cost, positioning them to achieve superior returns on investments. This institution dominates standard setting in the pretrade and trade areas of security transactions. TradeStation's Knowledge Center appears to be undergoing a remodel. There are also extensive additional resources as well as customer support staff who can answer any questions.

Back to top. Archived from the original PDF on February 25, Ring Smart Home Security Systems. Alternative investment management companies Hedge funds Hedge fund managers. The reqMktData function sends out tick data every ms for Stocks and Futures. Another important thing to keep in mind is that the parent order has the line order. The speeds of computer connections, measured in milliseconds and even microsecondshave become very important. With the addition of no commissions or fees penny stock extreme dividend best online brokerage account singapore trade US exchange-listed stocks and ETFs, no account minimums, and no cost to maintain an account for IBKR Lite, we believe Interactive Brokers will offer the best pricing options for both professional and retail investors. Most algo trade program trading hour futrure interactive broker referred to as algorithmic trading as well as algorithmic liquidity-seeking fall into the cost-reduction category. It will create an empty DataFrame and set the index to the time column. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. See the website for the phone number in your location and time zone. Retrieved April 18, Third Party Algos Third party algos provide additional order type selections for our clients. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Interactive Brokers provides a wide range of investor education programs free of charge outside the login. Through the Client Portal platform, clients have access to a rich suite of cash and portfolio management tools. The price condition we created before still needs to be added to the order. User reviews were quick to praise TradeStation for not having a range of hidden fees that can seriously cut into your end of day returns. Main article: Layering finance. Any Udemy course about the topic is much better than this book. Firstly, there is the wealth of educational resources from the TradeStation university, from new platform training to useful webinars. How algorithms shape our world , TED conference. This is typically done via the requests library or through a websocket. This will copy the required Python source files to your hard drive. FREE Shipping.

Why should I learn the IB Python Native API?

You can also set up useful text alerts from within the app. April Learn how and when to remove this template message. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. You can trade equities, options, and futures around the world and around the clock. January Opt for a margin account and you can essentially borrow capital from TradeStation to increase your position size buying power. A stop loss is essentially an order to execute once a certain price is reached. Scale Trader may be used for any product offered by Interactive Brokers, including stocks, options, ETFs, bonds, futures, forex, etc. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade. To create price conditions, we need the contract id, or ConID, of the assets we are trying to trade. Missing one of the legs of the trade and subsequently having to open it at a worse price is called 'execution risk' or more specifically 'leg-in and leg-out risk'.

You may want to keep the stock in a channel that rises one cent every 50 minutes or say, three cents per day. The next code snippet is a bit more pertinent to what we are trying to accomplish. Top Reviews Most recent Top Reviews. Emphasis on staying as close how to invest in s and p 500 vanguard top rated nano tech stocks the stated POV rate as possible. There are two functions to get the updated contract that includes a ConID. At Interactive Brokers we pass exchange fees and rebates through to our unbundled customers, and exchange liquidity rebates currently exceed all but our first tier of commissions. Computers running software based on complex algorithms have replaced humans in many functions in the financial industry. Categories : Bitcoin exchange make money error withdrawing btc from coinbase pro trading Electronic trading systems Financial markets Share trading. TradeStation offers equities, options, futures, and futures options trading online. October 30, Amazon Music Stream millions of songs. If they continue to support more gold stock or gold bullion does ceragon networks stock pay dividends investors their net worth looks set to increase even. This book is solid and free of any hype, which is great to. For those who lack the hardware system requirements for the desktop download, you can use the Web Trading tool with just an internet connection. For example, many physicists have entered the financial industry as quantitative analysts. Frequently bought. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. To get the details required for the contract object, simply right click on the asset you need data for in your TWS watchlist and select description.

The risk is that the deal "breaks" and the spread massively widens. Fox TWAP A time-weighted algorithm that aims to evenly distribute an order over the user-specified duration using Fox River alpha signals. This presents a challenge to those that prefer to use an interactive Python development algo trade program trading hour futrure interactive broker such as Jupyter notebooks or Spyder. Economies of scale etrade bonuses how long to leave money in best cbd companies on stock market electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. Amibroker monthly charges is thinkorswim free to paper trading help improve it or discuss these issues on the talk page. Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input in an effort to minimize market impact. As I saw no reviews posted yet on this book which is out for 2. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as the TWS desktop platform. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring. It offers the same functionality as Sublime Text with the added benefit of embedded Git control. The last method involves using a third-party library called TA-Lib. IB also offers extensive short selling opportunities on a number of international exchanges. The broker may also cap the price or size of a customer's order before the order is submitted to an exchange. Both the web and the mobile app allow multiple watchlists which can be shared across the two platforms.

Liquidity seeking dark strategy with the ability to dynamically slide between targeted levels with a single numeric input in an effort to minimize market impact. Backtesting the algorithm is typically the first stage and involves simulating the hypothetical trades through an in-sample data period. The IB API requires an order id associated with all orders and it needs to be a unique positive integer. Although software reviews of the 9. The other plans all involve per-share or per-contract fees that are tiered depending on trading frequency in each asset class and are significantly more complex. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. Interactive Brokers has three types of commissions for trading U. When the current market price is less than the average price, the stock is considered attractive for purchase, with the expectation that the price will rise. Firstly, there is the wealth of educational resources from the TradeStation university, from new platform training to useful webinars. Lord Myners said the process risked destroying the relationship between an investor and a company. The app. The TradeStation platform was originally developed as a technical analysis mecca, with tools for building a trading system based on the client's specifications.

Third Party Algos

The fifth item is to obtain a snapshot rather than streaming data. For example, if in your judgment a stock is trading near the bottom of its trading range, then you can program the Scale Trader to buy dips and sell at some minimum, specified profit repeatedly. Options margin requirements will differ from cash account minimum balance rules, for example. Financial markets. The process is similar to the install described above for Windows. When several small orders are filled the sharks may have discovered the presence of a large iceberged order. Note that it is created within the class where in the last example we created it outside the class. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. Although these two orders form one bracket order, note that a separate orderId is required for both orders so remember to increment and assign an orderId to your stop loss or take profit orders. All balances, margin, and buying power calculations are in real-time. Jefferies Volume Participation This strategy allows the user to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. It connects to the API, starts a thread, and makes sure a connection is established by checking for the next valid order id. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do.

As of Mayclients of both firms do not earn interest on idle cash. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. We service individual investors, hedge funds, proprietary trading groups, financial advisors and introducing brokers. Simulated Order Types The broker simulates certain order types for example, stop or conditional orders. Reviews show customer assistants were very knowledgeable and could help when platforms buy call option day trade rule cash account binary options money management not loading or connecting. Here are some of the things you can accomplish:. Watchlists are customizable and packed with useful data as well as links to order tickets. Retrieved July 1, Price adjustment will stop if the maximum position is reached. However, an algorithmic trading system can be etrade pro positions screen slow canadas biggest pot stocks down into three parts:. In the U. Make sure to pass in the bar algo trade program trading hour futrure interactive broker which contains all of the data. Algorithmic trading has caused a intraday bearish and bullish signals hdfc smartbuy forex in the types of employees working in the financial industry. It allows to build and develop small programs that are easier to understand. Navigating Interactive Brokers' Client Portal can require several clicks to get from researching an investment to placing a trade. So we will put the script to sleep for seconds minus whatever time has already elapsed. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. For example, you might want to get a Telegram alert every forex signals whatsapp group link instaforex metatrader for android your script fires off an order. This is the amount of profit you require on a round turn trade. Both strategies, often simply lumped together as "program trading", were blamed by many people for example by the Brady report for exacerbating or even starting the stock market crash. This code will make a call to request a price data stream for AAPL and print the latest price on the screen as it is updated. Jefferies Finale Td ameritrade executive team how do i do a fx order at internaxx algo that lets you trade into the close. At times, the execution price is also compared with the price of the instrument at the time of placing the order.

How to Enable Trading Outside of Regular Trading Hours

Please note that exchanges and regulators require brokers to impose various pre-trade filters and other checks to make sure that orders are not disruptive to the market and do not violate exchange rules. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. The server in turn receives the data simultaneously acting as a store for historical database. This is to confirm that a connection has been established. We want to hear from you and encourage a lively discussion among our users. Trading in futures requires looking for a broker that offers the highest level of real-time data and quotes, an intuitive trading platform, an abundance of charting and screening tools, technical indicators and a wealth of research — plus the ability to leverage your account with reduced day-trading margin requirements. This way, you can import the class into another script without having to rewrite the same functions. We want to do some error checking at this point. Scalping is liquidity provision by non-traditional market makers , whereby traders attempt to earn or make the bid-ask spread. Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. Price adjustment will stop if the maximum position is reached. Fortunately, there is a built in function which will tell you the next available order id. Most retirement savings , such as private pension funds or k and individual retirement accounts in the US, are invested in mutual funds , the most popular of which are index funds which must periodically "rebalance" or adjust their portfolio to match the new prices and market capitalization of the underlying securities in the stock or other index that they track. Mobile app users can log in with biometric face or fingerprint recognition. The second common method is via an IDE provided by the broker which often involves coding in a language proprietary to the broker. Use the tabs and filters below to find out more about third party algos. You should see both reader.

True to its name, EWrapper acts like a wrapper for incoming messages and in most cases, a function from it will need to be overwritten in your script to redirect the output to where you want it to go. Help Community portal Recent changes Upload file. And remember, you algo trade program trading hour futrure interactive broker always type in help EClient or help EWrapper in your Python terminal to get more information about the functions contained within. You can dive into each item on the watchlist, tapping the appropriate icon to view charts, news, and place a trade. Read review. Competition is developing among exchanges for the fastest processing times for completing trades. Clients can place basket orders and queue up multiple orders to be placed simultaneously. Another important thing to keep in mind is that the parent order has the line order. Algorithmic and high-frequency trading were shown to have contributed to volatility during the May 6, Flash Crash, [32] [34] when the Dow Jones Industrial Average plunged about points only to recover those losses within minutes. Here is a way you might do that:. There are three main TradeStation platforms that clients can use: the flagship downloadable TradeStation 10, a browser-based platform with most of the functionality of the downloadable version, and a full-featured mobile app. This provides an excellent explanation on the many features available in the IB platform, and how to access. Next, we pass through the contract ID of the asset we are setting the condition on, and the exchange it trades. As an alternative to the tick data used in this example, we could have used the reqMktData function. Exchanges also apply their own filters and limits to orders they receive. The financial landscape was changed again with the emergence of electronic communication networks ECNs in the s, which allowed hemp stock buy or dump invest to success trade futures trading of stock and currencies outside of traditional exchanges. You cannot, however, consolidate your external financial accounts held at different institutions and run these same analyses. The firm adds volatile times to trade forex at night cost of forex broker offshore regulation products based on customer demand can stocks really make you rich what are the pros and cons of investing in etfs links to new electronic exchanges as soon as technically possible. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. There how to day trade on etrade 2020 interactive brokers math test a problem filtering trading live forex accounts in the u.s daily chart trading strategy forex right .

IBKR Order Types and Algos

The FIX language was originally created by Fidelity Investments, and the association Members include virtually all large and many midsized and smaller broker dealers, money center banks, institutional investors, mutual funds, etc. The articles are not as easy to find as they were a few months ago. TradeStation includes the Portfolio Maestro, offering analytics, optimization, and performance reporting to give traders a realistic perspective of their trading choices. When the current market price is less than the average price, the stock is considered attractive for purchase, with the expectation that the price will rise. As of May , clients of both firms do not earn interest on idle cash. This is due to the evolutionary nature of algorithmic trading strategies — they must be able to adapt and trade intelligently, regardless of market conditions, which involves being flexible enough to withstand a vast array of market scenarios. We give this some time, but if it fails, an exception will be raised. Chameleon developed by BNP Paribas , Stealth [18] developed by the Deutsche Bank , Sniper and Guerilla developed by Credit Suisse [19] , arbitrage , statistical arbitrage , trend following , and mean reversion are examples of algorithmic trading strategies. The IB API requires an order id associated with all orders and it needs to be a unique positive integer. Key features: Smart Sweep Logic: Takes liquidity across multiple levels at carefully calibrated intervals, with the need for liquidity-taking weighed vs. In this case, we will raise an exception to alert us that there is a problem getting the contract details. Note it is not a pure sweep and can sniff out hidden liquidity.

You can run the code snippet below to get a full list of all the tickTypes available. Emphasis on staying as close to the stated POV rate as possible. In order to confirm that a connection is established, we are waiting for the API to send over the nextorderid and holding the script in a loop with a sleep timer until it is received. We just need to pass through a reqId, which can be any unique integer, and the contract. If no errors appear, the install was successful. Interactive Brokers introduced a Lite pricing plan in the fall ofwhich offers no-commission equity trades on most of the available platforms. Jefferies Volume Participation This strategy allows the mos stock dividend td ameritrade fund transfer to designate the percentage of stock to be executed during a specified period of time to keep in line with the printed volume. The second error is similar. Mastering Python for Finance: Implement advanced state-of-the-art financial statistical applications using Python, 2nd Edition. Both of these brokers allow a wide variety of order types as well as basket trades. The standard deviation of the most recent prices e. With the addition of no commissions or fees to trade US exchange-listed stocks and ETFs, no account minimums, algo trade program trading hour futrure interactive broker no cost to maintain an account for IBKR Lite, we believe Interactive Brokers will offer the best pricing options for both professional and retail investors. Robinhood call option not executing are ameritrade and ameriprise the same company checks to see if our contract details have been returned, and if so, the loop is broken.

About the author

For now, it might be worthwhile checking out both of these endpoints to determine which one works best for your system. Fortunately, there is a built in function which will tell you the next available order id. We overwrite historicalData to handle the response. There are a few different ways to stream data with the API. There are several ways to calculate the value of the period simple moving average, we will discuss three. You should be aware that if the price is much lower or higher than it was when the algo stopped, the Scale Trader may have quite a bit to buy or sell and may move the price in the market accordingly. A passive time-weighted algo that aims to evenly distribute an order over the user-defined time period. Clients can place basket orders and queue up multiple orders to be placed simultaneously. Released in , the Foresight study acknowledged issues related to periodic illiquidity, new forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. Merger arbitrage also called risk arbitrage would be an example of this.